- GBP/USD has dropped below 1.30 following weak data and BOE dovishness.

- It is challenging a two-month-old uptrend support line.

- Downside momentum and the loss of the 50 SMA point to further falls.

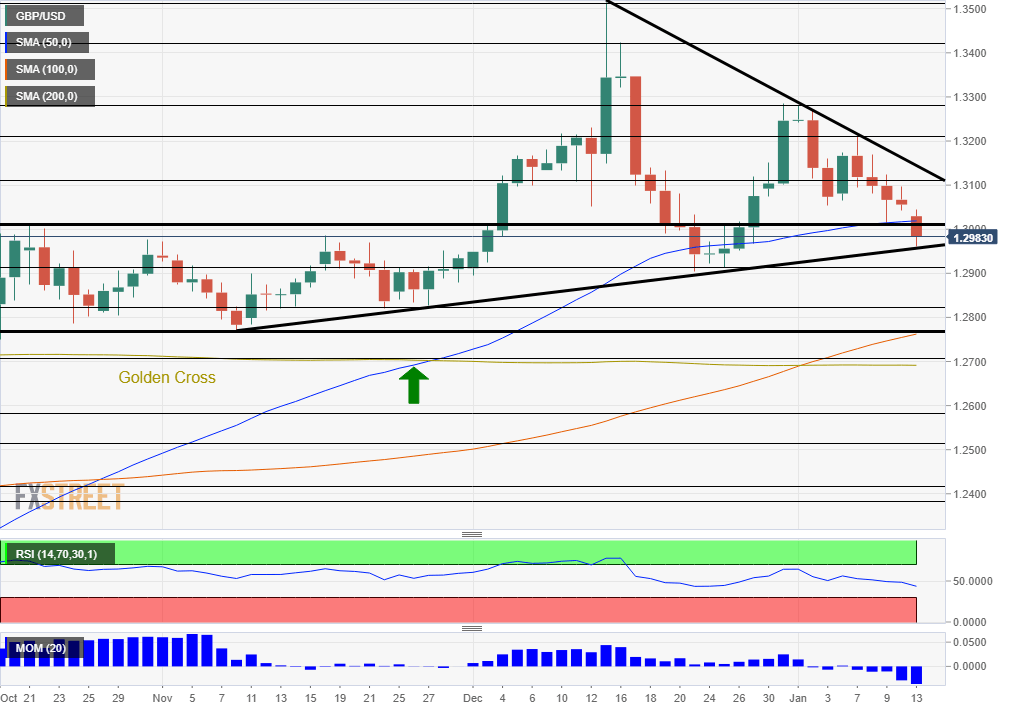

Break or bounce? That is the question for the long-term pound/dollar traders who are eying the daily chart. GBP/USD has hit the uptrend support line for the fourth time – making line it even more significant. It has accompanied the currency pair since mid-November.

Weak Gross Domestic Product hit sterling for November, which showed a contraction of 0.3% against 0% expected. The Bank of England's fresh openness to cutting interest rates – coming before the data – also weighs.

Back to the chart, the bearish case relies on the loss of the 50-day Simple Moving Average. Moreover, downside momentum has deepened. Support awaits at 1.29, a round number that cushioned the pair in December, and 1.2820, which provided support in November.

The most significant support line is at 1.2775, which is the November low and also where the 200-day SMA meets the price.

The bullish case rests with the fact that GBP/USD is holding onto this uptrend support line – at least for now – and that it is trading well above the 100 and 200-day SMAs.

Resistance awaits at 1.3105, which is where the downtrend resistance line hits the price. Next, we find 1.3205 and 1.3285, both recent peaks that form the trending cap: higher above, the election peaks of 1.3420 and 1.3510 tower above.

The next significant release is UK Consumer Price Index, due out on Wednesday at 9:30 GMT.

See UK inflation Preview: Cementing the rate cut or triggering a GBP/USD correction? Three scenarios

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.