GBP/USD

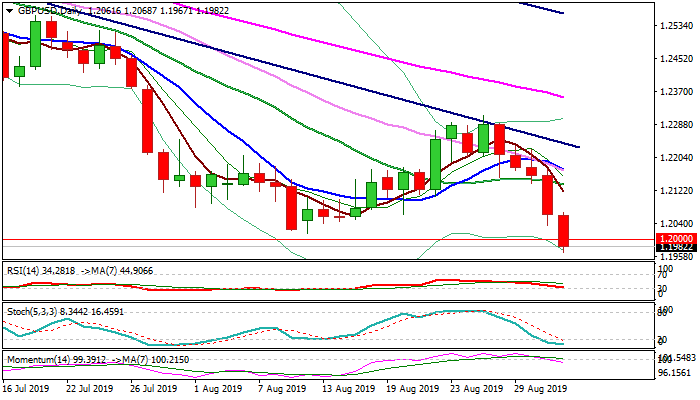

Cable broke below psychological 1.20 support in early European trading on Tuesday, as persisting Brexit turmoil maintains negative sentiment and keeps pound under strong pressure.

The pair hit new lowest level since early Oct 2016 and threatens for break below 1.1930 (10 Oct 2016 flash crash low), loss of which would trigger significant bearish acceleration and expose levels last traded in 1985.

All eyes are on UK parliament, as lawmakers will meet today in attempts block no-deal Brexit scenario as PM Johnson called for snap election on 14 Oct.

The opposition is trying to pass the legislation to force the government to stop divorce without deal, with possibilities of further three-month Brexit extension.

Bearish studies on daily chart add to negative outlook on political chaos, as 14-d momentum eventually broke into negative territory and heads south, along with other indicators, but deeply oversold stochastic warns that bears may take a breather before final break below 1.1930 pivot.

Broken 1.20 support and former low at 1.2015 (12 Aug) now revert to initial resistance, followed by session high at 1.2068.

Potential upticks are expected to offer better opportunities to re-enter bearish market, while only break above falling 20DMA (1.2138) would put bears on hold.

Res: 1.2000; 1.2015; 1.2068; 1.2100

Sup: 1.1967; 1.1930; 1.1902; 1.1832

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD holds ground as RBA leaves the door open for a hike

Tuesday's session witnessed the Australian Dollar clearing losses against the US Dollar following the release of the hawkish RBA minutes and the US JOLTs figures from May. For the USD, the confidence of Jerome Powell on inflation coming back down sooner on the prospects of a cooling labor market weakened the Greenback.

USD/JPY extends gains near 161.50 ahead of US data, FOMC Minutes

The USD/JPY pair trades on a stronger note near 161.40 after reaching a new high for this move near 161.75 during the early Asian trading hours on Wednesday. Market players remain focused on the possible foreign exchange intervention from the Bank of Japan, which might cap the pair’s upside.

Gold falls amid falling US yields, soft US Dollar

Gold price slid during the North American session as market participants digested Federal Reserve Chair Jerome Powell’s comments at a European Central Bank forum in Portugal. Powell turned slightly dovish, yet US Treasury yields remained firm. The XAU/USD trades around $2,324.

Ethereum ETFs set for $5 billion inflows despite ETH Foundation's continuous sales

Ethereum is down more than 1.4% on Tuesday following another ETH sale from the Ethereum Foundation. Meanwhile, crypto exchange Gemini's recent report reveals that ETH ETF could see about $5 billion in net inflows within six months of launch.

Benefit of the doubt: US consumer confidence and elections

Despite widespread expectation for the US economy to be in recession in 2024, that fate has been avoided thanks to a resilient consumer. Yet it is difficult to square this undaunted spending with consumer confidence and sentiment readings that are lackluster at best.