GBP/USD

Cable edged lower on sub-forecast Uk November earnings which adds to talks about possible rate cuts, although the BoE signals that cuts are still not on the table, with hawkish hold expected on Thursday’s policy meeting.

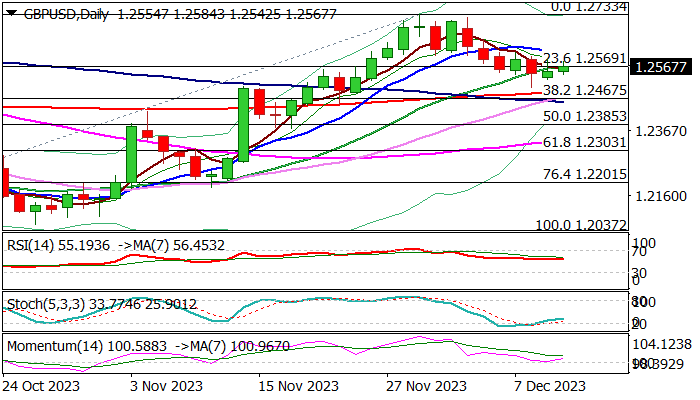

Near-term structure remains positively aligned while the price stays above 200DMA (1.2491), but break above 10DMA (1.2608) is needed to generate positive signal and shift near-term mode from sideways to bullish.

Positive momentum on daily chart supports the notion, as larger uptrend from 1.2037 (Oct 4 low) is still intact.

Caution on loss of lower pivots at 1.2491 (200DMA) and 1.2467 (Fibo 38.2% of 1.2037/1.2733) which would open way for deeper correction.

Res: 1.2608; 1.2652; 1.2678; 1.2733.

Sup: 1.2502; 1.2491; 1.2467; 1.2428.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD stands tall above 0.6700 after Australian trade data

AUD/USD holds higher ground above 0.6700 in the Asian session on Thursday. The Aussie pair shrugs off mixed Australian trade data, as sustained US Dollar weakness continues to undermine amid light trading. The focus shifts to Friday's US Nonfarm Payrolls data.

USD/JPY keeps losses near 161.50 amid thin trading

USD/JPY is off the lows, still offered near 161.50 in Asian trading on Thursday. A broad US Dollar weakness alongside the US Treasury bond yields, softer risk tone and a US holiday-thinned trading contribute to the pair's downside.

Gold price remains supported by rising September Fed rate cut bets

Gold price oscillates in a narrow band during the Asian session on Thursday. The softer US economic data released on Wednesday pointed to a slowing labor market and economic momentum, which lifted bets for an interest rate cut by the Federal Reserve in September.

Here are the best and worst-performing cryptocurrencies in H1 2024

A recent report by Crypto Koryo on Wednesday revealed meme coins as the top performers among cryptocurrencies so far in 2024, with several altcoins coming in behind. The worst-performing tokens are DeFi and governance tokens.

Could the post-UK elections market moves resemble 1997 and 2010?

Thursday's UK elections expected to bring political change. Similar developments in both 1997 and 2010 weighed on the Pound. History points to a significant easing in Pound volatility across the board. Recent FTSE 100 performance matches the 2015 pre-election moves.