GBP/USD Forecast: Upside locked in? Ongoing UK lockdown, BOE, and NFP to determine next moves

- GBP/USD has been rising amid dollar weakness and PM Johnson's return.

- The next move in the UK lockdown, the BOE's decision, and US Non-Farm Payrolls stand out.

- Early May's daily chart is pointing to gains.

- The FX Poll is pointing to lower targets in all timeframes.

Pound/dollar has moved higher in a week that saw emotions rise and fall. The first full week of May features the Bank of England's rate decision, the Non-Farm Payrolls, and speculation about returning to normal in both the US and the UK.

This week in GBP/USD: Boris is back, the Fed all in

Boris is back: UK Prime Minister Boris Johnson has returned to work after recovering from COVID-19 and also witnessed the birth of his new baby boy. His first public appearance outside Downing Street was somewhat somber, and he was reportedly hesitant about lifting the lockdown, thus weighing on the pound. However, he gradually returned to his optimistic self toward the end of the week, declaring that the peak of coronavirus has passed and gearing up for easing restrictions.

Fed support: The US dollar was mostly on the back foot due to several factors, first and foremost, the Federal Reserve's commitment do whatever is necessary. The Fed began by expanding its municipal bond-buying scheme and then by loosening conditions for its Main Street lending facility.

In the middle, Jerome Powell, Chairman of the Federal Reserve, reaffirmed his commitment to do what is needed – leaving rates at zero, buying bonds "at the amount needed" and called for the government to do more and leave debt considerations for later on. Printing more money and the high level of stocks weighed on the safe-haven US dollar.

Weak US data: The background for the bank's commitment was a crash of 4.8% in Gross Domestic Product in the first quarter, driven by a plunge of 7.6% in Personal Consumption. Unemployment claims rose by around another 3.8 million in the week ending April 24, bringing total job losses to around 30 million since mid-March.

The ISM Manufacturing Purchasing Managers' Index beat expectations with 41.5 points, but the devastating employment component, at 27.5, implies a substantial loss of jobs.

US coronavirus situation: While the US confirmed COVID-19 cases topped one million and nearly 2,000 people are dying daily, the pace is slowing down also in America. Several states have let their "stay-at-home" orders lapse or eased restrictions.

Sino-American relations: President Donald Trump continued encouraging the reopening of the economy but also weighed on sentiment by suggesting that the virus originated from a lab in Wuhan, China. Tensions between the world's largest economy imply weaker global trade. That weighed on sentiment and supported the dollar.

All in all, April ended on a higher note for GBP/USD, yet with more than a few mood swings.

UK events: Decision time for Boris and the BOE

The current lockdown extension ends on May 7, and PM Johnson will probably announce the next steps beforehand. On the one hand, the curve is flattening, and businesses pressure the government to let the economy reopen. On the other hand, his personal experience and fears of a second infection may push for maintaining most limits.

Around 70% of Brits do not want businesses to open if the virus is not fully contained, more than in any other country:

Source: Ipsos Mori

In his election campaign, Johnson touted the National Health Service (NHS) – usually championed by Labour – amid growing support for enlarging funding. He may go with the public opinion also on this matter, thus weighing on the pound. Apart from downbeat prospects for the economy, maintaining a stricter version of the shuttering also implies that the virus is still not under control.

May 7 is also the day the Bank of England announces its rate decision and this time it is due out at 6:00 GMT – 7:00 in the UK. The extraordinary timing will add to speculation about why the BOE needs to release the data before markets open. Various statistics have been brought forward to that hour and do not consist of a media lockup, to prevent leaks. Is that the reason? Or does the bank plan to shock markets with a big announcement?

The "Old Lady," as the institution is also known, will likely leave its interest rate unchanged at 0.10% and the Quantitative Easing program at £645 billion. The BOE previously expanded slashed its rates twice and boosted its QE program by around 50% in response to the crisis .Similar to other central banks, it might opt to take stock of the current situation before acting again.

Andrew Bailey, Governor of the Bank of England, will also be presiding over his first release of Monetary Policy Report. The quarterly publication consists of growth and inflation forecasts. These will be in the spotlight. The Office for Budget Responsibility had a contraction of 35% in the second quarter as one of its scenarios. Will the BOE be similarly pessimistic? The bank's projections will likely rock the pound.

If the BOE surprises with expanding its QE program, it would allow the government to pump more money into the economy and boost the pound. The Treasury already received a loan from the central bank in what was described as normal activity. However, direct monetary financing on a regular basis may already be seen as devaluing the pound.

Overall, these two big decisions, on the health and monetary fronts, are likely to rock the pound.

Here is the list of UK events from the FXStreet calendar:

US events: Slow reopening and terrible jobs report

Several US states have been easing shelter-in-place orders or canceling them as a new month begins. Balancing between health and economic concerns is difficult, especially with political pressures from the president. Tracing and testing are critical to curbing fresh infections and experts say these are not fully ready.

The focus remains in the tri-state area of New York, New Jersey, and Connecticut, the epicenter of the US outbreak. Andrew Cuomo, Governor of New York, intends to gradually lift lockdowns only on May 15 despite significant improvement. Worries about a surge in deaths in New Jersey are eyed.

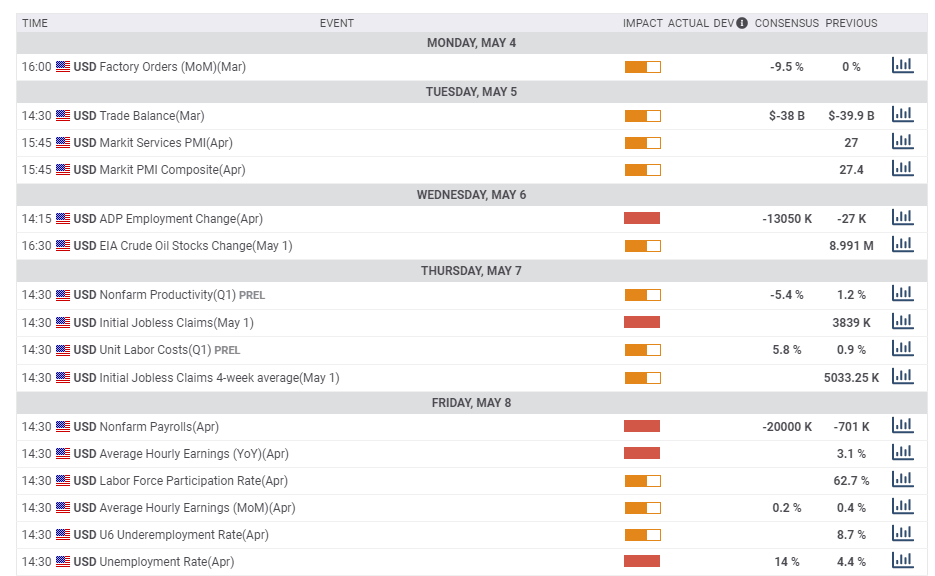

The US calendar is packed with top-tier events once again. Factory orders for March kick off the week, and the publication also includes revisions to Durable Goods Orders. Both figures feed into first-quarter GDP calculations that may be due for a downward revision.

Tuesday is when investors receive more hints towards Friday's Non-Farm Payrolls report. The ISM Non-Manufacturing PMI for April will likely show a crash in sentiment within the services sector, with the employment component closely watched.

The ADP Non-Farm Payrolls report will likely show a plunge in private-sector jobs, setting the stage for the official jobs report. While the correlation is not always clear, markets tend to react. Thursday's jobless claims will likely be in the millions once again, yet the publication refers to the week ending May 1, thus outside the NFP survey time.

Finally, Non-Farm Payrolls for April are expected to show a loss of no fewer than 20 million jobs. The disease has probably destroyed all the positions gained in the decade since the financial crisis. In March, the US reported a loss of 701,000 jobs, and that will likely be revised down.

The Unemployment Rate carries expectations of jumping to 14%. It is essential to note that due to the magnitude of the pandemic, ranges vary wildly, and market reaction may be extraordinary. In general, worse numbers would weigh on stocks and boost the safe-haven dollar, but this NFP is dissimilar to any previous one.

The jobless rate depends on participation in the labor force, which has tumbled to 62.7% in March and may further drop. If the unemployment rate is relatively low while participation crashes, it will take the sting out of any optimism. People that leave the workforce may find it hard to return.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar has continued setting higher highs and higher lows – a bullish sign. Moreover, it crossed the 50-day Simple Moving Average, and momentum on the daily chart turned positive. It still trades below the 100 and 200-day SMAs, but the picture remains positive.

Fierce resistance awaits at 1.2645, which is a double-top and converges with the 200-day SMA. It is followed by 1.2720, which provided support early in the year, and it is also where the 100-day SMA hit the price. The next lines to watch are 1.2850 and 1.2980.

Support awaits at 1.2515, which was a swing high in late April and also played a role beforehand. The next cushion is 1.2380, which initially worked as resistance and then as support in April. Further down, 1.2250 and 1.2165 are eyed.

GBP/USD Sentiment

Downbeat US data and ongoing UK lockdowns may bring GBP/USD's recovery to an end. The 1.2645 level is critical.

The FXStreet Forecast Poll is showing that experts are pointing to lower prices yet with a broad split between them. The average targets have been moderately upgraded in the past week.

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637239244162122890.png&w=1536&q=95)

-637239277118794061.png&w=1536&q=95)