- GBP/USD has been advancing on Fed-fueled dollar weakness.

- Clashes around Brexit and worries about rising UK cases could slow the pair's advance.

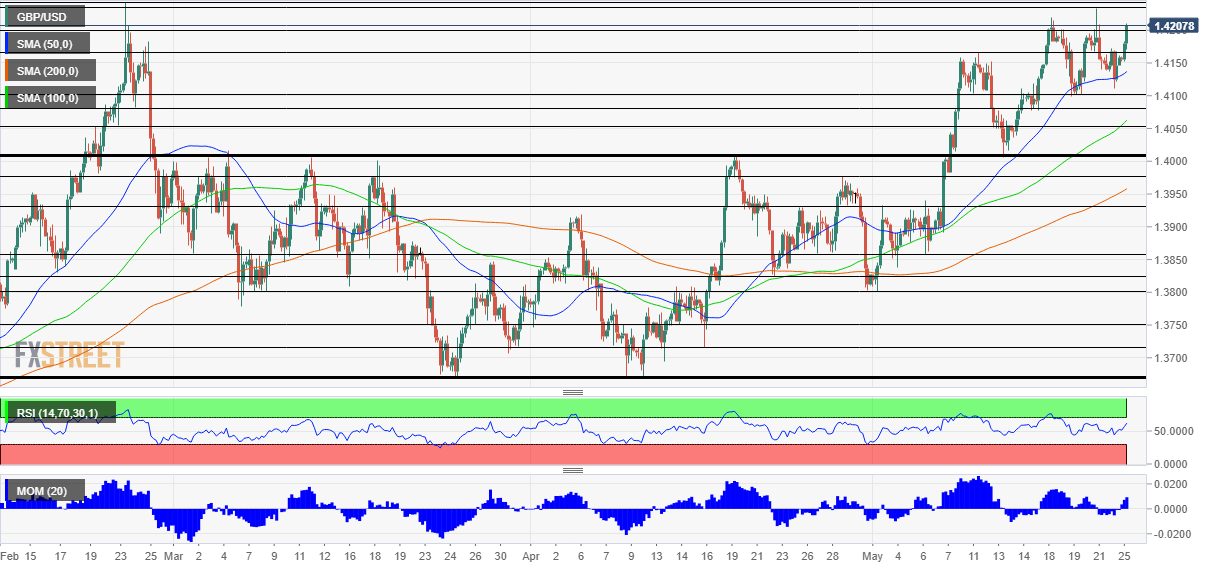

- Tuesday's four-hour chart is pointing to further gains.

Fed fuel as its limits – sterling is struggling to take advantage of dollar weakness and that may indicate an inability to reach higher ground. While EUR/USD has hit new highs, GBP/USD is lagging behind.

There are two reasons for the pound's issues. First, Brexit refuses to die, and with it, the frictions around the Northern Ireland protocol. European Commission President Ursula von der Leyen stated there can be no changes to the agreement signed, angering London.

UK Prime Minister Boris Johnson's insistence that there will be no customs checks on the Irish Sea – separating Great Britain and Northern Ireland – contradicts the Withdrawal Agreement. Both sides still need to settle regulations related to the services sector.

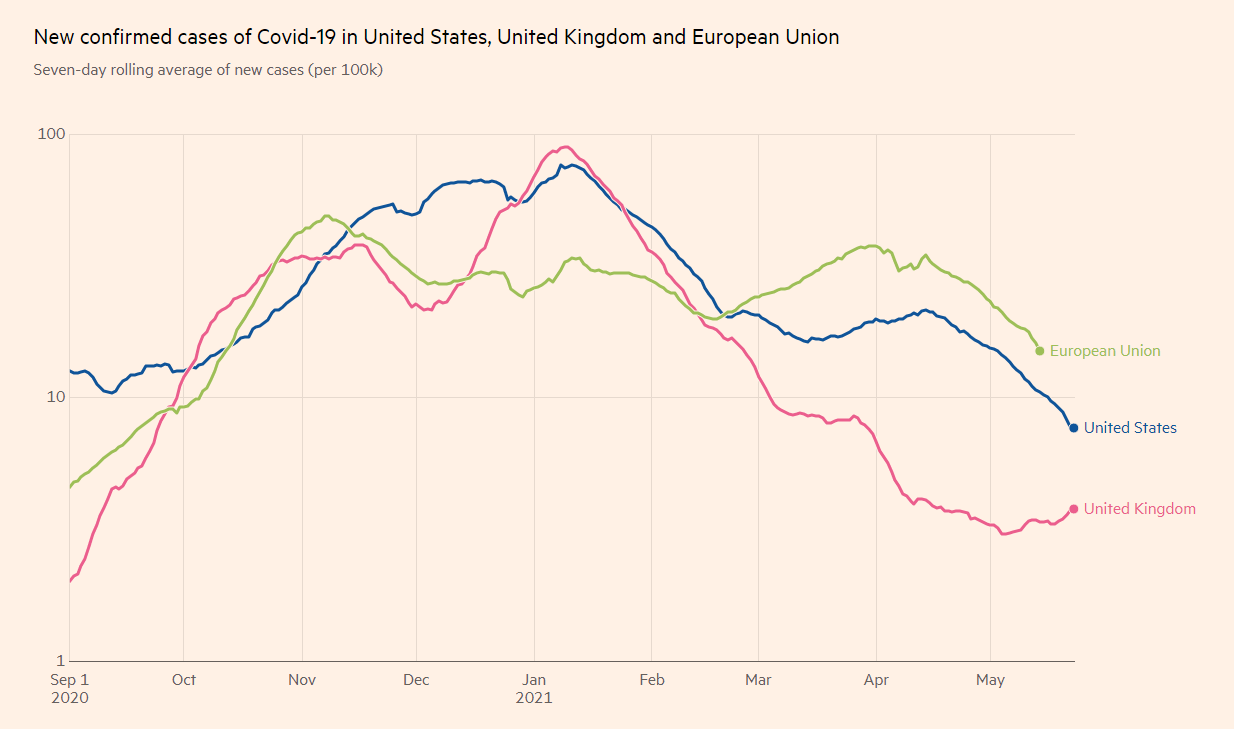

Secondly, coronavirus cases have been picking up in the UK. Britain had been leading the vaccine drive among large economies and also benefited from the fruits of the effort – a quick reopening. However, the fast spread of a variant first identified in Britain has been causing an uptick. While the plans to fully reopen are still on track, the swing higher may further hobble sterling.

Source: FT

On the other side of the pond, the dollar suffered from the Federal Reserve's consistent message that the economy still has a long way to go and that rising inflation is transitory. The latest to provide such comments were Fed Governor Lael Brainard and Esther George, a known hawk. Their colleagues Charles Evans and Randal Quarles will speak later in the day.

The Conference Board's Consumer Confidence measure for May – and its inflation components – are also of interest.

US Conference Board Consumer Confidence May Preview: Inflation saps consumer sentiment

Overall, even if the dollar remains on the back foot, sterling has its own issues.

GBP/USD Technical Analysis

Pound/dollar remains in an uptrend – the four-hour chart is pointing to higher highs and higher lows. However, upside momentum is not as strong as it used to be earlier in the month and the pair already dipped below the 50 Simple Moving Average.

Some resistance is at the round 1.42 level. It is followed by 1.4220, May's high, and then by the 2021 peak of 1.4240.

Support is at 1.4160, a peak in early May, followed by 1.41, a support line from last week. Further below, 1.4075 and 1.4050 await the pair.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0700 area following post-PCE jump

After spiking to a daily high of 1.0720 with the immediate reaction to US PCE inflation data, EUR/USD lost its traction and declined to the 1.0700 area. Investors remain cautious ahead of this weekend's French election and make it difficult for the Euro to gather strength.

GBP/USD stays below 1.2650 after US inflation data

GBP/USD struggles to preserve its bullish momentum and trades below 1.2650 in the American session on Friday. Earlier in the day, the data from the US showed that the annual core PCE inflation declined to 2.6% in May, limiting the USD's upside and helping the pair hold its ground.

Gold keeps its daily gains near $2,330 following US PCE data

Gold prices maintain their constructive bias around $2,330 after US inflation readings gauged by the PCE matched consensus in May and US yields advance slightly across the curve.

BTC struggles around the $62,000 level

Bitcoin price faces pullback resistance at the lower band of the descending wedge around $62,000. Ethereum price finds support at $3,288, the 61.8% Fibonacci retracement level. Ripple price faces resistance at $0.500, its daily resistance level.

French Elections Preview: Euro to suffer after the calm, as specter of extremists, uncertainty rise Premium

The first round of French parliamentary elections is set to trigger high uncertainty. Soothing messages from the far right and far left leave the Euro vulnerable to falls. Calm may return only after the second round of voting on July 7.