GBP/USD Forecast: New month, new falls? Brexit, Non-Farm Payrolls, and coronavirus stats are key

- GBP/USD has been pulled and pushed by Brexit, politics, and hopes for a return to normal.

- Brexit, a full buildup to US Non-Farm Payrolls, and recovery hopes are all eyed.

- Late May's daily chart is painting a mixed picture.

- The FX Pol is pointing to short and medium-term declines.

GBP/USD cannot complain about the lack of volatility – albeit things are becoming more complex. Politics, including Brexit, is growingly competing with coronavirus headlines from both sides of the Atlantic and eventually sent cable higher on the week, but lower on the month. The first week of June consists of top-tier US publications and an even more significant role for Brexit.

This week in GBP/USD: Internal and external politics

Brexit: A glimmer of hope was seen early in the week when reports emerged that the EU was ready to provide concessions around fisheries – a politically sensitive topic in the UK. However, sterling's rise was cut short by Britain's repeated refusal to extend the transition period beyond year-end, raising the chances that if talks fail, the UK would revert to World Trade Organization rules in 2021.

Scandal: One rule for everybody and another for those at the top – that is how many Brits felt after it was revealed that Dominic Cummings, the senior Downing Street adviser, violated the lockdown rules he was instrumental in devising.

Cummings and also his boss, Prime Minister Boris Johnson, did not fully apologize, and the issue means that people may find it hard to follow instructions when elites do not give an example. The scandal limited the pound's ability to take advantage of dollar weakness.

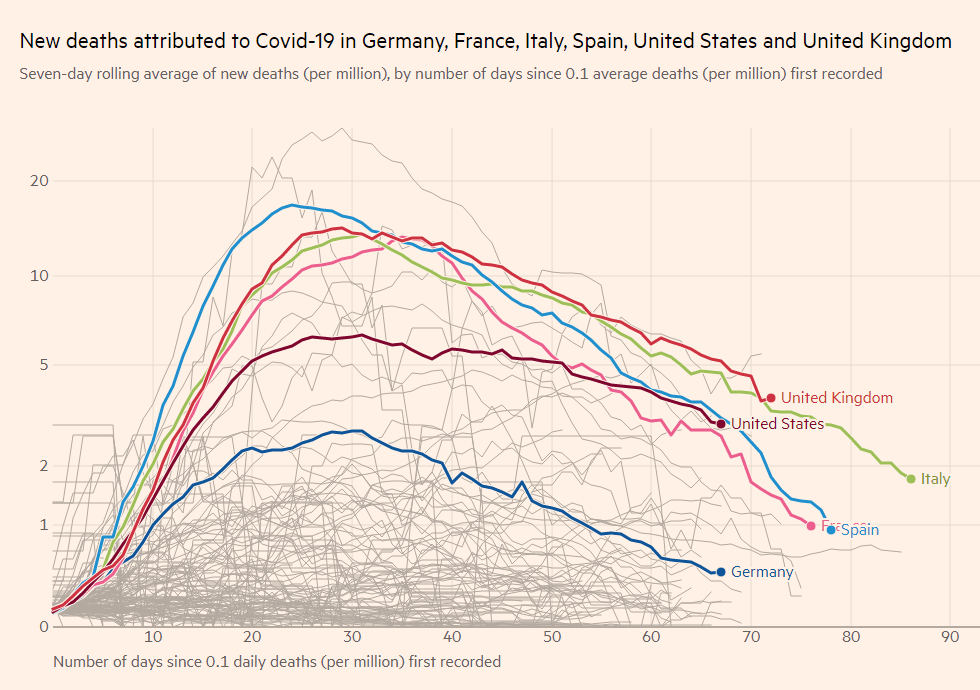

Easing lockdowns: The slow fall in coronavirus infections and deaths has encouraged the PM to allow for some shops – and also the Premier League – to return to business in June. A new tracing app has been deployed and is set to help control potential second waves. The UK is moving slower than some European countries, which experienced faster falls in their COVID-19 statistics and sterling lagged behind the euro.

A seven-day rolling average of new deaths (per million), by number of days since 0.1 average deaths (per million) first recorded

Source: Financial Times

Negative rates: Speculation about setting sub-zero interest rates remained rife, but Andrew Bailey, Governor of the Bank of England, seemed to hint it is not imminent. The June meeting may be focused on topping up its bond-buying scheme rather than setting negative rates, and that was a positive development for the pound.

US markets: In America, the Federal Reserve is highly unlikely to further lower rates, but its ongoing support – and pledge to do more – continue underpinning stock markets, and weighing on the safe-haven dollar. Investors were also encouraged by ongoing efforts to develop COVID-19 vaccines. Various states, such as California, continued loosening stay-at-home orders.

Sino-American relations: The equity rally was occasionally hit by growing Sino-American tensions. Beijing's decision to tighten its grip on Hong Kong triggered protests in the city-state and to a US declaration that HK is no longer autonomous. Both Democrats and Republicans passed bills related to human rights and listing of Chinese firms in the US, further intensifying the "new cold war." The fallout between the world's largest economies sent the greenback higher at times.

US data has been mixed, with optimism coming from a drop in continuing claims – suggesting some Americans have gone back to work despite the dire situation. Gross Domestic Product was downgraded to fall of 5% annualized in the first quarter, and investment crashed, as seen by substantial falls in Durable Goods Orders in April.

UK events: Brexit, final PMIs, coronavirus stats

The deadline for prolonging the Brexit implementation period beyond the year-end is here. While the UK repeated its objection to any extension, passing the June 2 deadline without optimism for an accord may weigh on the pound. Reports of progress on trade or any other topic may boost the pound.

Both sides still have time to negotiate a deal until the last moment – December 31 – but negotiations may slow down around the summer.

Ongoing improvement in coronavirus figures is critical to further return to normal – including reopening of more shops in mid-June. As shown in the graph above, the UK's improvement pace lags behind its peers. Moreover, testing capacity and reports about the tracing application's ability to help contain new clusters will also come to the test and may impact the pound.

The UK economic calendar remains light, with Markit's final Purchasing Managers' Indexes for May set to confirm weakly, yet improving economic activity. GfK's Consumer Confidence figure will likely show shoppers remain pessimistic.

Here is the list of UK events from the FXStreet calendar:

US events: Tensions, reopening, the buildup to the Non-Farm Payrolls

Sino-American tensions will probably remain high on the agenda for markets. The rows about Huawei, Hong Kong, and also Taiwan may continue supporting the safe-haven dollar after taking a brief pause on Friday. Investors find comfort in the trade deal – which both sides are upholding. While that lasts, the greenback could occasionally come under pressure.

The daily death toll from coronavirus has dropped below 1,000 in the US while states are reopening. The longer this lasts, the better for the market mood and for GBP/USD. However, flareups in various states – as seen in several places in the world – may trigger dollar demand.

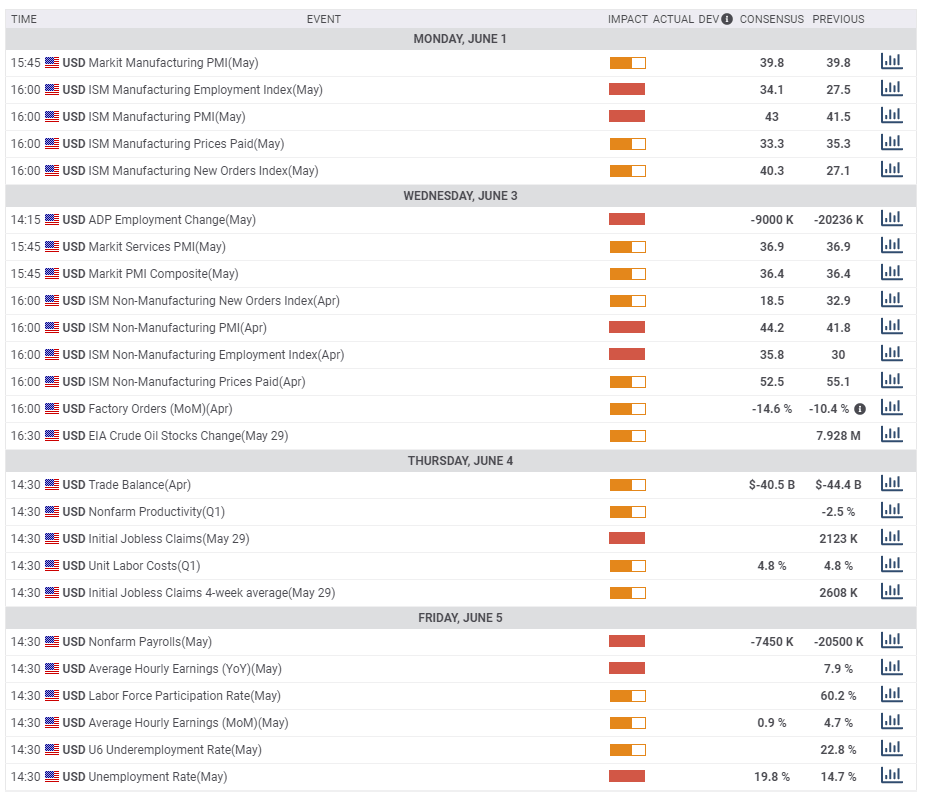

The economic calendar is packed and revolves around Friday's Non-Farm Payrolls report. The buildup kicks off on Monday, with the ISM Manufacturing Purchasing Managers' Index. The forward-looking indicator and its employment component will likely show a bounce from the lows but remain below the 50-point mark separating expansion from contraction.

ADP's private-sector labor market report will shape NFP expectations in a more precise manner. ADP's report of 20.236 million positions lost in April was in line with the private sector component of the official figure. The ISM Non-Manufacturing PMI later on Wednesday is set to show a pickup in the labor market in the services sector, albeit from depressed levels.

May's Non-Farm Payrolls will likely show a smaller loss of jobs, but still in the millions. The unemployment rate could leap to around 20% – horrible, yet below the Great Depression peak of 25%. Wages, that jumped in April, are set to revert to normal. Figures such as the Underemployment level, U-6, and Employment-to-Population ratio will provide a broader picture of the economy.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar is trading in an upwards channel of sorts and has also topped the 50-day Simple Moving Average. However, momentum remains to the downside and the currency pair remains below the 100 and 200 SMAs.

All in all, the picture is mixed.

Fierce resistance awaits at 1.2360, which was a stubborn cap in late May and also played a role earlier in the year. It is followed by 1.24, a round number, and also a support line several times in April. Next up, 1.2470 was a swing high in early May. Further above, 1.2520 was a swing high in April and 1.2575 played a role around the same time.

Further down, 1.2285 capped cable in mid-May. The next level is 1.2250, which was a trough in mid-April. It is followed by 1.2210, a low point in late May, followed by 1.2160, also a low point from the same time. The last line to watch's is May's bottom, at 1.2180.

GBP/USD Sentiment

Will the more recent uptrend continue or the broader downtrend prevail? Sino-American relations, Brexit, the UK's slow pace of recovering from the disease, and exaggerated hopes from US data may send the pair down to kick off June by extending May's downtrend.

The FXStreet Forecast Poll is pointing to minor declines in the short term before a gradual decrease later on. Average targets are little changed, but looking deeper into the data shows a wide variety of targets, especially in the longer term.

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.