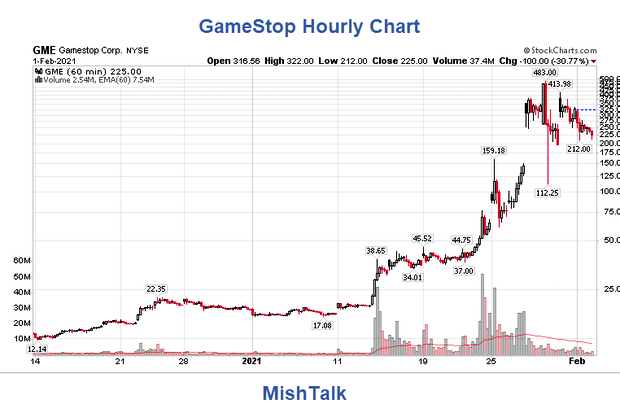

GameStop (GME Stock) plunged 30% today, is the short squeeze over?

Squeeze Likely Over

My guess is the squeeze is over. Hedge funds have covered their shorts. And we have a three surge stage that frequently marks tops in short squeezes.

The remaining shorts are small players who rode it out, hedge funds who recently got short timing the play much better, or the market makers who are now the ones net short in size.

If my thesis is correct, GameStop will go back where it came from. The market makers will pull bids as they did today.

Option Buying

Put speculation is now on the rise. Until now it was call speculation. The call sellers hedged by buying shares driving up the price.

That dynamic has changed. PUT sellers short stock as PUTs get into the money.

Options bets fuel both rises and declines, especially in illiquid stocks.

How to Play?

I am not touching this. For starters I could be wrong about the squeeze being over. I doubt it but I could be.

One could try options, but the premiums are nuts.

GameStop Option Prices

Those are near-term, near the money Option Prices From the CBOE.

Each option represents 100 shares but prices are per share. Thus prices are 1/100th of the money to buy or sell an option.

For a strike 215 PUT option that expires on February 12, in 9 trading days you will pony up $7,485 dollars or $78.85 per share.

To make any money, shares will have to decline enough for you to recover your price paid, and it has to happen by February 12.

The break even price is $215.00-$78.85 = $136.15 and it's at $225 now.

Who Wins?

You may win if you are correct about getting a big enough plunge in the next 9 days.

But the market maker who sells you the PUTs will make money no matter what happens.

He will hedge by shorting if the price declines and just watch you lose all your money if the price rises.

Maximum Pain

Don't count out price manipulation in which the price on February 12 falls at the exact price that makes the most options (PUTs and CALLs) expire worthless. That is known as "Maximum Pain".

There are technical hedging reasons why Maximum Pain happens but manipulation also happens if the market makers can get away with it.

GME Home Runs

Nonetheless home runs can and do happen. But in this case the home runs are likely in the past.

People rode this up from $17 to $413 and you want to get in now on the long side?

Why?

Yet the short side is not without risk as two hedge funds nearly blew up over this. One lost half their money in a month. It's possible the squeeze is not over.

But if you believe like me that the squeeze is over but don't like huge option premiums, the buying deep in the money PUTs will effectively turn your option play into a short without the risk of getting squeezed out.

For example, a Feb 26 strike $800 PUT would set you back $602 but the cost would be $60,020. To gain on the trade GME would have to close below ($800-$602 = $198) vs the current price of $225.

The first advantage in the trade is you have a maximum defined loss of $60,020 vs an unlimited loss in shorting.

But the advantage of that trade is you only need a decline of $27 not $89 to break even. You would also have until February 26, not February 12 to be correct.

Care to put up $60,020 per option? I don't. Care to bet on a $90 plunge by February 12? I don't but some have.

I suspect option premiums are so high that near term, near the money CALL and PUT buyers both get wiped out.

Related Discussion

Please see related discussion.

- How Do GameStop and Silver Trading Differ From Bank Lending?

- Naked Shorting is Illegal: So How the Hell was GameStop 140% Short?

- The Reddit Inspired Attack on Shorts Exposed Wall Street Sleaze and Corruption

- Silver Coin Dealers are Overwhelmed With Orders as Reddit Speculators Takes Aim

Number 1 Rule

Above all, remember my #1 rule: You may win but the casino never loses.

And once again blame the Fed. The casino action in money leads to casino action in stocks.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc