- Investors expect Frances's second round of parliamentary elections to end with a hung parliament.

- Keeping extremists out of power is priced in and could result in profit-taking on Euro gains.

- A surprise victory for Marine Le Pen's National Rally would send the common currency plunging.

Are investors basking in the summer fun too soon? The French are going to the polls while organizing their annual vacances and markets seem calm ahead of the second round of parliamentary elections. This calm may create an opportunity.

Here is a preview of the French elections due on Sunday, July 7.

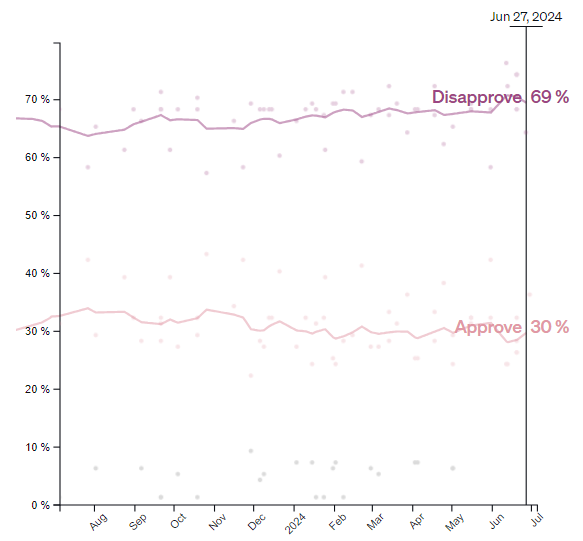

France is Europe's second-largest economy and the only nuclear power in the European Union. Markets adore centrist President Emmanuel Macron and his reforms – but his compatriots beg to disagree.

Macron's approval rating. Source: Politico

His centrist party came out third in the first round, while Marine Le Pen's far-right National Rally came on top, receiving nearly a third of the votes.

France has a complex electoral system, making it difficult for pollsters and political analysts to assess the outcome. Nevertheless, there is an optimistic scenario stemming from the fact that many candidates retired in an effort to stop the far-right.

Macron's centrists and the New Popular Front – itself comprised of four parties – have agreed to let the leading candidate in each constituency remain in the race against Le Pen's person. While not all candidates obeyed, hopes of halting have risen.

According to some estimates, the National Rally will obtain no more than 240 or 250 seats in parliament, short of the 289 needed for a majority. The division of seats among of the 577-strong Assemblée nationale (as the French parliament is called) will be known as markets open in Asia.

French second round market positioning

The Euro has been advancing as the optimism of halting the Le Pen victory has increased. A scenario of a hung parliament – which could result in a technocratic harmless government – is already in the price.

I expect the common currency to decline on a "buy the rumor, sell the fact" response, declining from the highs. Such an impact may be short-lived, until other factors return to impact the Euro.

Later, a government which comprises Macron's centrists, the center-left Socialists and the center-right Republicans would be the best outcome and could lift the currency. A do-nothing technocratic government would be ignored.

There is another scenario in which the far-right does achieve a majority if center-right or extreme-left voters give Le Pen's party a chance. Such an outcome would shock markets after a sanguine week. In such a case, global stock markets would suffer, and the Euro would plunge.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats from daily highs, holds above 1.0800

EUR/USD loses traction but holds above 1.0800 after touching its highest level in three weeks above 1.0840. Nonfarm Payrolls in the US rose more than expected in June but downward revisions to May and April don't allow the USD to gather strength.

GBP/USD struggles to hold above 1.2800 after US jobs data

GBP/USD spiked above 1.2800 with the immediate reaction to the mixed US jobs report but retreated below this level. Nonfarm Payrolls in the US rose 206,000 in June. The Unemployment Rate ticked up to 4.1% and annual wage inflation declined to 3.9%.

Gold approaches $2,380 on robust NFP data

Gold intensifies the bullish stance for the day, rising to the vicinity of the $2,380 region following the publication of the US labour market report for the month of June. The benchmark 10-year US Treasury bond yield stays deep in the red near 4.3%, helping XAU/USD push higher.

Crypto Today: Bitcoin, Ethereum and Ripple lose key support levels, extend declines on Friday

Crypto market lost nearly 6% in market capitalization, down to $2.121 trillion. Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) erased recent gains from 2024.

French Elections Preview: Euro to “sell the fact” on a hung parliament scenario Premium

Investors expect Frances's second round of parliamentary elections to end with a hung parliament. Keeping extremists out of power is priced in and could result in profit-taking on Euro gains.