The two sharpest moves in financial markets last year were caused by political rather than economic events, as the Brexit vote and US election provided multiple trading opportunities. Whilst both these developments continue to wrangle on and potentially impact markets, looking ahead the immediate focus now shifts to France where another seismic political event could occur.

The main candidates

The two front-runners are the independent Emmanuel Macron and the far-right Marine Le Pen. Whilst there are many possible outcomes in the first round it seems probable that Le Pen will pass through, leaving Macron to fight it out with Republican leader Fillon and possibly Melenchon, who has performed well in televised debates, for a place in the final round.

As such the base case for us is that Macron and Le Pen progress to the final round, but should another outcome transpire in the first round an adjustment based on a broad simplification that the final result will provide either a market positive president (Macron or Fillon) or a market negative president (anyone else) ensures that relevance is maintained.

There are potential similarities between the French election and the US election/Brexit with an anti-establishment victory (EG Le Pen) having the potential to cause similar volatility to the triumph’s of Trump and “leave”. Whilst polls suggest this event unlikely, the outcomes of the US election and Brexit were both deemed unlikely according to surveys in the run-up to the vote and as such the largest market reaction could well occur should Le Pen prevail.

Can polls be trusted?

It is worth pointing out at this point that the margin between the two favourites is significantly higher than during the US election or Brexit and whilst pollsters have been roundly criticised in failing to predict the outcome of those events it was more a case of a misinterpretation of polling data rather than the data itself which lead to false conclusions. The vast majority of polls prior to Brexit had both sides neck and neck, but pollsters believed remain would be victorious based on the assumption that undecided voters would lean towards this side - this assumption proved to be false. As for the US election, polls placed both candidates within the margin of error, but the false assumption here was that key swing states would be won by Clinton when in fact they were taken by Trump.

Both those votes also contained binary decisions (Trump vs Clinton and Remain vs Leave) whilst at present there are several scenarios which could play out. Therefore the polling for the final round will be less accurate until the initial vote has taken place on the 23rd April.

Positive or negative market reaction?

With the political situation briefly outlined and two possible distinct scenarios described (market positive/market negative) let’s now focus on the potential impact this could have on the selected markets. It is important to note here that both rounds of voting take place on a Sunday and therefore the market will be closed. The last voting booths are scheduled to close at 8PM with exit polls due to be released shortly afterwards. These will give an early indication of the result but it should be kept in mind that these aren’t the final result itself, which will become apparent several hours later once the votes have been counted.

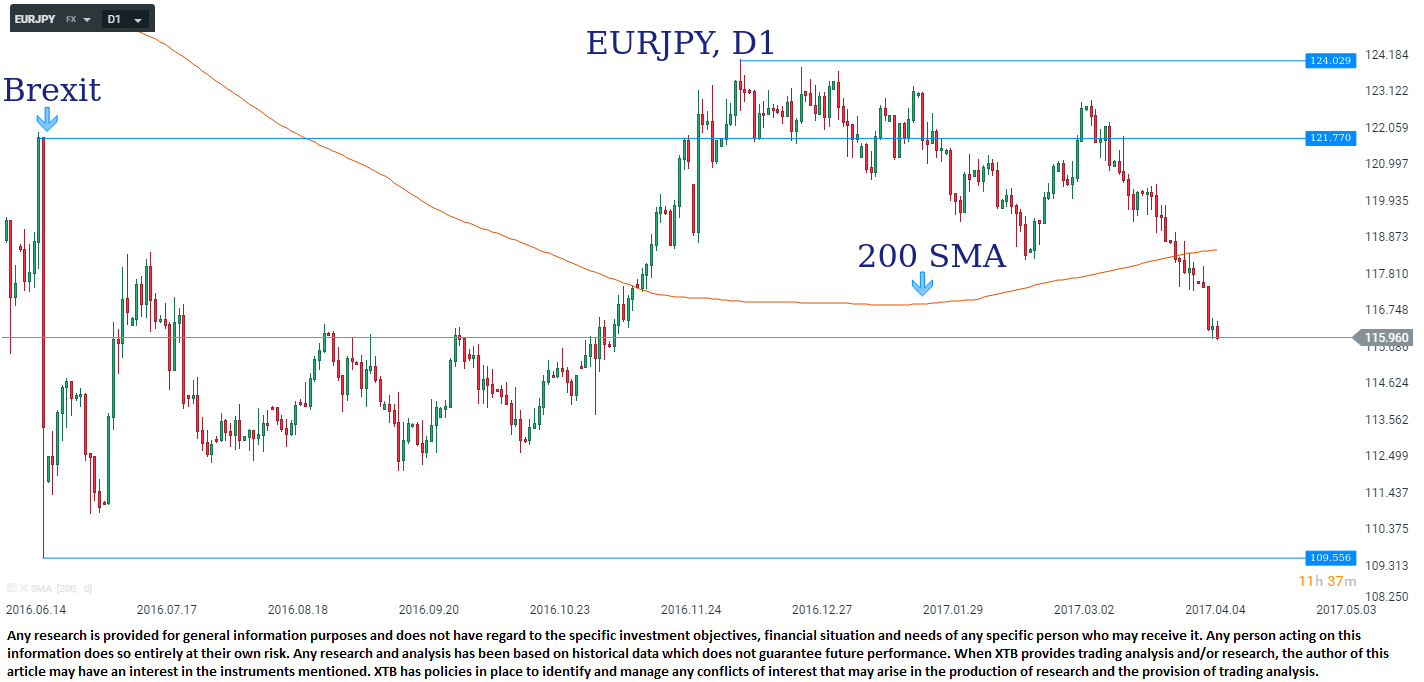

EURJPY

Le Pen recently described the Euro as a “knife in the ribs” of the French people and has promised to take France out of the eurozone and hold a referendum on EU membership should she be elected. Therefore a victory for Le Pen would likely be seen as Euro negative and due to the high levels of uncertainty it would bring, the EURJPY could experience some sharp declines. This pair has previously exhibited strong downside on political shocks and dropped around 1200 pips on the Brexit vote last year and a combination of this risk aversion attribute of the pair as well as its sensitivity to the Euro could mean this is one of the biggest movers in FX space over the election. Alternatively, a defeat for Le Pen could be positive for this market and see a relief rally as any discount in price for the possibility that she is elected would be erased once the result is clear.

From a technical perspective the EURJPY recently fell back below its 200 day SMA (orange line) for the first time since mid-November. The orientation of price and 200-day SMA can be used as a trend identification technique in that if price is above the indicator then it is assumed to be in an uptrend and vice versa if price falls below it. The market has declined by more than 600 pips in the past month and there's a growing feeling that more and more traders are positioning themselves for a market negative outcome.

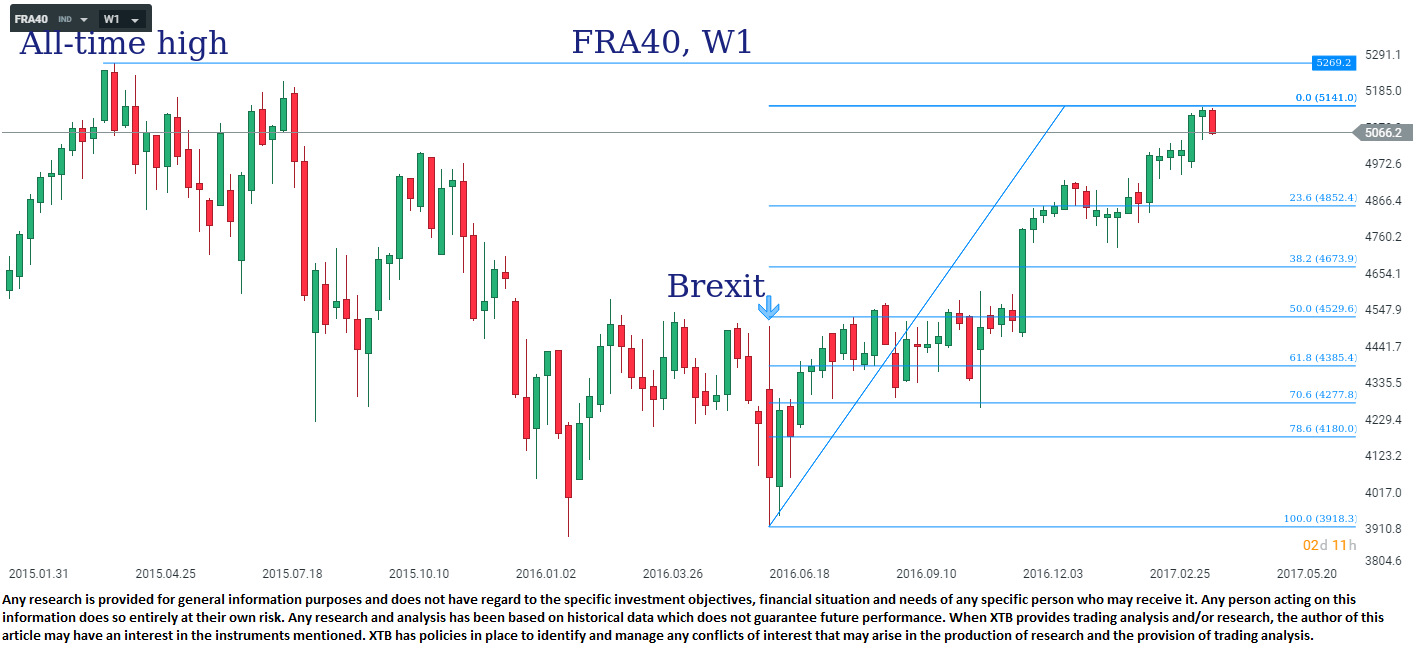

FRA40 (underlying CAC40)

The leading French stock market is obviously sensitive to the election result and has been enjoying a strong run higher in recent months. The market is higher by around 5% year-to-date and at the time of writing sits just a little over 3% from its all-time high of posted in April 2015. There appears to be little caution in this market heading into the elections which could be taken to mean that there is the possibility of sharp declines should an unexpected outcome occur (Le Pen win).

The all-time high of 5269.2 is a potentially major resistance level. A break above here on a positive outcome could lead to a breakout rally and sustained upside. Alternatively, if we do see an adverse reaction here then Fib retracements from the post-Brexit low to the recent high (currently 5141 but this may change in the coming weeks) could be seen as support or targets for shorts. The 50% retracement at 4529 could be particularly important as it is near a previous resistance level where the market broke higher from.

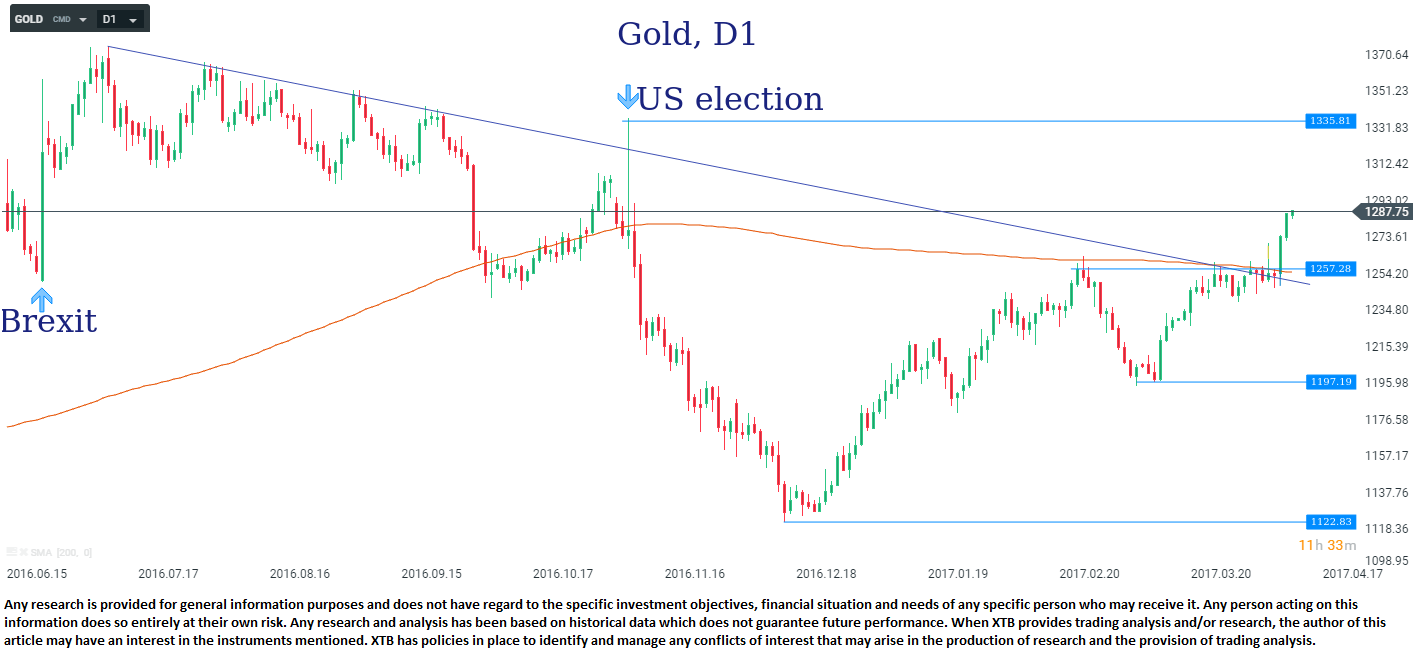

Gold

The price of Gold has enjoyed a strong run higher so far this year and is sitting on gains of approximately 12% in 2017. This market is renowned for its safe haven status and performs particularly well during times of uncertainty and panic. These characteristics mean that Gold could be one of the most sensitive assets to the election with an upset having the potential to see a spike higher like the one seen during the Brexit vote and US election. The price of Gold spiked by $100 from the lowest point to the highest on the day the Brexit result became known, and also popped $75 higher during the US election before swiftly reversing.

The technical picture for Gold is particularly interesting at present, as the market has clearly broken above the 200 day SMA (orange line) in the past week. Price has also broken above a falling trendline from the 2016 peak of 1374. An unexpected result that causes a shock in the election could see sharp gains as we saw during the Brexit vote and US election. The post US-election high of 1335 could be a target for bulls. Alternatively, the absence of any significant shock may see the precious metal turn lower once more with 1257 and 1197 a possible swing support level to keep an eye on should the market decline.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.