French election uncertainty weighs on EUR as traders eye US PCE inflation

EUR/USD

The EUR/USD has been on a depreciatory trend for the past five weeks, falling from a high of 1.0938 on May 22nd to a low of 1.0669 on June 15th. This weakness has been driven by a combination of factors, including political uncertainty in France, a mixed economic picture in the Eurozone, and a strengthening US dollar. The ECB's rate cut on June 6th failed to provide sustained support for the Euro, as investors remained cautious about the Eurozone's economic prospects.

Short-term (five-days) outlook: The Euro is likely to remain under pressure in the short term, as investors await the outcome of the French elections. The release of the Eurozone's flash HICP inflation estimate for June on June 28th will also be a key event to watch. A hotter-than-expected inflation print could reinforce the ECB's hawkish stance and provide some support for the Euro. Conversely, a softer inflation reading could fuel expectations for further rate cuts, potentially weighing on the single currency.

-

June 26 (Wed): German GfK Consumer Sentiment (Jul).

-

June 28 (Fri): Eurozone Flash HICP (Jun), French CPI (Jun), German Unemployment Rate (Jun), Comments from ECB's Rehn, Panetta & Lane.

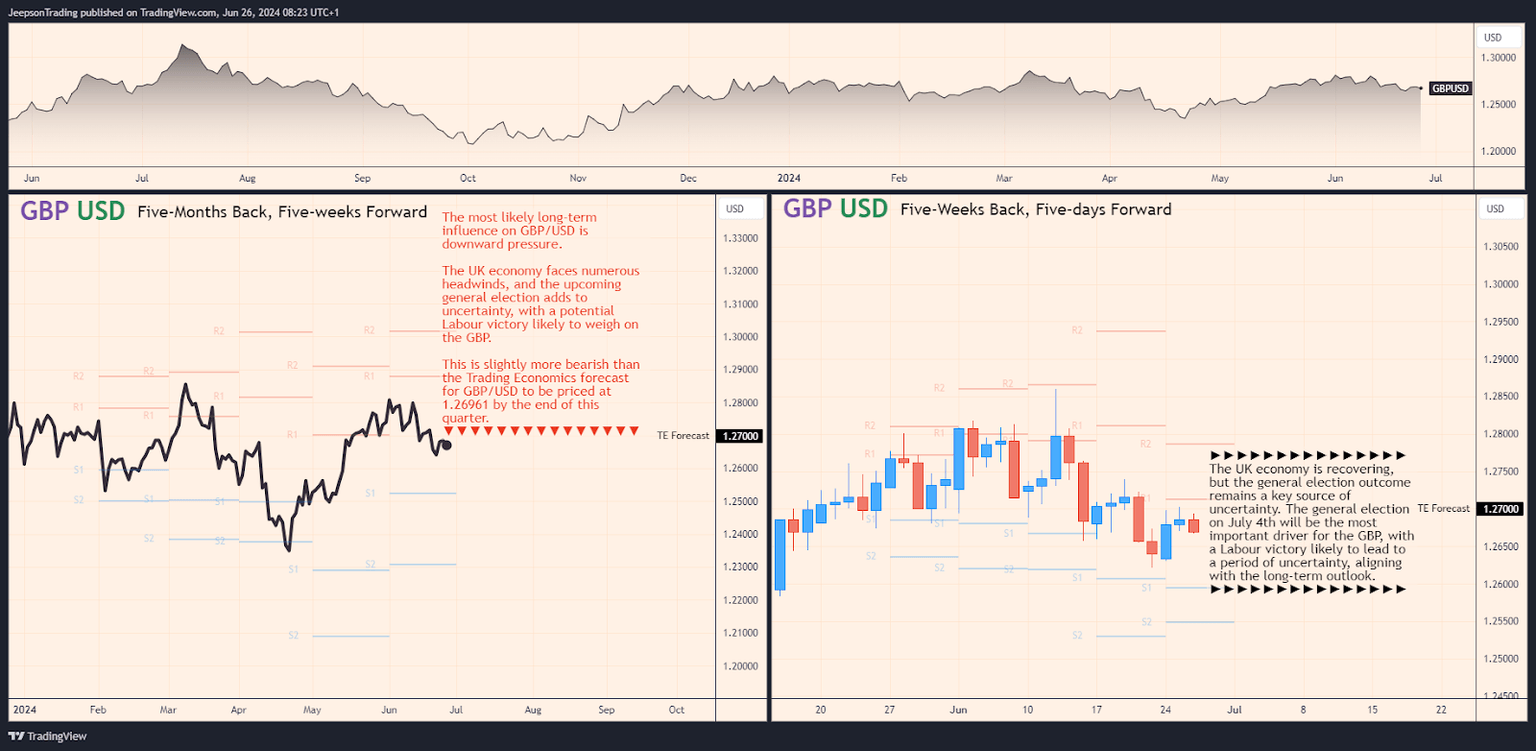

GBP/USD

The GBPUSD has been range bound over the past five weeks, trading between 1.2550 and 1.2800. The Pound has been supported by signs of resilience in the UK economy, including stronger-than-expected GDP growth and falling inflation. However, uncertainty surrounding the upcoming general election on July 4th has capped the GBP's upside potential.

Short-term (five-days) outlook: The GBP is likely to remain volatile in the short term, as investors position themselves ahead of the general election. The release of the second estimate of Q1 GDP growth on June 28th could provide further confirmation of the UK's economic recovery. A positive surprise could lend support to the GBP. Conversely, a downward revision could weigh on the currency.

- June 28 (Fri): UK Q1 GDP (Second Estimate), UK Current Account (Q1).

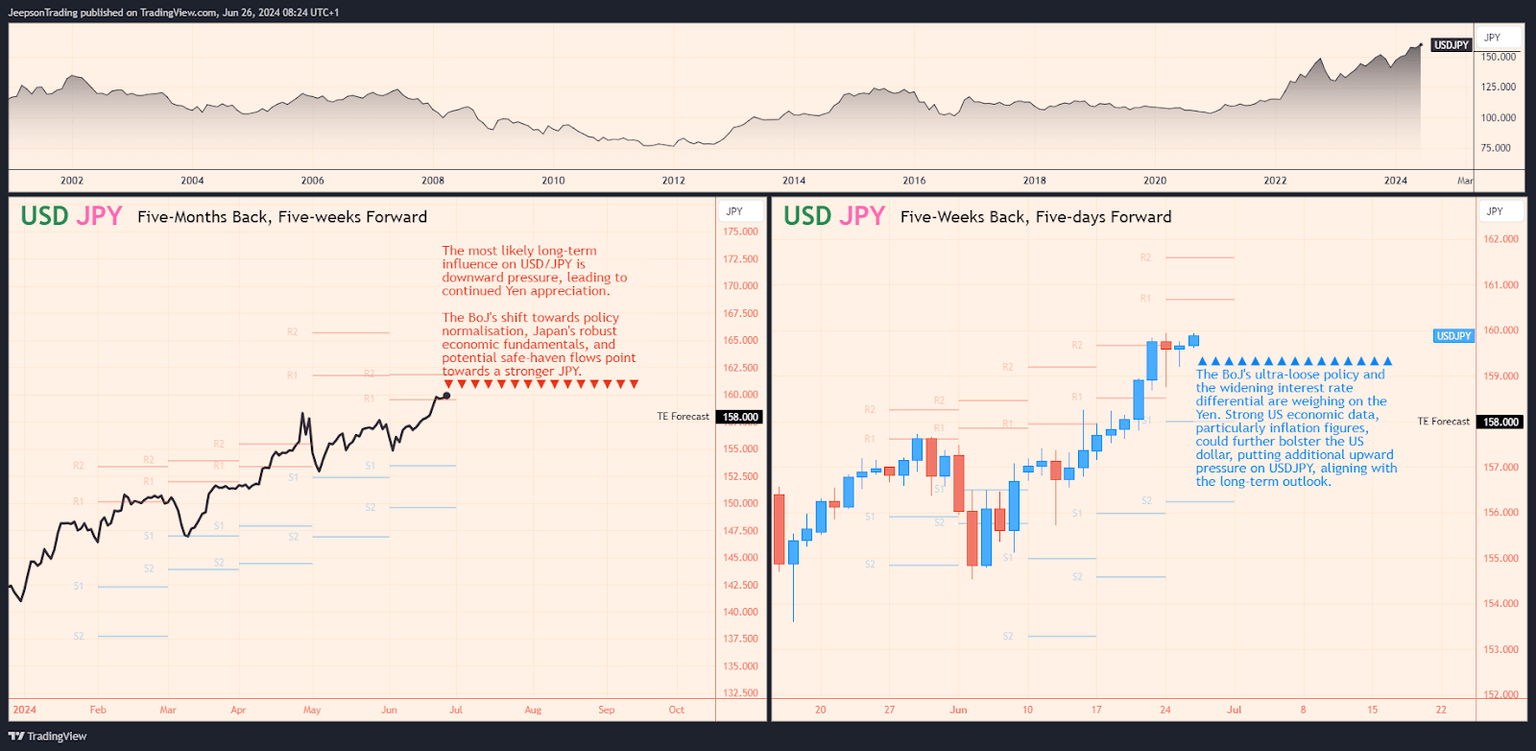

USD/JPY

The USD/JPY has been on an appreciating trend for the past five weeks, rising from a low of 156.60 on May 24th to a high of 159.95 on June 21st. This strength has been driven by the divergence in monetary policy between the BoJ and other major central banks, leading to a widening interest rate differential. The BoJ's decision to maintain its ultra-loose policy at its June meeting did little to stem the Yen's decline.

Short-term (five-days) outlook: The USDJPY is likely to remain supported in the short term, as the interest rate differential remains wide. The release of US PCE inflation data on June 28th will be a key event to watch. A hotter-than-expected reading could further bolster the US dollar, putting upward pressure on USDJPY. Conversely, a softer inflation print could lead to a correction in the US dollar, potentially providing some respite for the Yen.

-

June 27 (Thu): Japan Retail Sales (May), Japan Industrial Production (May), Japan Unemployment Rate (May).

-

June 28 (Fri): Japan CPI Tokyo (Jun), Japan Industrial Output (May), US PCE Inflation (May), US Personal Income & Spending (May).

Geopolitics and market themes

Conflict in the Middle East

Synopsis: The ongoing conflict in the Middle East is creating uncertainty for global markets, including the Forex market. The conflict has the potential to disrupt oil supplies and global trade routes, leading to higher inflation and weaker economic growth.

Key developments:

-

Disruptions to shipping through the Red Sea are causing delays and pushing up shipping costs.

-

Oil prices have risen moderately, but remain well below their 2022 peaks.

-

The conflict has heightened geopolitical tensions and increased uncertainty for businesses.

Market impact:

-

Safe-haven currencies, such as the USD and JPY, have benefited from risk aversion.

-

Equity markets have declined, reflecting concerns about the impact of the conflict on corporate earnings.

-

Commodity prices, particularly for oil, have been volatile.

French legislative elections

Synopsis: The upcoming second round of the French legislative elections on July 7th is a major source of uncertainty for the Euro. A fragmented National Assembly or a far-right victory could lead to political instability and weigh on confidence in the Eurozone.

Key developments:

President Macron's centrist coalition is facing a strong challenge from a left-wing alliance and the far-right National Rally.

Polls suggest that the elections could result in a hung parliament, making it difficult for Macron to pass legislation.

Market impact:

The Euro has been volatile in recent weeks, reflecting uncertainty about the election outcome.

French government bonds have also been under pressure.

US PCE inflation data

Synopsis: The release of US PCE inflation data for May on June 28th will be a key event for the US dollar. A hotter-than-expected reading could reinforce the Fed's hawkish stance and support further USD strength. Conversely, a softer inflation print could fuel expectations for a sooner-than-anticipated rate cut, potentially weighing on the greenback.

Key developments:

The Fed has signalled that it is data-dependent and will adjust its policy stance based on incoming economic data.

Inflation in the US has moderated somewhat, but remains above the Fed's 2% target.

Market impact:

The US dollar has been strengthening in recent months, driven by expectations of a more hawkish Fed.

US Treasury yields have also been rising, reflecting expectations for higher interest rates.

Other news

Australian Monthly CPI (May): Australia's monthly CPI data for May came in hotter than expected, with the weighted CPI rising to 4.0% year-on-year, exceeding the market forecast of 3.8%. This has led to increased expectations for an RBA rate hike at its August meeting, with money markets now pricing in a 33% probability of a 25bps hike. The Australian dollar (AUD) strengthened following the release, as investors reassessed the outlook for RBA monetary policy.

Conclusion

The Forex market is currently navigating a complex landscape of political and economic uncertainty. The French legislative elections and the US PCE inflation data are key events that could significantly impact currency markets in the coming weeks. Traders should closely monitor these developments and adjust their positions accordingly.

Author

Gavin Pearson

Independent Analyst

Gavin Pearson of Jeepson Trading is a currencies speculator from the UK focused on the G7 economies and is a recognized member of the eToro Popular Investor Program as well as being a funded prop trader with The 5%ers.