- The Federal Reserve is set to raise rates by 50 bps and squeeze its balance sheet.

- Markets have priced in aggressive action, opening the door for a dollar "sell the fact" response.

- Signals for the next meetings will likely be variations on this dollar-positive scenario.

- A hint of peak inflation is the only one that would send the dollar down.

Sell in May and go away? For King Dollar, this adage on stock markets may be the way to go – albeit for a short time. The greenback has surged throughout April as investors have been increasing their expectations for aggressive action by the Federal Reserve. It may now be time for a "buy the rumor, sell the fact," which may prove a "buy the dip" opportunity on the greenback.

If all this jargon seems confusing, I will make the argument for buying the dollar after the Fed decision in the baseline scenario, and detail three other options. Let's go.

Background: the economy is on fire

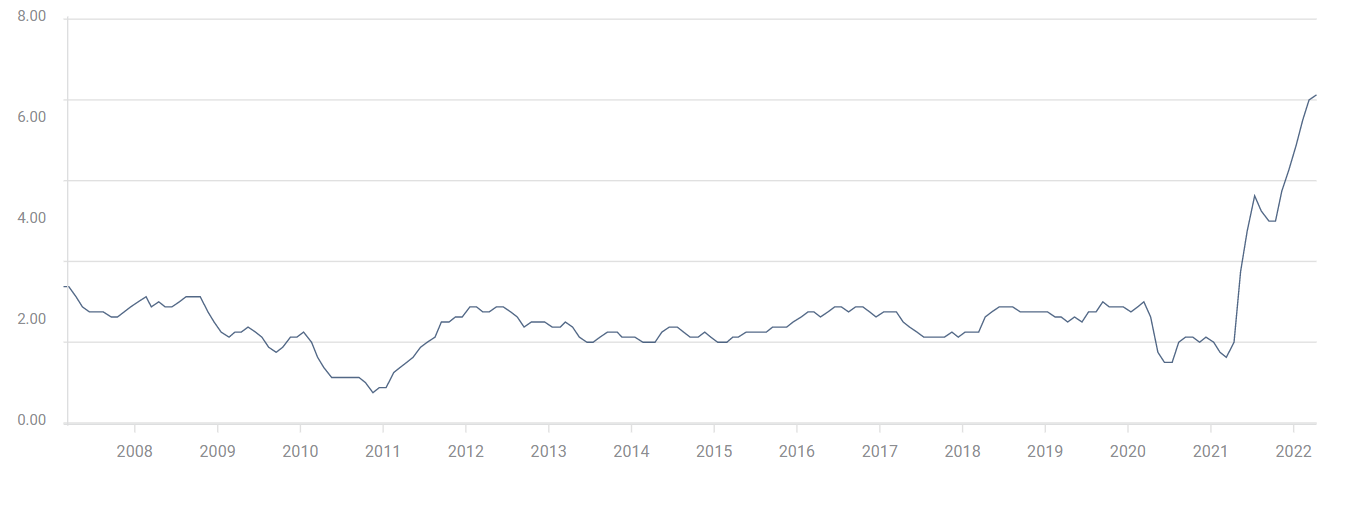

The price we are paying at the pump pokes our eyes on billboards, but that phenomenon is global. What makes America exceptional when it comes to inflation is core prices – those excluding energy and food. Underlying inflation hit a high of 6.5% YoY in March.

Source: FXStreet

Companies feel that they can transfer rising costs to consumers, who are not only willing to pay but are also able – wages are up 5.6% YoY. While we would all enjoy pay rises, if everybody gets them, more money is spent and prices rise too quickly. The Fed aims to cool an overheating economy.

Will the bank's action hurt the labor market? Perhaps, but America's issue is job shortage, not unemployment, so Fed Chair Jerome Powell has some room to cool the "very tight" labor market without triggering a recession. At least that is the hope.

Setting expectations

Even without agreeing with the arguments, I have written above, the outcome of the Fed meeting is mostly known, because Fed officials already told us. Powell said he intends to raise interest rates by 50 bps in the May meeting. It is fully priced into the dollar.

Will the Fed also squeeze its balance sheet? Yes, as the Meeting Minutes from March revealed that the bank intends to let up to $95 billion worth of bonds and Mortgage-Backed Securities (MBS) mature without the proceeds being reinvested. This process is also known as Quantitative Tightening, or as I prefer calling it – the opposite of printing money.

Source: Federal Reserve

As mentioned, both steps are priced in, and the dollar depends on what Powell and his colleagues hint about the future, and less on what they do.

Here are my four scenarios and potential outcomes.

Baseline scenario: 50 bps, $95 billion, data-dependent future

In this case, the Fed follows through on promises but refuses to make commitments about the next moves. Such an approach is in line with Powell's phrase of staying "nimble and humble" – he got it wrong on transitory inflation, and cannot make big promises.

In this case, the dollar would initially drop on a "buy the rumor, sell the fact." A small portion of April's massive greenback surge would be undone as uncertainty about the Fed's May decision becomes a certainty coupled with the lack of further action.

However, such a "sell the fact" of the dollar would also turn into a "buy the dip" opportunity. Why? The dollar advanced not only in response to hawkish Fed expectations but also to safe-haven flows related to Russia's war in Ukraine and China's covid-related lockdowns. Nothing has changed on those fronts.

Even if we assume that these international issues are also fully in the price, which currency would we buy? All the others have their limits, while the Fed could continue raising rates as long as inflation increases.

Bottom line: dollar-negative certainty about May's decision would swiftly make way for uncertainty about the next moves + a "there is no alternative" (TINA) approach.

The dollar is on a roll:

Hawkish: Same, but with an open door to even more aggressive action

In this scenario, the dollar would not even offer a dip to buy – the only way would be up. The Fed would not only fulfill its pledge, but promise to do more, and soon. Bond markets have been pricing a 75 bps hike for June amid a nonstop influx of inflationary signs. By refusing to deny it, Powell would further boost the dollar.

The Fed could go even further by suggesting even more aggressive action in its statement. A similar, immediate outcome could happen if James Bullard, the most hawkish member, votes for a 75 bps move now – or was even joined by another colleague.

The dollar would rise even faster and stronger in this hawkish scenario.

Dovish: Same, but with hints that inflation is near the peak

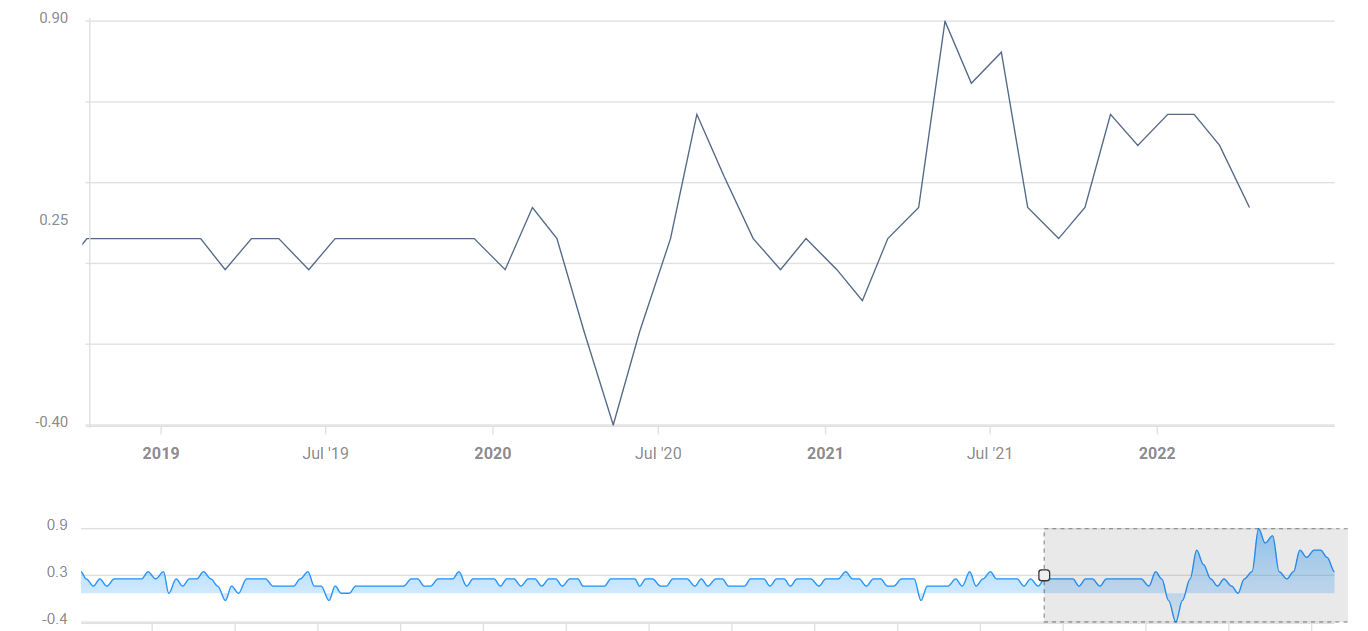

There was one silver lining in March's Consumer Price Index report – Core CPI rose by only 0.3% MoM. This relatively modest rise in underlying inflation might have been a one-off and the overall picture coming from other official measures and surveys is of an overheating economy. But maybe it wasn't a one-off.

Source: FXStreet

I have heard several times on financial media that "high prices are the cure to high prices" – when inflation rises, consumers sit on their hands, and costs eventually fall. Has inflation already peaked?

If Powell suggests that he and his colleagues are examining signs that price rises are already decelerating, they would send the dollar tumbling down. It would imply that the next hikes would be moderate. Moreover, it would signal to investors that the Fed's high point in interest rates would be lower than previously anticipated, thus denying the dollar a substantial part of its relative advantage.

The probability of such a move is low, as inflation remains high and the Fed is a slow-moving institution that needs more data and time to make shifts in its thinking.

Mixed: 50 bps, cautious QT, causing confusion

As I have mentioned earlier, there is less certainty about the QT program. While the minutes point to an advanced internal discussion, the decision could be different. The Fed's balance sheet is not only a tool of monetary policy – more money means more support, less means tightening – but also serves as a signaling one for interest rates.

The bank might opt to support battered financial markets by leaving more money to slosh around while raising interest rates to battle inflation. I find this logic somewhat twisted, but it is essential to note that the Fed watches the S&P 500 closely. It might want to refrain from extremely aggressive action by squeezing the balance sheet by only $40 or $50 billion per month.

Contrary to an intent to be less hawkish, such a move would only cause confusion for the dollar, at least in the initial response. It would undermine the balance sheet's role as a rate signaling tool. However, once the dust settles, the greenback could return to focusing on Russia and China, regaining some ground.

This hard-to-trade scenario has a low probability, but it cannot be ruled out.

Final thoughts

The Fed is at a critical crossroad in its battle to fight inflation, raising rates by more than 25 bps for the first time in a decade and a half. For the dollar, it would mean a temporary "uncanny valley" – a "sell the fact" dip before it returns to the broad uptrend. In (almost) every scenario.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0400, volumes remain light on New Year's Eve

EUR/USD stabilizes at around 1.0400 on Tuesday following Monday's choppy action. The cautious market stance helps the US Dollar stay resilient against its rivals and doesn't allow the pair to gain traction as trading conditions remain thin heading into the end of the year.

GBP/USD retreats below 1.2550 after short-lasting recovery attempt

GBP/USD loses its traction and retreats below 1.2550 after climbing above 1.2600 on Monday. Although falling US Treasury bond yields weighed on the USD at the beginning of the week, the risk-averse market atmosphere supported the currency, capping the pair's upside.

Gold rebounds after finding support near $2,600

After posting losses for two consecutive days, Gold found support near $2,600 and staged a rebound early Tuesday. As investors refrain from taking large positions ahead of the New Year Day holiday, XAU/USD clings to daily gains at around $2,620.

These three narratives could fuel crypto in 2025, experts say

Crypto market experienced higher adoption and inflow of institutional capital in 2024. Experts predict the trends to look forward to in 2025, as the market matures and the Bitcoin bull run continues.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.