Fed Interest Rate Decision Preview: The horns of an inflation dilemma

- No change in rate policy or bond purchases expected.

- US economy appears to be slowing under labor, supply chain shortages.

- Treasury curve has flattened, inflation has jumped since the June 16 FOMC.

- Dollar has gained against most majors since mid-June meeting.

Federal Reserve members who were undecided in June about what to do about surging inflation and economic growth have, in the last six weeks, found new support for their conflicting views, a split which will keep monetary policy unchanged at the extreme end of the accommodative scale.

The unanimous Fed voters for current policy last month can point to a labor market that is still far from its pre-pandemic state with rising jobless claims and a pronounced labor shortage inhibiting the business of many firms. COVID cases are again climbing, though with far less hospitalization or fatalities.

Members who felt in June that inflation might soon warrant a policy response can indicate the June CPI rate of 5.4% and the core gauge of 4.5%. The May core PCE rate of 3.4% was already the highest in three decades. It is expected to be 3.7% in June when released on Friday.

Core PCE Price Index

When the Federal Open Market Committee (FOMC) issues its policy statement at 2 pm on Wednesday, the fed funds upper target should remain at 0.25%, where it has been since last March. The bond purchases will continue at $120 billion a month of Treasuries and mortgage backed securities.

June Projection Materials

June’s Projection Materials brought the FOMC into the real world on inflation.

The 2021 headline estimate jumped to 3.4% from 2.4% and the core PCE rate climbed to 3% from 2.2%. For the first time since the pandemic began, an increase entered the three-year forecast as two hikes were envisioned by the end of 2023.

In the so-called dot plot, which charts the individual projections of the FOMC participants, all 18 individual estimates saw rates unchanged this year. In 2022, 11 members had rates unchanged, five predicted one hike, and two suggested two rate increases. For 2023 only five had rates stable, two members had one hike and three each had two, three and four increases.

When combined with comment in the minutes of that June meeting, released two-weeks later, that some members thought the time was approaching to begin a discussion about reducing bond purchases, it seemed that the countdown to a taper had begun.

Since then US consumer inflation has accelerated to heights not seen in a decade, and the entire year is headed for a bout of price gains not witnessed in a generation.

While each side in the policy debate has new ammunition, an actual policy change, that requires a majority of FOMC members, is as distant as ever.

Chairman Jerome Powell

The Fed’s new economic projections spoke for themselves in June and Chair Powell did not try to convince the markets otherwise.

In spite of insistent questions from several reporters in the virtual press conference following the Fed announcement, Mr. Powell refused to provide any indication when the bank might begin to reduce its $120 billion a month in bond purchases. He even deployed the striking phrase from the April press conference, “substantial further progress” to describe the conditions for a bond taper. A locution which, of course, tells nothing of the specific economic conditions needed for a change in policy. He did admit that officials had discussed the taper issue at the meeting.

In his answers in June, Mr. Powell noted the possibility that inflation might be stronger and more persistent than the bank had expected. This line has continued in the weeks subsequent as has the insistence that the surge in inflation will be temporary. He said in the June press conference that the rate, “lift-off is well into the future.”

Treasury market since the June FOMC

Treasury interest rates belie the notion of an imminent Fed policy change.

The yield curve has flattened in the six weeks following the prior FOMC. Long-term rates have come off substantially while short-term yields have gained modestly.

On June 16 the return on the 10-year Treasury opened at 1.499%, down from its high of 1.746% on March 31. Since then the yield has lost another 27 basis points, trading at 1.23% as of this writing. That is commensurate with its level in mid-February.

10-year Treasury yield

CNBC

The 2-year return was at 0.167% on the morning of June 16. By the close on June 25 it had moved up to 0.27%. It has since fallen to 0.209%.

2-year Treasury yield

CNBC

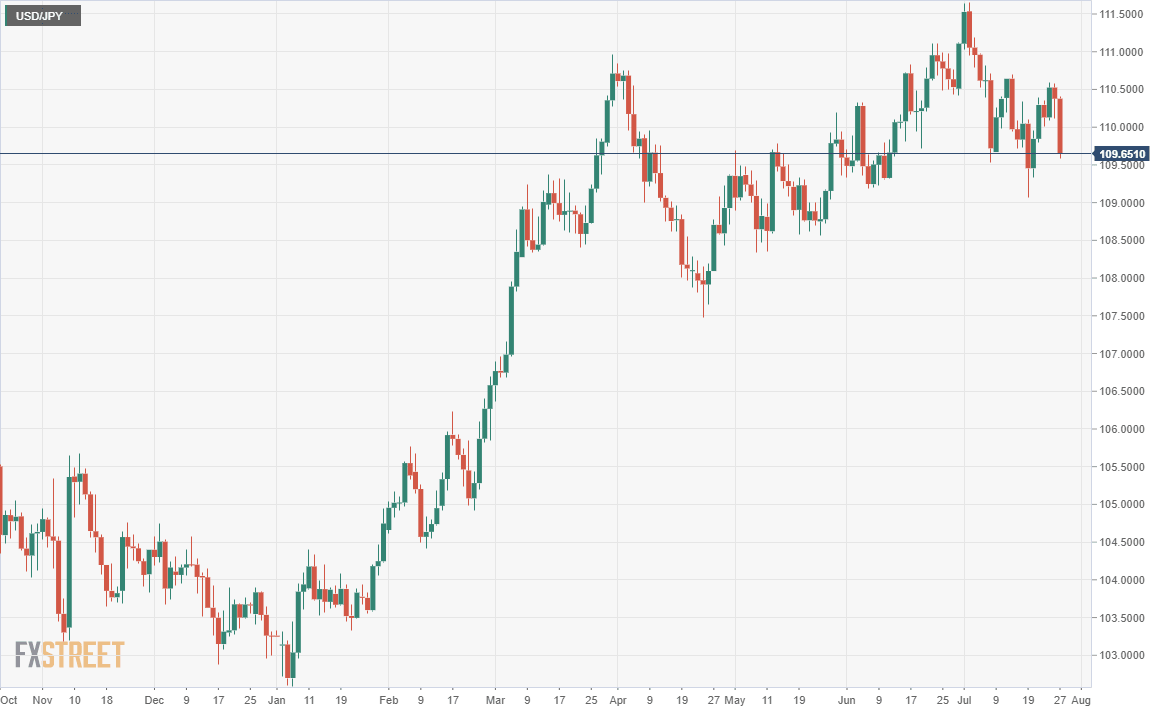

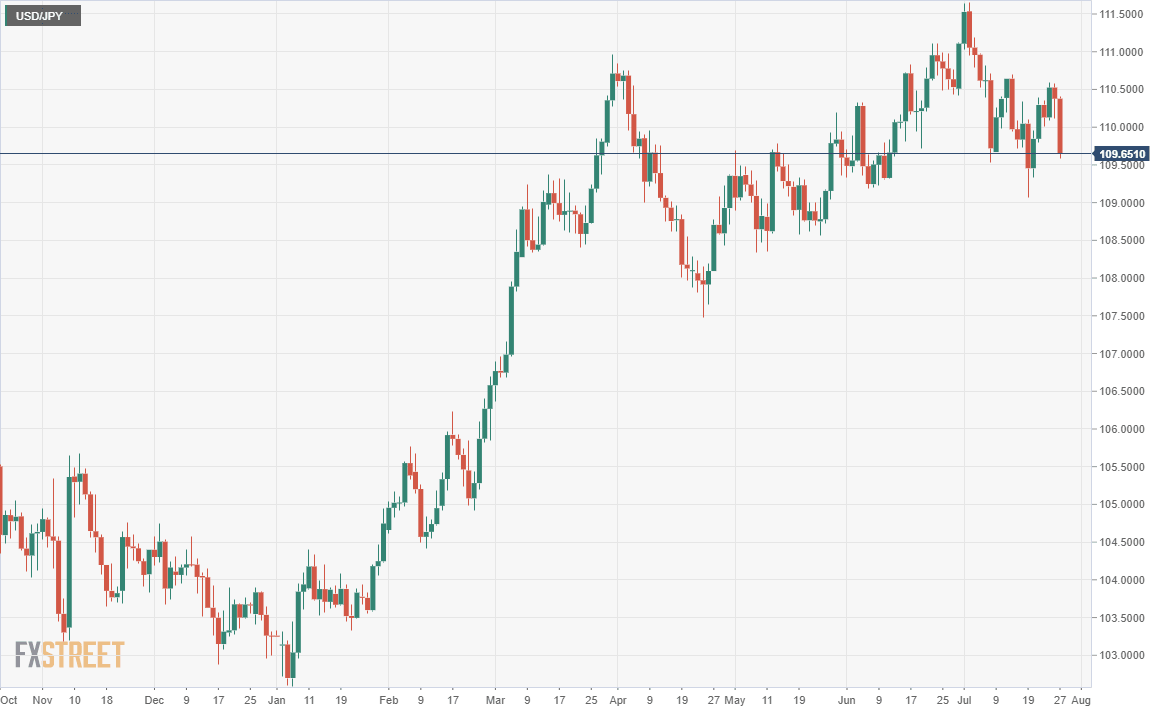

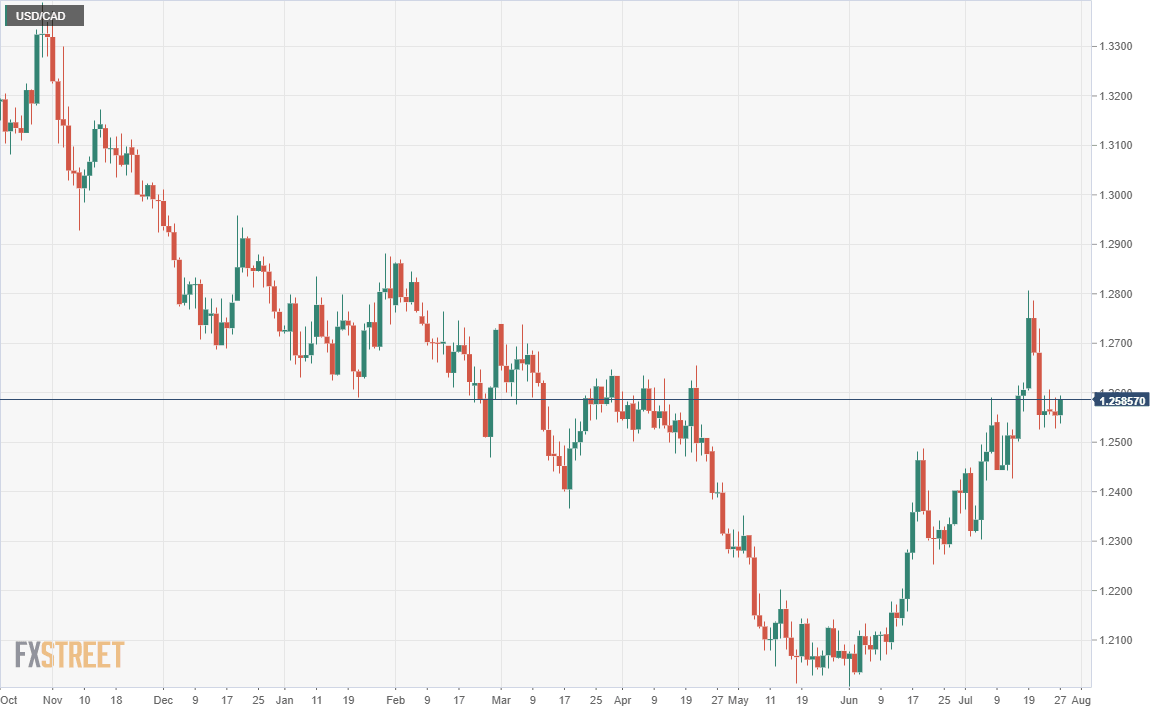

Currency market since the June FOMC

Despite the fall in long-term Treasury rates the dollar has prospered since the June Fed meeting, gaining in every major pair except the USD/JPY.

Several factors have helped the greenback in the last month-and-a-half, including rising COVID rates in many of its competitors, a strong economic recovery and the perception that whatever the current Treasury returns, US rates will likely rise first.

Conclusion

Even with no policy change anticipated, markets remain acutely sensitive to comments from Fed Chair Powell. His press conference is the main event. As in June, any comment that hints of a purchase taper, or even the conditions for a reduction, will send the dollar and Treasury rates higher and equities lower. Any acknowledgement of the difficulty of inflation and its persistence will have a similar, if lesser impact, mainly because, the Fed has already admitted that it has been surprised by the price gains.

Issues that will play against a possible rate hike scenario are the continuing underperformance of the US labor market, where employment is still several million short of its pre-pandemic headcount, and the supply-chain disruptions that look to be deeper and longer-lasting that originally presumed.

One particular topic will be the Fed's annual Jackson Hole, Wyoming symposium at the end of August. In the past the Fed has used this gathering to explore potential policy evolutions. Reporters might use questions about the agenda at the meeting to try to evoke a more detailed response from the chairman.

Mr. Powell is highly unlikely to reveal or even expound on any of the Fed's considerations or plans on Wednesday afternoon. That will not, of course, stop the markets from running with a perception.

The Fed does not intend to relent on its policy accomodation. The bond market has it right.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.