- The European Central Bank is set to leave policy unchanged in July after acting in June.

- The bank's decision comes ahead of a critical EU Summit to discuss fiscal stimulus.

- The ECB will likely urge governments to agree, yet without creating panic.

Lagarde has picked the low-hanging fruit – and now needs her political skills to poke policymakers on the fiscal front – without scaring markets, a fine balancing act.

The European Central Bank is set to leave its policy unchanged in its July meeting. The Frankfurt-based institution is set to take a break after topping up its Pandemic Emergency Purchase Program (PEPP) with €600 billion in June. This bond-buying scheme – which has fewer constraints than previous ones – now totals €1.35 trillion.

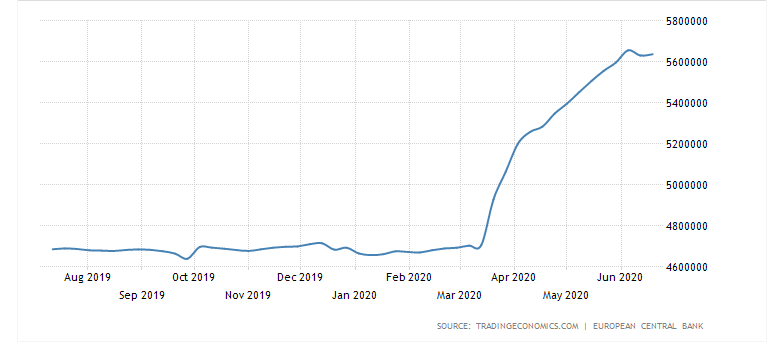

The ECB's balance sheet reflects the action:

Source: Trading Economics

That June announcement exceeded economists' expectations and sent the euro higher. Contrary to pre-pandemic times, printing money is seen as supportive to the economy – as governments' borrowing costs drop and they are able to deploy more funds. Consequently, output has room to rise and so does the currency.

Christine Lagarde, President of the European Central Bank set the stage for inaction in the upcoming meeting by telling the FT "...we have done so much that we have quite a bit of time to assess incoming data carefully"

The ECB is also set to leave its interest rates unchanged, with the main lending rate at 0% and the deposit rate at -0.50%. Recent inflation figures have held up above 0%, making further accommodation – lower real borrowing costs – unnecessary at this point.

She also patted her institution on the bank by raising its efficiency and effectiveness in doing its part in confronting the pandemic. What about the fiscal response? The former French politician also commented: "I wouldn't put all my bets on 18 July" – referring to the EU Summit.

Pushing governments to act, but not too hard

EU leaders will hold their first face-to-face summit on July 17-18 – just after the ECB meeting on July 16. The No. 1 topic is the EU recovery fund. The European Commission's ambitious €750 billion fiscal plan consists of a controversial component – €500 billion in grants funded by the mutual borrowing. These are "coronabonds" or imply a "transfer union" in all but name for critics.

Investors thought that German and French backing to the plan would be sufficient to bring it over the line. However, the Berlin-Paris axis has been met with fierce opposition from the "Frugal Four" – Austria, the Netherlands, Sweden, and Denmark. Previous summits failed to yield a compromise that would pleas both hard-hit countries such as Italy and the stubborn Dutch.

While Lagarde has called for lower expectations, the stakes are high and she will likely reiterate her call on governments to act. The ECB has been pushing leaders to spend well before Lagarde took over in November 2019 – with predecessor Mario Draghi upping the ante over the years.

The central bank's economic assessments and projections carry considerable weight and it could urge governments to act by warning of the long-term damage that the pandemic could inflict.

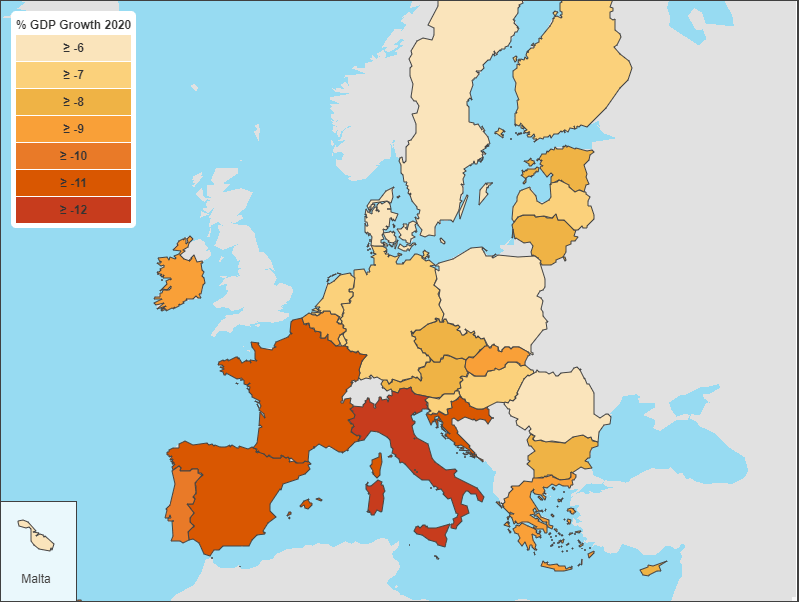

Lagarde's warning would compound the European Commission's latest forecasts, which included a downgrade to eurozone Gross Domestic Product contraction from -7.7% to 8.7%.

Source: European Commission

Convincing countries to act would boost the euro – but painting a dark picture may also scare investors. If the situation is so dire, investors could assess that the ECB is resigned to accepting the deterioration and worse off – is desperate and out of ammunition.

If Lagarde is all gloom, EUR/USD has room to fall, while a more balanced message would probably lift the common currency once again. That could be in the form of signaling that it is now governments turn, but readying more monetary stimulus afterward.

Conclusion

The ECB is set to leave its policy unchanged and the focus is on its message to leaders ahead of the EU Summit. A balanced message that calls governments to act without sounding depressing would keep the euro bid, while a gloomy, helpless stance would push it down.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends slide toward 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since December 2022 below 1.0350 on Thursday. The pair turned south amid a resurgent US Dollar demand and worsening market mood. Investors stay cautious at the onset of 2025, awaiting the US jobs data for fresh incentives.

GBP/USD slumps to multi-month lows below 1.2450

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2450. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as markets await mid-tier data releases.

Gold benefits from risk aversion, climbs above $2,640

Gold gathers recovery momentum and trades at a two-week-high above $2,640 heading into the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

XRP rockets 11% as Bitcoin starts New Year with bullish bang

Crypto majors zoomed higher in the past 24 hours as the market entered a widely expected bullish year, with Bitcoin inching above $95,000 to shake off losses from last week. XRP surged 11% to lead growth among majors as of Thursday, led by $1.3 billion worth of trading volumes on Korea-focused exchange UpBit.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.