EUR/USD Price Forecast: Slightly oversold RSI warrants caution for bears ahead of US PPI

- EUR/USD continues losing ground for the fifth straight day amid relentless USD buying.

- The Trump trade optimism and elevated US bond yields continue to underpin the buck.

- German political chaos and concerns over Trump’s protectionist tariffs weigh on the Euro.

The selling bias around the EUR/USD pair remains unabated for the fifth consecutive day in the wake of the continuation of the so-called Trump trade, which has been a key factor behind the post-election US Dollar (USD) rally. In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, has advanced to its highest level since November 2023 amid hopes that US President-elect Donald Trump's policies will boost economic growth.

Meanwhile, Trump's plans to hike tariffs on imports could accelerate inflation and force the Federal Reserve (Fed) to pause its easing cycle. Moreover, the US Consumer Price Index (CPI) released on Wednesday pointed to a slower progress toward bringing inflation down and could result in fewer rate cuts next year. This remains supportive of elevated US Treasury bond yields and continues to push the USD higher across the board.

The US Bureau of Labor Statistics reported that the headline CPI rose 0.2% in October and by 2.6% over the last twelve months. Additional details of the report revealed that the core gauge – which excludes the more volatile food and energy categories—increased by 0.3% last month and by 3.3% as compared to the same time period last year. The data reaffirmed bets that the Fed would deliver a third rate cut in December against the backdrop of a softening labor market.

Commenting on the report, St. Louis Fed President Alberto Musalem noted that the risk of inflation moving higher has risen and that sticky inflation makes it difficult for the central bank to continue to ease rates. Moreover, Dallas Fed President Lorie Logan struck a similar tone and said that the central bank should proceed cautiously, adding that if we cut too far, past neutral, inflation could reaccelerate and the FOMC could need to reverse direction.

Separately, Kansas Fed President Jeffrey Schmid made a rare appearance and said it remains to be seen how much more the US central bank will cut rates, and where they may settle. Hence, investors will closely scrutinize Fed Chair Jerome Powell's comments on Thursday for cues about the rate-cut path. This, in turn, will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the EUR/USD pair.

In the meantime, the shared currency might continue to feel pressure from the political uncertainty in Germany, following the collapse of the governing coalition in the Eurozone's largest economy. Adding to this, the highly probable tariffs on Europe's exports to the US, under the second Trump presidency, could significantly impact the region's economy. This further seems to weigh on the Euro and drags the EUR/USD pair to a fresh year-to-date (YTD) low.

Heading into the key event risk, the US economic docket – featuring the release of the usual Weekly Initial Jobless Claims and the Producer Price Index (PPI) – could drive the USD demand and produce short-term opportunities around the EUR/USD pair. Nevertheless, the aforementioned fundamental backdrop seems tilted firmly in favor of the USD bulls and suggests that the path of least resistance for spot prices remains to the downside.

Technical Outlook

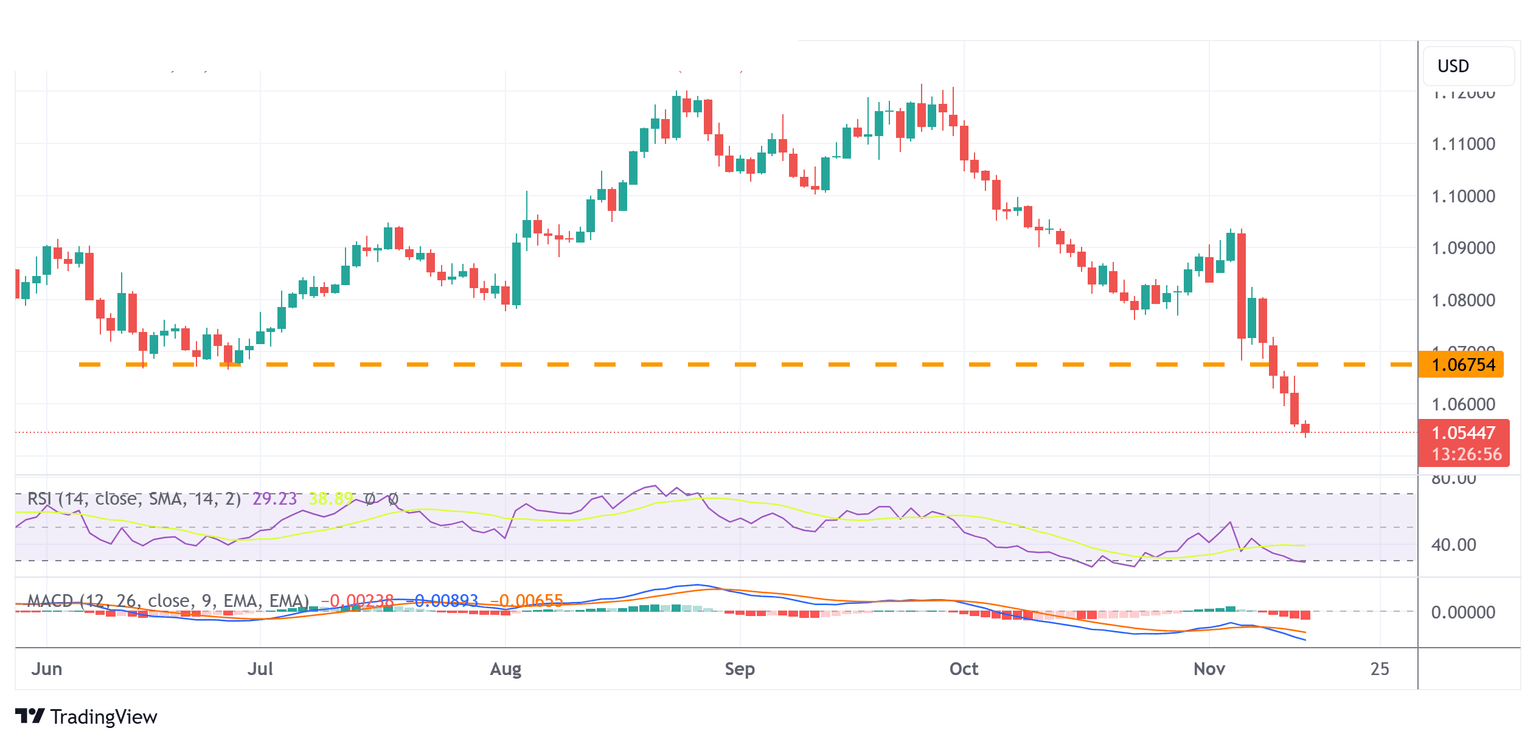

From a technical perspective, the overnight breakdown below the previous YTD low suggests that the path of least resistance for the EUR/USD pair remains to the downside. That said, the Relative Strength Index (RSI) on the daily chart has just started flashing slightly oversold conditions and warrants some caution. Hence, it will be prudent to wait for some near-term consolidation or a modest bounce before positioning for any further depreciating move. Nevertheless, spot prices seem vulnerable to weaken further below the 1.0500 psychological mark and test the October 2023 swing low, around the 1.0450-1.0445 region.

On the flip side, any meaningful recovery attempt now seems to face stiff resistance near the 1.0600 round-figure mark. Some follow-through buying, however, might trigger a short-covering rally and lift the EUR/USD pair to the overnight swing high, around the 1.0650-1.0655 region. A further move up, meanwhile, might still be seen as a selling opportunity and is more likely to remain capped near the 1.0700 handle. The latter should act as a key pivotal point, which if cleared decisively will suggest that the pair has formed a near-term bottom and pave the way for additional gains.

EUR/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.