EUR/USD

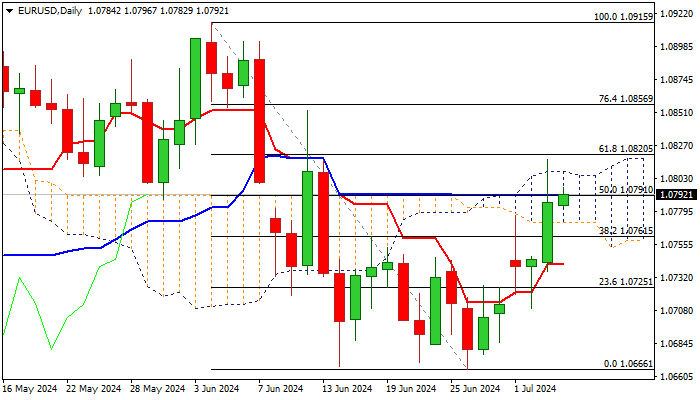

EURUSD remains at the front foot in early Thursday’s trading and holding under new three-week high (Wednesday’s spike at 1.0816).

Bulls probe again through cracked daily Kijun-sen (1.0791) and look for retest of daily cloud top (1.0808).

Cloud top was dented on Wednesday but subsequent pullback from new high and daily close well below cloud top, generate initial signal of bull-trap formation and warn of possible stall.

Adding to negative signals to the single currency was strong drop in German industrial orders in May that contributes to weak picture in manufacturing sector, which remains in contraction for two years.

Technical picture has further improved on daily chart, as positive momentum is rising and MA turned to almost full bullish setup however, sustained break above pivotal 1.0800 resistance zone (converged 100/200DMA’s / psychological / daily cloud top) is required to confirm bullish stance and signal continuation of recovery leg from 1.0666 higher base.

Otherwise, the downside is expected to remain vulnerable, despite prevailing bullish bias above cloud base (1.0771) and strong rally on Wednesday.

Loss of cloud base to generate initial negative signal, with drop below daily Tenkan-sen (1.0741), to confirm reversal and expose 1.0666 base for retest.

Markets are expected to operate with lower volumes today, as the US is shut for Independence Day, however, UK election, as top event today, may increase volatility.

Res: 1.0808; 1.0820; 1.0852; 1.0889.

Sup: 1.0771; 1.0741; 1.0723; 1.0700.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

GBP/USD hovers around 1.2750 on UK election day

GBP/USD is trading sideways near 1.2750 in the European session on Thursday. A broadly softer US Dollar keeps the pair afloat but traders refrain from placing fresh bets on the Pound Sterling, as UK voters head to polls.

EUR/USD retakes 1.0800 ahead of ECB Accounts

EUR/USD is battling 1.0800, regaining upside momentum in the European session on Thursday. The pair's renewed uptick is attributed to fresh US Dollar selling on escalated speculations of a September Fed rate cut. ECB Accounts is next in focus.

Gold trades with caution above $2,350, as focus shifts to US NFP

Gold price has reversed early gains to trade cautiously above $2,350 on Thursday. Sustained US Dollar weakness alongside sluggish US Treasury bond yields keeps the downside in Gold price capped amid the July 4 US holiday-thinned market conditions. Friday's NFP data eyed.

MANTRA partners with UAE real estate giant MAG to tokenize $500 million in assets

MANTRA announced its partnership with UAE real estate giant MAG on Wednesday via social media platform X. This collaboration introduces new investment opportunities for tokenized real estate worth $500 million in the flourishing Middle Eastern market.

Investors await NFP to validate their Fed rate cut bets

Investors expect two rate cuts, even though Fed signals one. Recent data corroborates investors’ take. Nonfarm Payrolls waited for more confirmation.