EUR/USD

EURUSD opened with gap-higher and rose to three-week high in early European trading on Monday, lifted by results of the first round French parliamentary election.

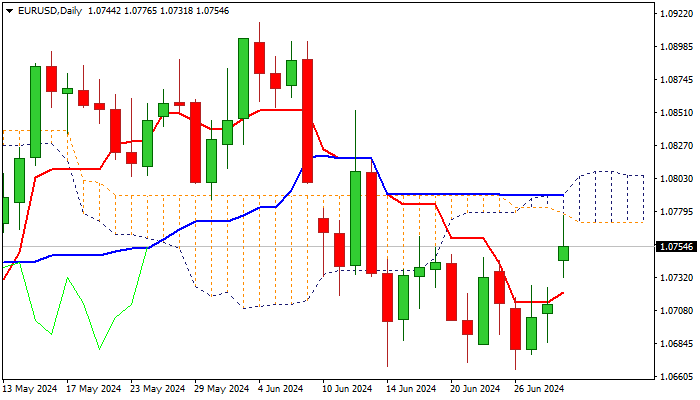

Rally was capped by the base of thickening daily cloud, following last week’s cloud twist, with subsequent easing, pointing to strength of 1.0778/1.0800 resistance zone (daily cloud, spanned between 1.0777 and 1.0791 and reinforced by converged 100/200DMA’s / psychological resistance).

Daily studies show strengthening positive momentum, MA’s in mixed setup, while daily cloud remains strong obstacle.

Near term price action may hold in prolonged consolidation while capped by cloud, but with slight bullish bias as long as today’s gap stays unfilled.

Sustained break higher would bring near term bulls fully in play and open way for further retracement of 1.0915/1.0666 bear-leg.

Conversely drop and close below daily Tenkan-sen (1.0712) would weaken near term structure and risk retest of 1.0666 higher base.

Res: 1.0777; 1.0800; 1.0820; 1.0852.

Sup: 1.0731; 1.0712; 1.0700; 1.0666.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains near 1.0750 after German inflation data

EUR/USD stays in positive territory at around 1.0750 in the second half of the day on Monday. The data from Germany showed that the annual CPI inflation declined to 2.2% in June, limiting the Euro's gains. Investors await US Manufacturing PMI data.

GBP/USD holds above 1.2650 ahead of US data

Following a bullish opening to the week, GBP/USD struggles to preserve its bullish momentum and trades in a tight range above 1.2650. The ISM Manufacturing PMI data for June will be featured in the US economic calendar on Monday.

Gold stabilizes above $2,330 as markets await US data

Gold clings to modest daily gains and fluctuates above $2,330 on the first trading day of the week. The benchmark 10-year US Treasury bond yield stays near 4.4% following last week's rally, limiting XAU/USD's upside ahead of US data.

Bitcoin is breaking above the falling wedge

Bitcoin breaking above the falling wedge pattern on Monday signals a bullish move, with Ethereum and Ripple poised to follow as they find support at key levels, paving the way for an upside rally in the days ahead.

Significant month for US stock markets and currencies

This month sees important time cycles across a range of instruments suggesting that we are at a major pivot point. In this video we look at the significant turning point coming out very shortly on the S&P 500 that will also impact the other US indices.