EUR/USD

EURUSD regained traction on Wednesday after moving within wide swings but without direction in past two days.

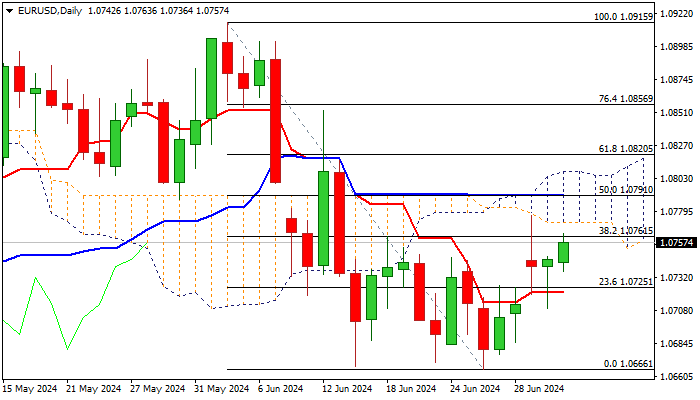

Fresh strength looks for retest of pivotal barriers at 1.0768/71 (55DMA/daily cloud base), which capped Monday’s attack.

Technical studies are mixed on daily chart (rising bullish momentum / conflicting MA’s/price weighed by thickening daily cloud).

Mixed PMI data from EU and Germany missed to impact the pair significantly, with US ADP report and PMI data) due later today, expected to provide signals.

Watch reaction on cloud base, with repeated failure here to signal that bulls might be running out of steam and that the downside is still vulnerable.

However, close below daily Tenkan-sen (1.0721) and filling Monday’s will be needed to signal that bears regained control for retest of 1.0666 base and possible acceleration towards 1.0601 (2024 low).

Alternatively, penetration of daily cloud would generate initial bullish signal, which will look for boost on break of daily Kijun-sen (1.0791) and confirmation on lift above daily cloud top (1.0808).

Res: 1.0764; 1.0771; 1.0791; 1.0808.

Sup: 1.0736; 1.0721; 1.0700; 1.0666.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD climbs back above 1.0750 ahead of ADP, Fed Minutes

EUR/USD has regained lost ground above 1.0750 in the European session on Wednesday. The pair draws support from the renewed US Dollar weakness, in the aftermath of the dovish Fed Chair Powell's comments. Eyes turn to US ADP data, Fed Minutes.

GBP/USD retakes 1.2700, looks to US data/Fed minutes

GBP/USD is battling 1.2700 in European trading on Wednesday, attempting a modest bounce. Traders appear reluctant and prefer to wait on the sidelines ahead of the FOMC minutes while the UK elections on Thursday also keep them on the edge. US ADP data eyed as well.

Gold jumps toward $2,350, with eyes on key US events

Gold price is closing in on $2,350 in the European trading hours on Wednesday, staging a rebound amid a fresh leg down in the US Dollar. Gold price capitalizes on dovish Fed Chair Powell's remarks on Tuesday, which added to the September rate cut expectations. US ADP data and Fed Minutes on tap.

Bitcoin price struggles around $61,000 as German government transfers, miners activity weigh

U.S. spot Bitcoin ETFs registered slight outflows on Tuesday. The German Government transferred another 832.7 BTC, valued at $52 million, on Tuesday.

ADP Employment Change Preview: US private sector expected to add 160K new jobs in June

The United States ADP Research Institute will release its monthly report on private sector job creation for June. The announcement is expected to show that the country’s private sector added 160K new positions in June after adding 152K in May.