EUR/USD Forecast: Initial resistance emerges around 1.0900

- EUR/USD struggled to retest or surpass the 1.0900 hurdle.

- No surprises from the final Inflation Rate in the euro area.

- The ECB Accounts said a rate cut discussion looked premature.

EUR/USD could not sustain the earlier move to three-week highs in the boundaries of 1.0900 the figure on Thursday, eventually receding to the 1.0820 region and ending the session barely changed.

The bounce in the Greenback was driven by another encouraging prints from weekly Initial Claims and occurred alongside the mixed performance in US bond yields across different maturity periods, always against the backdrop of ongoing speculation regarding a potential interest rate cut by the Federal Reserve (Fed) later in the year.

In the meantime, bets for an interest rate cut in May kept shrinking. According to the CME Group's FedWatch Tool, there is approximately a 27% probability of a rate reduction by the Fed at its May 1 meeting, with the likelihood of such action rising to nearly 52% for June.

The prospect of the Federal Reserve (Fed) implementing a series of monetary easing measures in the coming months gained further credibility following stronger-than-expected US inflation data in January (as indicated by CPI and PPI readings). This outlook is supported by robust underlying economic fundamentals and a consistently tight labour market.

Turning to developments in the eurozone, the ECB Accounts indicated a general agreement among members that it was too early to deliberate on rate reductions. Officials added that it's probable that the March 2024 inflation forecast will be revised downward, noting that the risks associated with achieving the inflation target were viewed as broadly balanced, or at the very least, approaching a more equitable distribution. Furthermore, policymakers suggested that implementing financial market relaxation measures might be premature and could potentially disrupt or postpone the timely attainment of the inflation target.

The dynamics surrounding the Greenback and its correlation with the Fed’s potential interest rate cuts (possibly starting in June) are expected to remain significant factors influencing the pair’s price action in the near term. Regarding the European Central Bank (ECB), President C. Lagarde and other officials have suggested the possibility of an interest rate cut as early as this summer.

On this note, ECB Board member Wunsch advised on Wednesday against prematurely raising expectations regarding interest rates, citing elevated wage pressures and constrained labour markets. He suggested that the possibility of maintaining stringent policies for an extended period should not be dismissed.

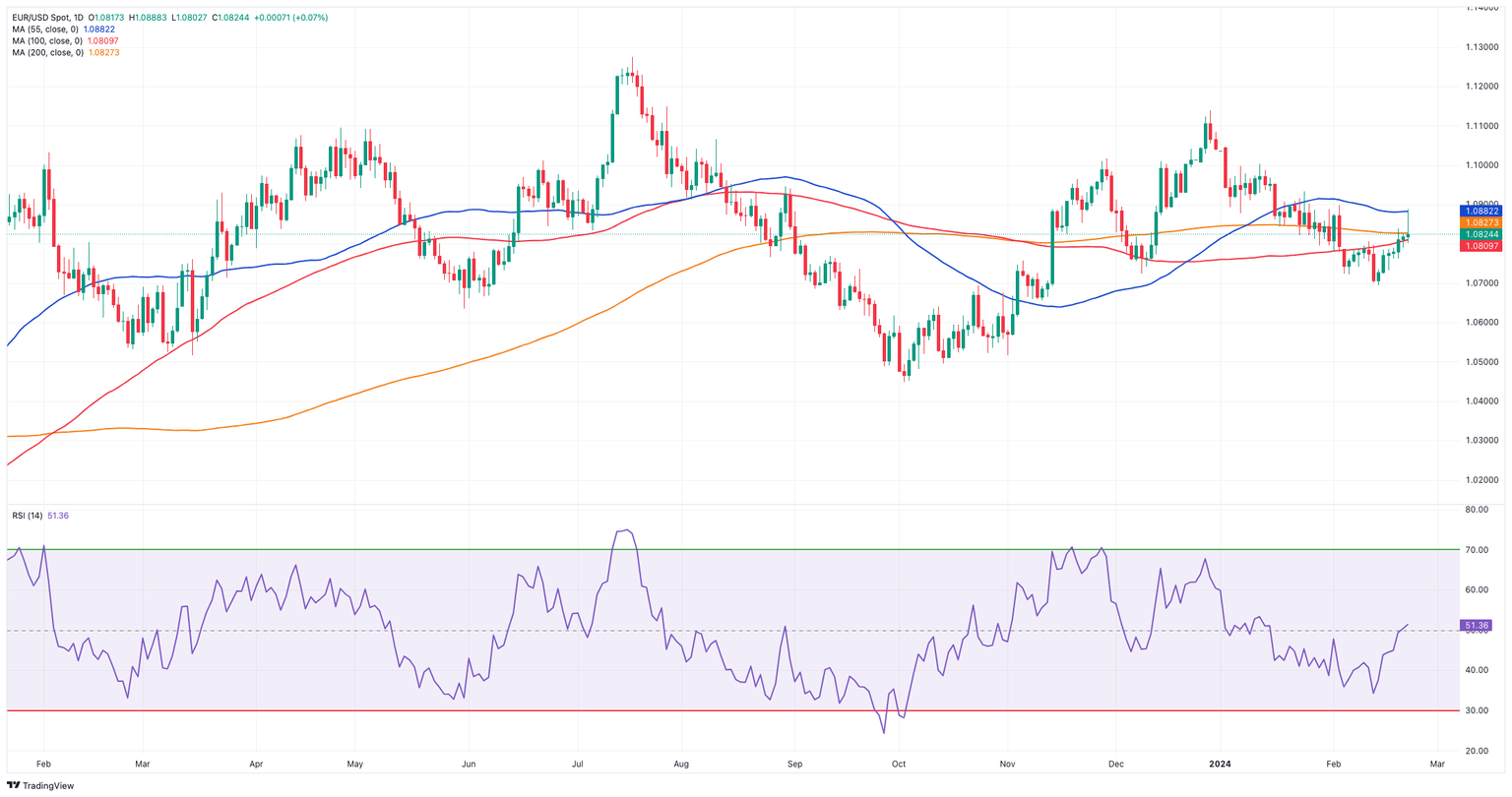

EUR/USD daily chart

EUR/USD short-term technical outlook

If EUR/USD rises over the weekly top of 1.0888 (February 22), it may reach another weekly peak of 1.0932 (January 24). Further up, the weekly high of 1.0998 (January 11) supports the psychological barrier of 1.1000, ahead of the December 2023 top of 1.1139 (December 28).

On the downside, if the pair clears the lowest point of 2024 at 1.0694 (February 14), it may then seek the November 2023 low of 1.0516 (November 1). The loss of the latter may result in a move to the weekly low of 1.0495 (October 13, 2023), which is prior to the 2023 bottom of 1.0448 (October 3) and the round level of 1.0400.

As long as the EUR/USD trades below the 200-day Simple Moving Average (SMA) of 1.0826, the pair's outlook is expected to remain negative.

Looking at the four-hour chart, the gradual rebound appears in place so far. The 55-SMA at 1.0772 offers provisional contention seconded by minor support levels at 1.0761, 10732 and 1.0694. If bullish advances continue, they may aim for 1.0888, ahead of 1.0897. The Moving Average Convergence Divergence (MACD) has advanced further into positive territory, while the Relative Strength Index (RSI) sank to 53.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.