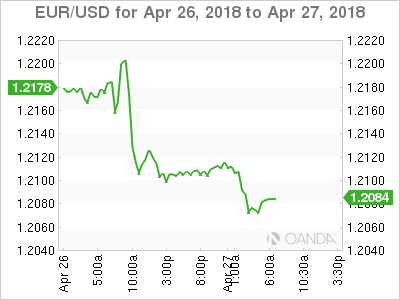

EUR/USD has posted slight losses in the Friday session. Currently, the pair is trading at 1.2086, down 0.15% on the day. On the release front, French Flash GDP dropped to 0.3%, shy of the estimate of 0.4%. German unemployment rolls dropped by 7 thousand, a weaker reading than the estimate of a decline of 15 thousand. In the US, Advance GDP is expected in at 2.0%, and UoM Consumer Sentiment is forecast to soften to 98.0 points.

The sliding euro has posted gains in only one session since April 16, and the downward trend continued on Thursday after the ECB rate announcement. There were no dramatic comments from the ECB on Thursday, as the bank maintained its monetary policy and guidance. The rate statement said that “the Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases”. The stimulus program of EUR 30 billion/month is scheduled to remain in place until September, so investors shouldn’t even think about an interest rate hike until sometime in 2019. In his press conference, Mario Draghi said that the eurozone economy had slowed in the first quarter, but expressed “caution tempered by an unchanged confidence” that the ECB would realize its target of around 2 percent inflation. Although the ECB has said that it plans to wind up stimulus in September, this is not a date set in stone – if second-quarter numbers are not strong, the ECB could continue to the stimulus scheme into 2019.

The US dollar has been on a tear against its rivals, and the euro has fallen 2.1% since April 16. Much of the credit for the dollar rally goes to rising yields on US bonds, which hit 4-year highs this week. On Wednesday, 10-year US Treasury notes climbed above the symbolic level of 3.0%, which led to investors snapping up bonds at the expense of equities. As oil prices have been moving higher, this has led to expectations of higher inflation, which in turn, has increased sentiment that the Federal Reserve will increase rates four times in 2018, rather than three hikes. This has made the US dollar more attractive to investors.

EUR/USD Fundamentals

Friday (April 27)

-

1:30 French Flash GDP. Estimate 0.4%. Actual 0.3%

-

2:00 German Import Prices. Estimate 0.1%. Actual 0.0%

-

2:45 French Consumer Spending. Estimate 0.4%. Actual 0.1%

-

2:45 French Preliminary CPI. Estimate 0.1%. Actual 0.1%

-

3:00 Spanish Flash CPI. Estimate 1.2%. Actual 1.1%

-

3:00 Spanish Flash GDP. Estimate 0.7%. Actual 0.7%

-

3:55 German Unemployment Change. Estimate -15K. Actual -7K

-

All Day – Eurogroup Meetings

-

Tentative – Italian 10-year Bond Auction

-

8:30 US Advance GDP. Estimate 2.0%

-

8:30 US Advance GDP Price Index. Estimate 2.2%

-

8:30 US Employment Cost Index. Estimate 0.7%

-

10:00 US Revised UoM Consumer Sentiment. Estimate 98.0

-

10:00 US Revised UoM Inflation Expectations

Open: 1.2104 High: 1.2117 Low: 1.2065 Close: 1.2086

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1809 | 1.1916 | 1.2025 | 1.2092 | 1.2235 | 1.2319 |

EUR/USD continues to break below support levels. The pair ticked higher in the Asian session but has lost ground in European trade

-

1.2092 is providing support

-

1.2235 was tested earlier in resistance and remains a weak line

Further levels in both directions:

-

Below: 1.2025, 1.1916 and 1.1809

-

Above: 1.2092, 1.2235, 1.2319 and 1.2460

-

Current range: 1.2025 to 1.2092

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0850 area as mood sours

EUR/USD stays under bearish pressure and trades deep in negative territory near 1.0850 on Tuesday. The US Dollar benefits from safe haven flows and weighs on the pair as investors adopt a cautious stance ahead of this week's key earnings reports and data releases.

GBP/USD closes in on 1.2900 on US Dollar recovery

GBP/USD is on the defensive toward 1.2900, struggling to find a foothold on Tuesday. The US Dollar holds steady following Monday's pullback amid a negative shift seen in risk sentiment, not allowing the pair to regain its traction.

Gold reconquers $2,400, lacks directional momentum

Gold stages a rebound and trades above $2,400 on Tuesday after closing the fourth consecutive trading day in negative territory on Monday. The pullback seen in US Treasury bond yields help XAU/USD cling to modest daily gains despite the US Dollar's resilience.

Bitcoin price struggles around $67,000 as US Government transfers, Mt. Gox funds movement weigh

Bitcoin struggles around the $67,000 mark and declines by 1.7% at the time of writing on Tuesday at around $66,350. BTC spot ETFs saw significant inflows of $530.20 million on Monday.

Big tech rebound ahead of earnings, Oil slips

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

Tesla and Google are due to report earnings today after the bell, and their results could shift the wind in either direction. Despite almost doubling its stock price between April and July, Tesla sees appetite for its cars and its market share under pressure.