EUR/USD Elliott Wave technical analysis [Video]

![EUR/USD Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/money-euro-and-dollar-banknotes-17371247_XtraLarge.jpg)

EURUSD Elliott Wave Analysis – Trading Lounge.

Euro/U.S. Dollar (EURUSD) – Day Chart.

EUR/USD Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Navy Blue Wave 2.

-

Position: Gray Wave C.

-

Direction next lower degrees: Navy Blue Wave 3.

-

Details: Navy Blue Wave 1 appears completed, and now Navy Blue Wave 2 is in progress.

-

Wave cancel invalid level: 1.12136.

The Elliott Wave analysis for the EURUSD on the daily chart indicates the market is currently in a counter-trend phase, moving within a corrective pattern. The primary structure identified is Navy Blue Wave 2, following the conclusion of Navy Blue Wave 1.

Currently, the market is positioned within Gray Wave C, which represents the ongoing correction phase as part of the larger Navy Blue Wave 2. This corrective movement generally signals a temporary pullback or consolidation before the larger trend resumes.

Once the Navy Blue Wave 2 correction concludes, Navy Blue Wave 3 is anticipated to begin, potentially indicating a stronger impulsive move, whether upwards or downwards, depending on the market response. The current wave count remains valid as long as the price stays above the wave cancellation level.

The key invalidation level to monitor is 1.12136. Should the price dip below this level, the existing wave structure would be deemed invalid, prompting a reassessment of the wave count. Traders and analysts are carefully watching this level to ensure the market follows the expected corrective path.

Summary: The EURUSD daily chart presents a corrective phase within Navy Blue Wave 2, after the completion of Navy Blue Wave 1. The current market position is in Gray Wave C, and once Wave 2 ends, the next phase, Navy Blue Wave 3, is projected to start. The wave cancellation level to watch is 1.12136. If breached, the current wave analysis would no longer be valid.

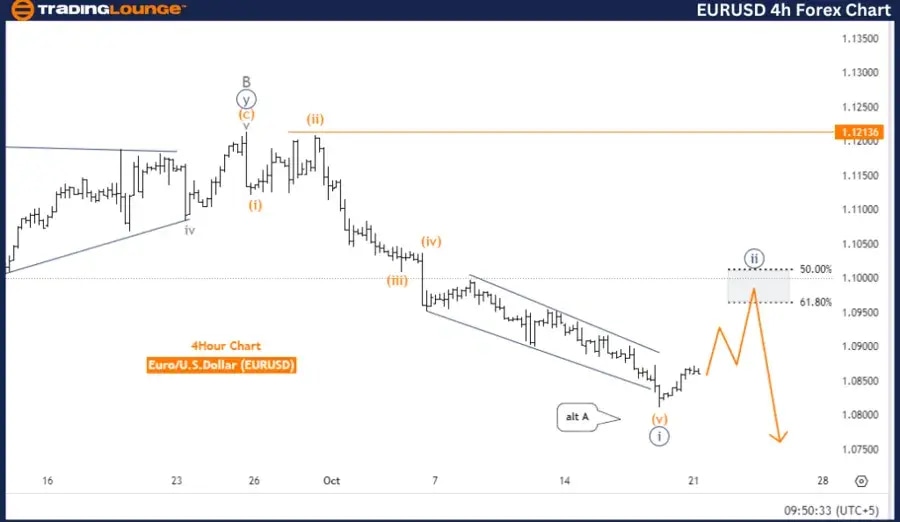

Euro / U.S. Dollar (EURUSD) – 4 Hour Chart

EUR/USD Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Navy Blue Wave 2.

-

Position: Gray Wave C.

-

Direction next lower degrees: Navy Blue Wave 3.

-

Details: Navy Blue Wave 1 appears completed, with Navy Blue Wave 2 now in play.

-

Wave cancel invalid level: 1.12136.

The Elliott Wave analysis for EURUSD on the 4-hour chart shows that the market is currently in a counter-trend phase, following a corrective mode. The primary wave structure under observation is Navy Blue Wave 2, which suggests the market is in a correction after the completion of Navy Blue Wave 1.

At present, the market is positioned within Gray Wave C, which forms part of the larger corrective phase of Navy Blue Wave 2. The analysis indicates that Navy Blue Wave 1 has concluded, and the market is now developing Navy Blue Wave 2. This phase typically involves a temporary pullback or consolidation before the trend resumes.

The next expected movement, once Wave 2 finishes, is Navy Blue Wave 3, which could signal the start of a more impulsive trend. This could mark the beginning of a new trend direction, either upward or downward, depending on how the market unfolds.

For traders, the critical level to watch is the wave cancellation point at 1.12136. If the price drops below this level, the current wave analysis would become invalid, and a reassessment of the wave count would be necessary. Until that point, the corrective phase within Wave 2 remains active, and further development within this structure is expected.

Summary: EURUSD is in a corrective phase with Navy Blue Wave 2 in progress, following the completion of Navy Blue Wave 1. The market is currently positioned within Gray Wave C, and the next move is projected to be Navy Blue Wave 3. The invalidation level to monitor is 1.12136.

Technical analyst: Malik Awais.

EUR/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.