Economic outlook in the face of uncertain election outcomes

Our central scenario of a Eurozone take-off and a US soft landing, confirmed by the latest available indicators, is characterised by an expected convergence in growth rates. This base case could, however, be impacted by political uncertainties on both sides of the Atlantic (uncertain outcomes of the early parliamentary elections in France and the US presidential election). Furthermore, while the ECB began its easing cycle in June, as expected, providing timely support for growth, the Fed is still holding back. This extension of the status quo, even if it seems justified for the time being, constitutes another downside risk. However, growth is benefiting from other supportive and resilient factors, chief among them real wage gains. The dynamism of tourism, the support of public policies (such as Next Generation EU in Europe and the Inflation Reduction Act (IRA) in the United States), investment in the low-carbon transition and the dissipation of the energy shock also act as tailwinds.

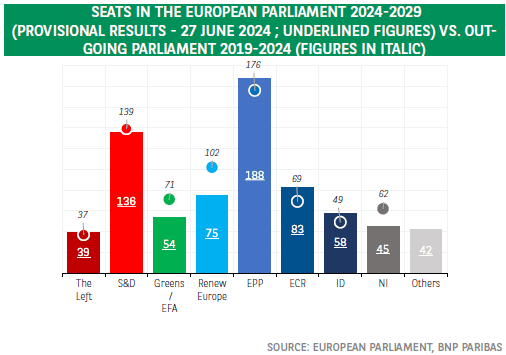

The uncertainty surrounding the outcome of the European elections, held between 6 and 9 June, has now been lifted and we know the results. But there is still significant uncertainty about the practical implications of these results for Europe’s agenda. On the face of it, the composition of the new European Parliament elected for 2024-2029 has changed little overall, with the centrist parties, comprising the EPP, the S&D Group and Renew Europe, still in the majority (399 seats out of 720 according to the 27 June count, which is still provisional), albeit to a lesser extent (see chart). The strong growth of the far-right parties (ECR and ID) to the detriment of the Renew Europe Group and the Greens is the first striking feature of these elections. At this stage, it is difficult to know what the exact implications of this political reconfiguration will be for the priorities of the European agenda, and how easy or difficult it will be to reach the compromises required to continue to move this agenda forward.

At the close of the European Council of 27 June, the priorities for the next five years1 were defined and summarized this way: “In the face of a new geopolitical reality, the strategic agenda will make Europe more sovereign and better equipped to deal with future challenges”. This strategic programme is based on three pillars: a free and democratic Europe, a strong and secure Europe, and a prosperous and competitive Europe. This last point will be based in particular on the reports by Enrico Letta (on the single market), Christian Noyer (on European capital markets) and the forthcoming report by Mario Draghi (on competitiveness). The convergence in growth rates between the Eurozone and the US that we are forecasting by 2025, if it materialises, would only be a tiny step forward given the growth divide that has appeared between the two regions. It is the conditions for this leap forward that these reports seek to put in place. The EU’s ambition must be to promote, in a pragmatic way, a new model of economic development that meets the climate and social challenges. The EU 27 also agreed on the reappointment of Ursula von der Leyen as President of the European Commission, an appointment that must still be approved by the European Parliament, which is due to vote on 18 July.

The second salient feature of the European elections is the political impact of their results in France. While the results were in line with the opinion polls, the surprise came from the announcement, immediately after, by President Emmanuel Macron, of the dissolution of the National Assembly and therefore of snap parliamentary elections (first round on 30 June, second round on 7 July), the outcome of which is highly uncertain.

This is the particular background to our quarterly review of the economic situation and outlook in the major OECD economies. Our central scenario is that of a take-off by the Eurozone and a soft landing by the US economy and is characterised by an expected convergence in growth rates (on a quarterly basis from Q3 2024 and as an annual average in 2025). However, this baseline scenario could be derailed if the recovery underway in the Eurozone falters due to political uncertainties. Two other major uncertainties continue to represent a downside risk to US growth, primarily, but also to the rest of the world through spillover effects. These are, on the one hand, the consequences of the Fed’s prolonged monetary status quo (until, possibly, a first rate cut only in December) and, on the other, the outcome of the US presidential election on 5 November.

Fcaelnlt rinal inscfleantaiornio, mreosnieltieanrty geraoswintgh, acnodn tfiinsuceadl consolidation

Alongside these downside risks however, there are factors supporting and bolstering growth that underpin our current central scenario. Firstly, real wage gains as inflation falls faster than the still limited moderation in wages. The following factors should also have a positive impact: the buoyancy of tourism (France will also benefit from the specific impact of the Olympic Games); the dissipation of the shock on energy prices (which has been more detrimental for the Eurozone than for the US); the reduction in the degree of monetary restriction – to quote Christine Lagarde – which has begun in the Eurozone and is still to come in the US; the continuing strength of the labour market; and the considerable and urgent need for investment in the low-carbon transition It is also worth noting the support of public policies (NGEU and all its variants for Europe2; the Infrastructure, Investment and Jobs Act, the CHIPS Act and the Inflation Reduction Act in the US).

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.