-

ECB meets on Thursday; markets expect a 25bps rate cut.

-

Lots of reasons for a pause, including the lack of staff projections.

-

But the ECB might choose to avoid disappointing the markets.

-

The Euro could really benefit from a rate pause.

ECB meets on Thursday

The ECB will hold its penultimate meeting for 2024 on Thursday, just five weeks after the September gathering that produced another rate cut. It has been an eventful period for the markets with the Fed announcing a 50bps rate cut and the conflict in the Middle East moving up a notch.

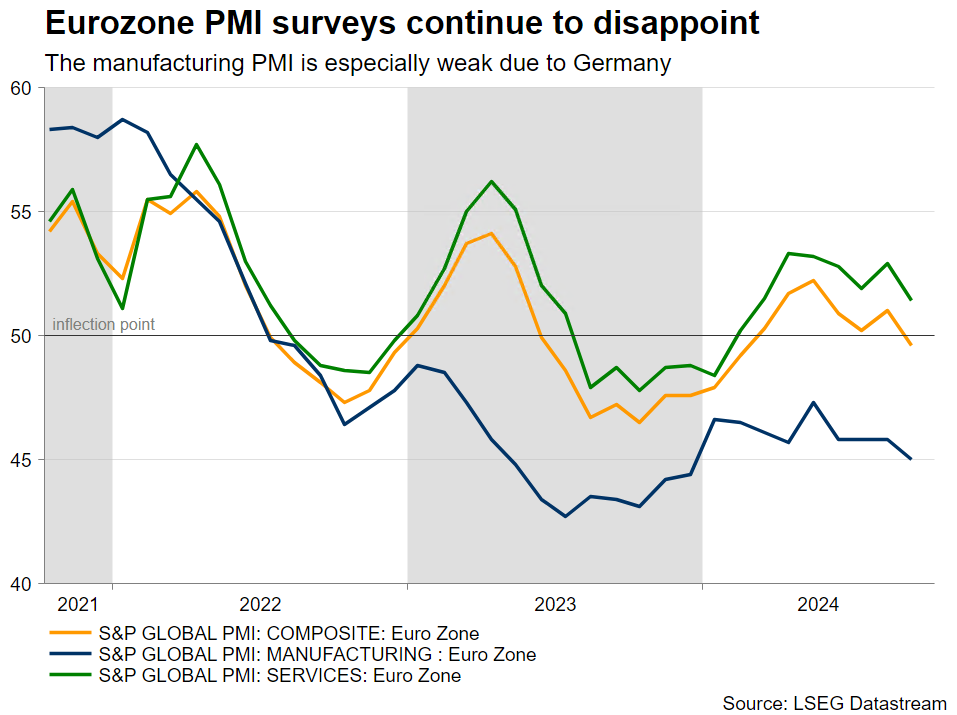

In the meantime, the eurozone data continued to worsen. Most notably, the September PMI surveys, predominantly the manufacturing ones, confirmed the rather protracted soft patch experienced by the euro area economy, particularly in Germany, and the September headline CPI figure dropped below 2% for the first time since July 2021.

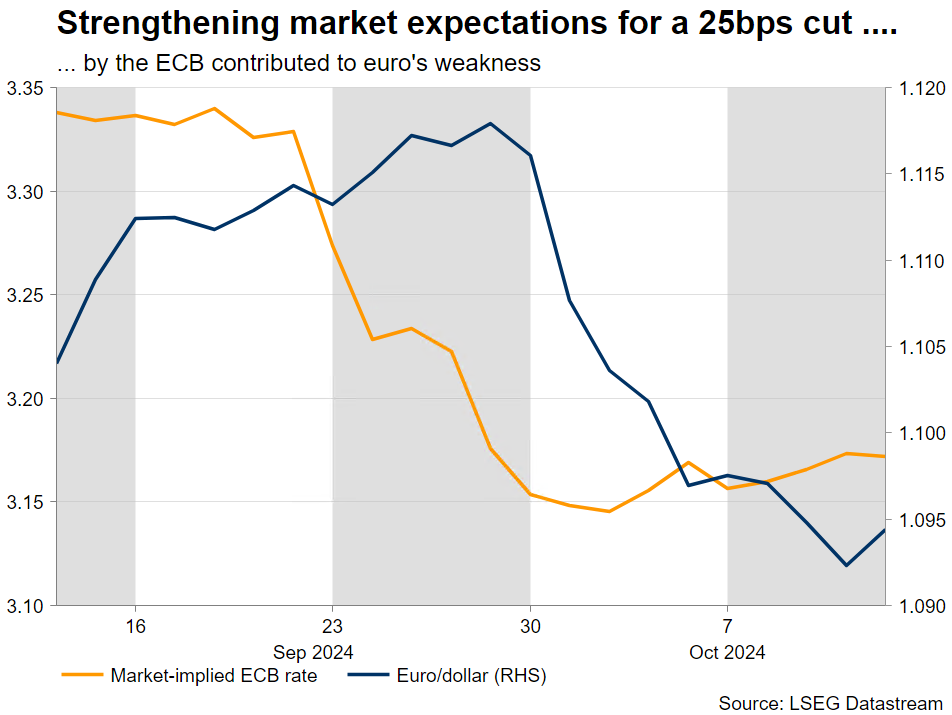

These developments, i.e. the aggressive Fed rate cut, the weak growth outlook and satisfaction from the euro area inflation prints, allowed most ECB members to move from vague comments about the need for further rate cuts to openly state their preference for an October move. The difference between the recently published minutes of the September meeting and the ECB members’ most recent rhetoric is quite telling.

This shift is also reflected in market expectations. The probability of an October 25bps cut was around 30% after the September gathering, but it quickly rose to fully price in this rate move. It is currently hovering around 99%, which, in the eyes of the market, makes this week’s rate cut a done deal.

Is the rate cut really a done deal?

Frankly, the September CPI report was not surprising, as President Lagarde had already announced that the ECB expects a weak print, with inflation rising again towards the end of 2024. Interestingly, there are no staff projections this time around, and considering the fact that the meeting comes only five weeks after the September one, some ECB members might be inclined to wait until December. Additionally, Thursday's gathering will take place in Ljubljana, Slovenia and the ECB usually, but not always, prefers to announce rate changes when the meeting is hosted at the ECB tower in Frankfurt.

This extra time until the December gathering is probably important for other reasons. The ECB could examine any likely Fed announcements on November 7, where the outlook is equally complicated following the recent strong jobs data, and digest the outcome of the US presidential election.

But the most important factor for pausing on Thursday might be that in September the ECB adjusted its rates profile. The deposit rate was cut by 25bps to 3.5%, but the gap with the main ECB rate dropped to 15bps from 50bps, with the latter dropping to 3.65% from 4.25% before the September gathering.

The market is convinced of the need of another rate cut

Despite the plethora of reasons for a pause, the ECB has to take tough decisions based on the incoming data and the overall economic outlook. It is obvious that the eurozone economy is barely growing with Germany officially expected to contract for a second year running, and with no help expected at this stage from China, which continues to face its own grave issues. Therefore, another 25bps rate cut could only prove beneficial for the eurozone economy.

At the end of the day, an agreement could provide a solution. The doves might begrudgingly accept a pause on Thursday in exchange for a strong pre-commitment for a 25bps rate cut in December, possibly more if needed.

The Euro could suffer from a dovish rate cut

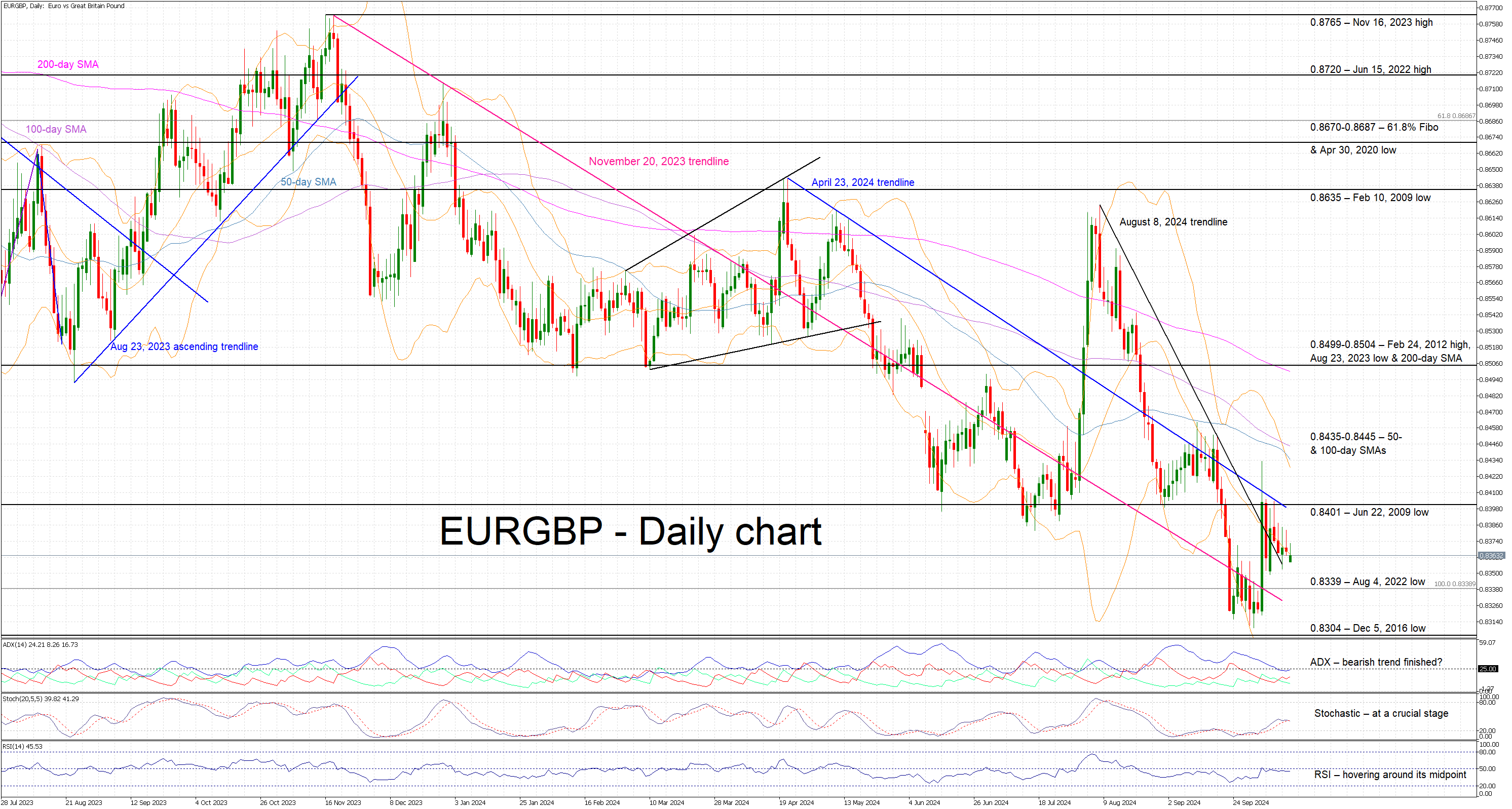

Despite the recent upleg in euro/pound, mostly on the back of the early October comments from Governor Bailey for a more aggressive BoE stance in terms of the rate cuts, the downward trend from the November 2023 high remains in place.

A dovish rate cut on Thursday will probably allow euro bears to overcome some key support levels and test again the 0.8304 level. On the flip side, a surprising rate pause could cause a sizeable upleg in euro/pound with the 0.8500 area looking like a plausible target.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD below 1.0400 as mood sours

EUR/USD loses its traction and retreats to the 1.0380 area in the second half of the day on Monday. The negative shift seen in risk mood, as reflected by Wall Street's bearish opening, supports the US Dollar and makes it difficult for the pair to hold its ground.

GBP/USD nears 1.2500 on renewed USD strength

GBP/USD turns south and drops toward 1.2500 after reaching a 10-day-high above 1.2600 earlier in the day. In the absence of high-tier macroeconomic data releases, the US Dollar benefits from the souring risk mood and weighs on the pair.

Gold falls below $2,600 amid mounting risk aversion

Gold fell below the $2,600 level in the American session on Monday, with US Dollar demand backed by the poor performance of global equities and exacerbated by thin trading conditions ahead of New Year's Eve.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.