ECB Rate Decision Preview: The question is not if but when

- No change in rate policy or emergency program forecast.

- Rising COVID-19 cases and potential closures increase pressure for action.

- Lagarde expected to reassure that the ECB can and will act when necessary.

- Euro has fallen to near three-month lows.

With COVID-19 cases rising and several countries contemplating new restrictive measures the European Central Bank is again under pressure to support the Union's economy.

Bank President Christine Lagarde will likely promise that she is prepared to ease policy when economic conditions warrant but that a decision is not yet necessary at the meeting on Thursday.

The bank is widely expected to leave its main refinance rate unchanged at 0% and its deposit rate at -0.5%. The ECB's bond purchase program, the Pandemic Emergency Protection Program (PEPP), with only about 500 billion-euros of its allotted 1.35 trillion limit used, should also remain unmodified.

Eurozone economy

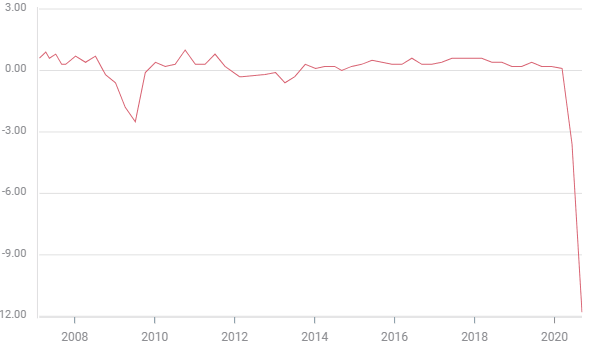

Third quarter GDP in the Eurozone is projected to rebound 9.4% after contracting 3.6% in Q1 and 11.8% in April, May and June. Unemployment has been slowly increasing from 7.1% in March to 8.1% in August, the high of the pandemic era, with 8.3% expected for September,.

EMU GDP

France, Italy and Spain have already introduced modified restrictions and Germany is preparing to follow, of the type that crashed the economy earlier in the year. Even though most economic limits were lifted in the summer, euro-area services were contracting from the huge declines in travel and hospitality.

Governments will again need to provide economic and business support. Italy approved a new relief package this week and Germany is planning more assistance.

The returning pandemic and potential for re-instituted closures means that a second recession is becoming ever more likely.

The Brexit talks with the UK are another flash-point but with both economies under severe COVID-19 threat neither side will want to risk the additional exactions of a no-deal departure.

Markets

Credit markets have been betting that more bond buying by the ECB is on the way. Many expect that the PEPP scheme will be enhanced by another 500 billion euros in December.

German bonds rose on Wednesday sending the 10-year yield to its lowest since the March panic. Italian and Greek yields have also dropped to record lows this month.

Equities have fallen in Europe and the United States. In Europe the FTSE lost 2.55% and the German DAX 4.17% on Wednesday and the Dow and S&P 500 were down 3% in the early afternoon. Japanese and Chinese exchanges saw small gains.

The euro has come under selling pressure this week as the viral spread makes costly preventative measures more likely but it is still well within its1.1630-1.1940 range of the last three months.

Conclusion

The pandemic is a slow moving economic catastrophe. If European governments choose to shut their economies in response to the return of the COVID-19 infections, the result is well-known.

The planners at the ECB and the continent's chancelleries do not have to speculate on the outcome, if their economies are closed they will have a second recession. The only question is how soon they will act. The odds for a surprise preventative strike from the ECB are rising.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.