- The European Central Bank is set to raise rates by 75 bps.

- Falling gas prices have boosted the euro but may cause ECB to signal looser policy.

- President Lagarde will find it hard to reject recession forecasts.

Winter is still coming – even if temperatures are unusually high in Europe, the drop in gas prices could still bite the common currency. That is only one factor in my assessment that the European Central Bank's decision will be a downer for EUR/USD.

First is first – the rate decision. Economists expect the ECB to raise borrowing costs by 75 bps for the second time in a row. That would put the main refinancing rate at 2% and the deposit rate – what commercial banks receive when parking funds at Frankfurt – at 1.50%. Officials at the bank made their intentions clear.

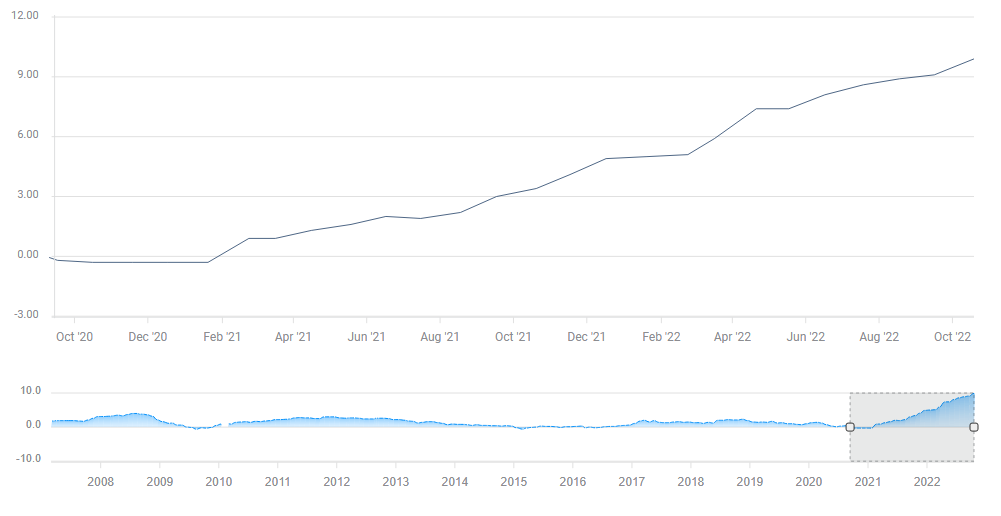

The hawkish camp at the ECB was vindicated by rising inflation, which is hovering at around 10%, far above the 2% target. It looks like a one-way street to the upside::

Source: FXStreet

While Europe's rising prices are primarily driven by soaring energy costs, Core CPI has been too high as well. An increase in more-unionized Europe and an ongoing post-pandemic recovery have put underlying inflation at 4.8%. Both figures mean more rate rises.

As the main rate reaches and matches the ECB's 2% target, the big question is: is there more in store? In September, ECB President Christine Lagarde signaled that the tightening cycle would end in February. Markets have priced that borrowing costs will peak at 3%, but there is a high degree of uncertainty.

The ECB's next moves hinge on economic developments and the euro depends on what Lagarde says. She is unlikely to provide straight answers to questions about the bank's next decision in December, especially as new staff forecasts will be available only then. Nevertheless, her comments on the current situation – and her tone – are critical.

That is where gas prices come to the front burner amid Russia's de-facto embargo. The unusually warm autumn has diminished demand for heating and pushed electricity costs lower. Gas storage is above seasonal levels, and fears of blackouts or rationing have almost disappeared. However, higher costs and uncertainty have still taken their toll.

Economists are falling over themselves to downgrade forecasts for the old continent alongside talk of higher interest rates despite lower gas prices. Forecasting a recession has become common, especially for Germany, which relies heavily on gas. The highly regarded German IFO think-tank projected a "winter recession."

The ECB has been careful to refrain from using the R-word when discussing the next developments. If Lagarde puts such an option on the table, it will imply a slower path of rate hikes starting from December. Arguably, more importantly, expectations for the peak rate would also decline. That would push the euro lower.

If she surprises and denies a recession is coming, it will be insufficient to shore up the euro. To lift the common currency, she would need to pledge raising rates beyond February. I am certain a reporter will ask her about that, and only if she opens the door to additional moves would the euro rise.

What to expect from EUR/USD

I expect EUR/USD to react negatively to the ECB decision. Why?

First, a 75 bps hike is fully priced in and there is little the bank could do on the hawkish side to add to euro strength.

Secondly, it would be hard for Lagarde to deny a European recession is coming due to elevated energy costs. The fall in gas prices is insufficient to create a production and consumption boom. Their current drop only means less pressure on the ECB to hike rates, implying a weaker euro. A double-edged sword.

Third, EUR/USD's recent rise has been fueled by the Federal Reserve's "pivot" toward slowing down the pace of rate hikes in America. Nevertheless, the US economy is still in better shape, and the ECB's statement would put things in proportion.

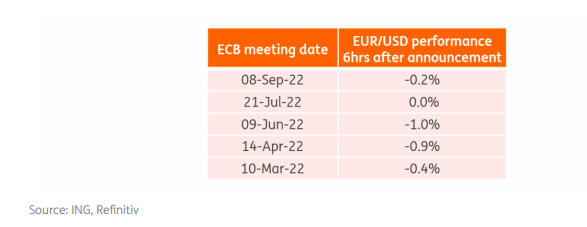

Fourth, recent history speaks for itself. EUR/USD has failed to take advantage of recent ECB hawkishness. The best it could do was to stay unchanged in July, which dropped in response to all the other rate decisions. It is hard to bet in favor of EUR/USD this time.

EUR/USD previous responses:

Source: ING

Final thoughts

I expect the ECB's 75 bps hike to be the bank's last big rate hike. One more is likely in mid-December, and then winter is officially upon us – and potentially an official recession. Warmer temperatures will be of little comfort to the euro if the economy cools down.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.