CPI surprises markets, but miners prepared their own surprise

So, the CPI and – more importantly, from the Fed’s point of view – core CPI was lower than expected, and the markets soared. What’s next?

Historical patterns

As always, it’s imperative to look at the context before saying that something is bullish or bearish. And the context is… What happened to gold miners when inflation news surprised the market by being lower than expected.

Here’s what:

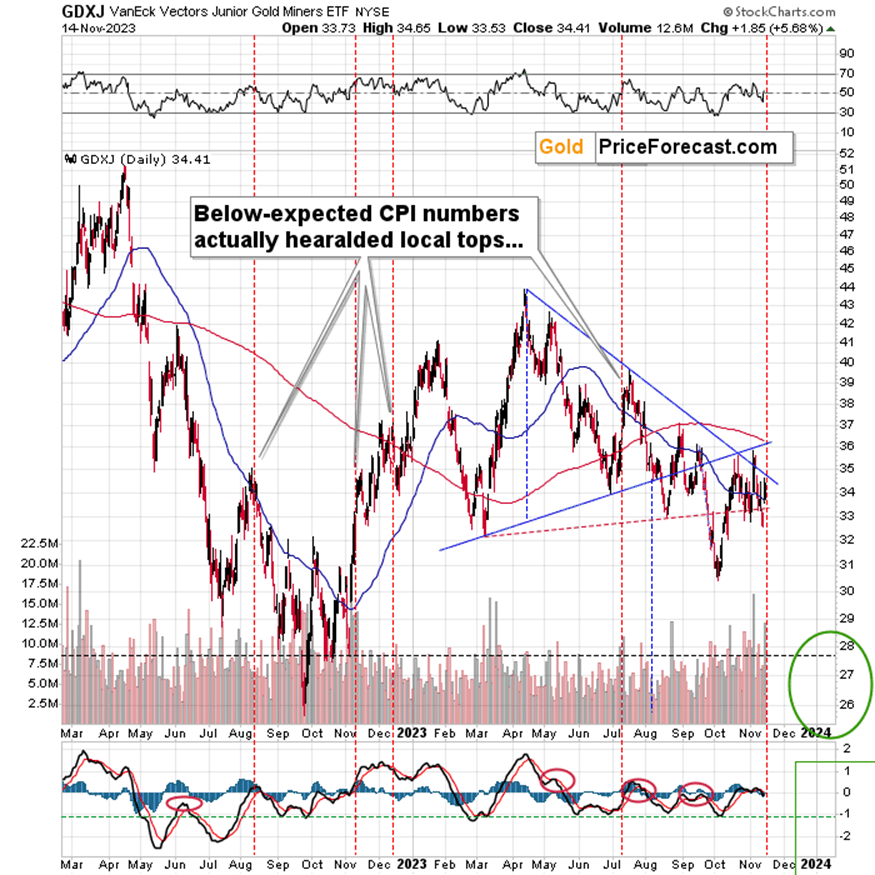

The orange vertical lines represent days when the core-CPI was released, and the numbers were below the market’s expectations.

-

Back in August 2022, it was practically right at the top, which was followed by a sizable decline.

-

In November 2022, it was right before a local top.

-

In December 2022, it was practically right at the local top.

-

In July 2023, it was right before a local top, which was followed by a sizable decline.

What are the implications? They are unclear for the immediate term (1-3 days), bearish for the short-term (1-2 weeks), and likely bearish also for the medium-term (several weeks).

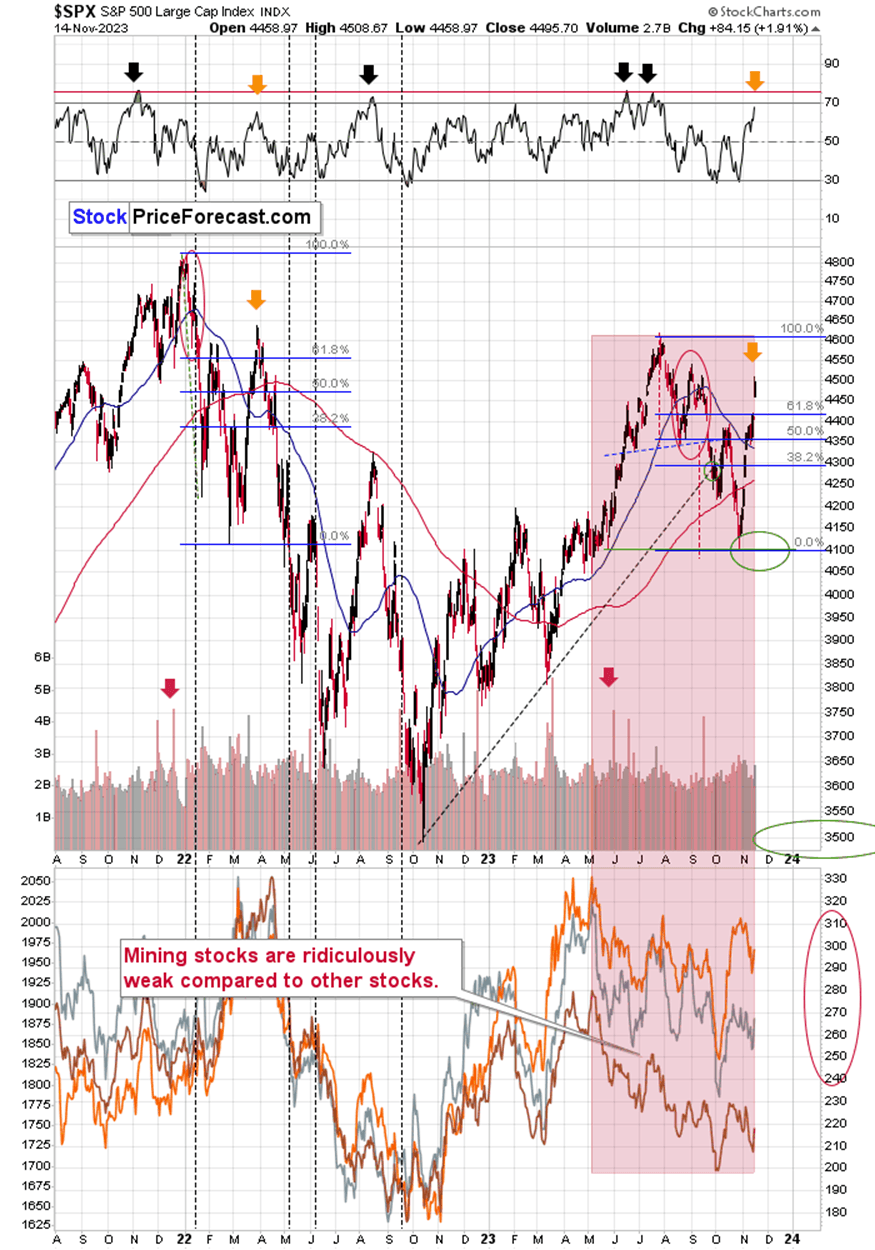

The reason for the latter is that the medium-term trend in the mining stocks is clearly down, and the fact that junior miners clearly underperformed both gold and the general stock market in recent weeks confirms this bearish gold prediction.

Besides, the reaction of the precious metals market was weak in general – at least when compared to what happened in stocks and in the USD Index.

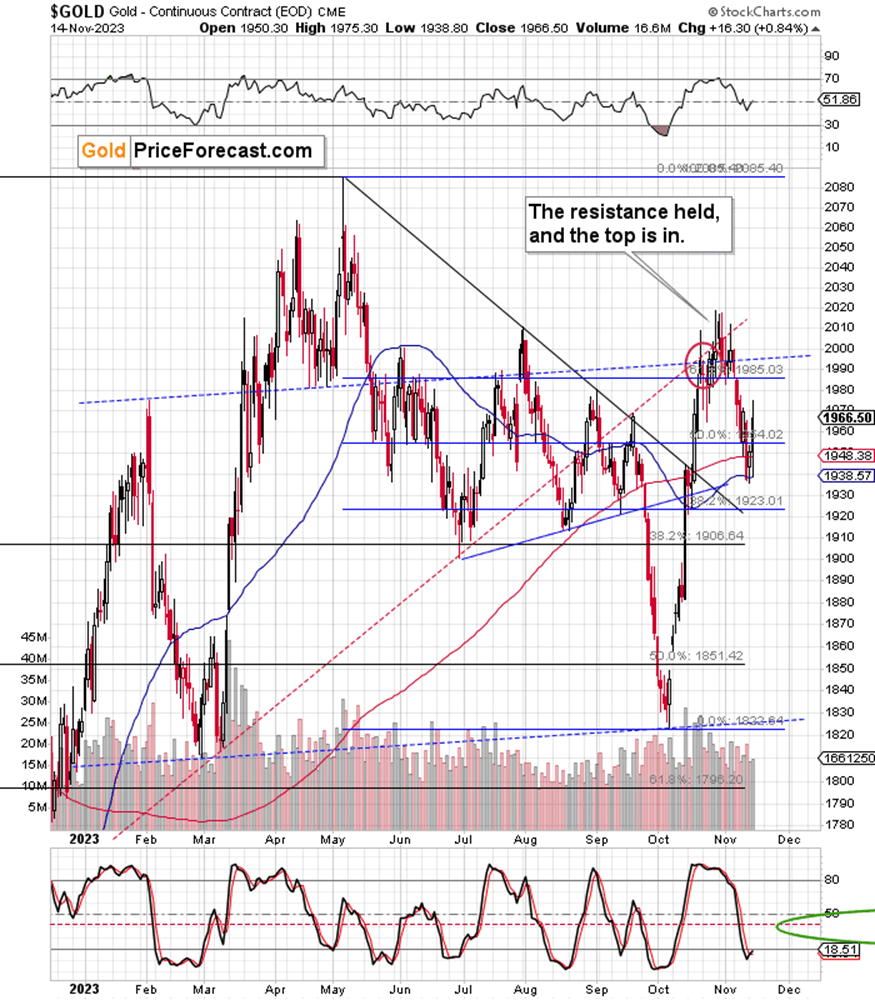

Gold moved visibly higher on an intraday basis, but in reality, it was a correction that didn’t erase a significant part of the recent decline. It was not that important.

Diverse market reactions

At the same time, stocks soared to new monthly highs.

They also moved above their 61.8% Fibonacci retracement level, while the RSI level based on the S&P 500 moved close to 70. This situation is very similar to what we saw in March 2022. The rally was sharp, and it was just as fake as it was sharp. Stocks plunged shortly thereafter, and the same thing is likely right now (or soon).

The oil price also didn’t “buy” the bullishness. Despite the early-day rally, crude oil reversed its course before the end of the session and ended the day flat.

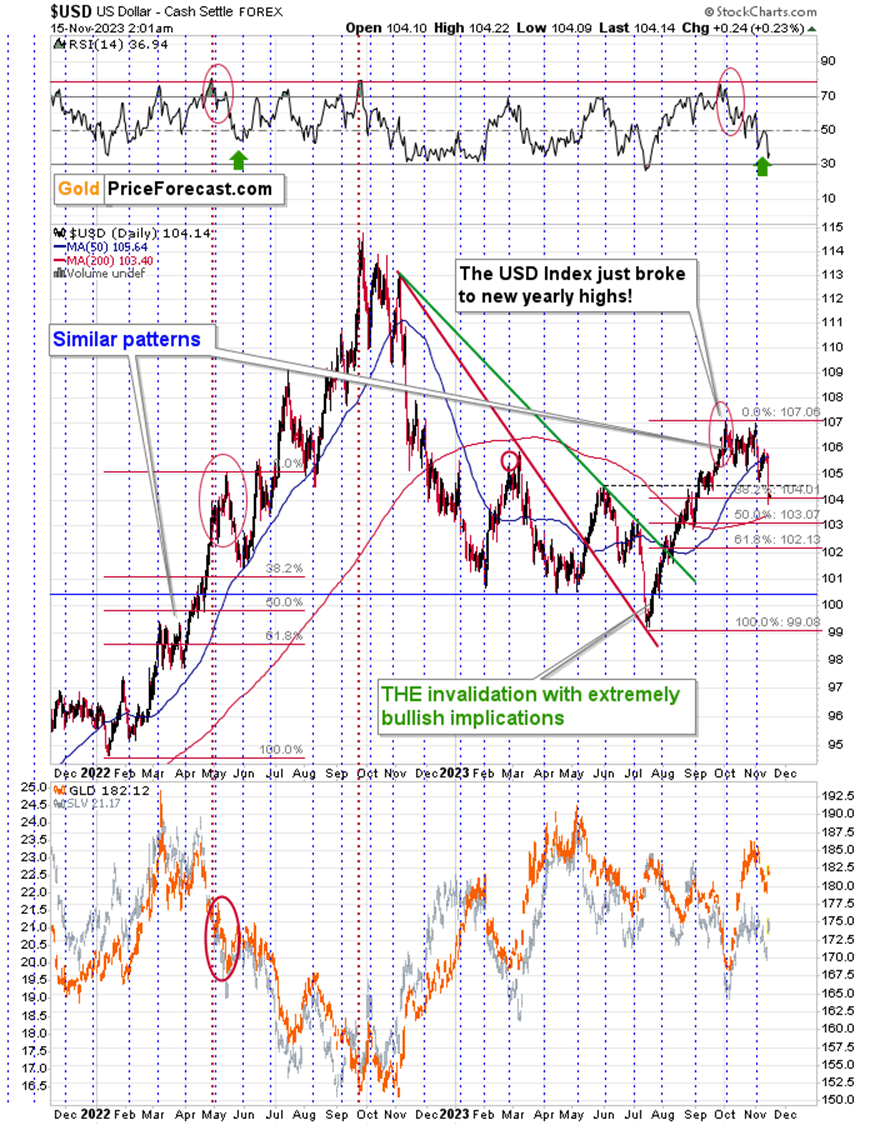

The USD Index declined significantly yesterday, but did it change the outlook? Not at all.

The USDX moved to its 38.2% Fibonacci retracement based on the recent big rally, and that’s a normal thing for a market to do in order to cool down some of the more emotional investors.

The mid-2022 correction also ended when the USD Index moved close to its 38.2% Fibonacci retracement, so I’d say that this kind of decline is not bearish but rather in tune with the previous bullish pattern.

Also, while the USD Index moved to a new monthly low, gold and miners are far from their monthly highs. So, yes, the precious metals market is weak here, even though it might not be apparent based on the size of yesterday’s rally.

Remember when, on Nov. 6th, I told you that negative surprises in nonfarm payrolls are not necessarily a bullish thing despite the market’s initial reaction? The GDXJ plunged shortly thereafter. It seems that we are in a similar situation with regard to the CPI numbers.

You have been warned.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any