China: Activity firms further

3Q23 GDP growth shows further incremental growth as retail sales pick up the slack from fixed-asset investment and real estate.

A modest, but realistic improvement

The first glance of the deluge of data that we got from China this morning gave an impression of stronger-than-expected activity, building on the slight improvements from August. And further examination tends to support that impression, though there are definitely nuances, and this wasn't wall-to-wall good news.

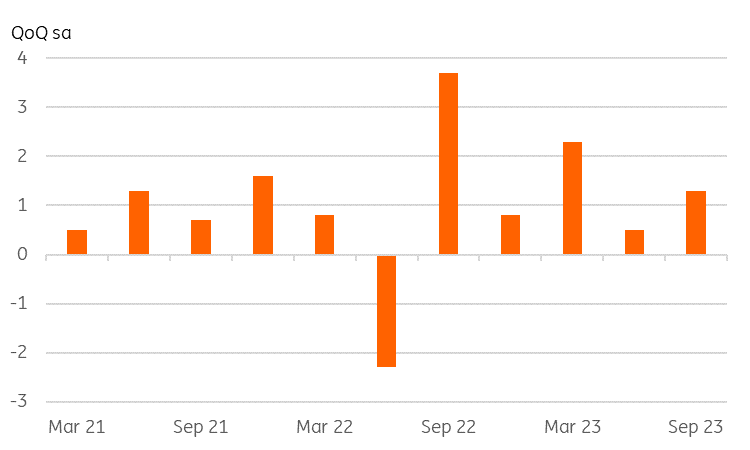

Most attention has probably been focused on the 3Q23 GDP result. We will gloss over the year-on-year outcome which was heavily distorted by fluctuations in activity last year, and instead, focus on the incremental QoQ (sa) growth. This came in at 1.3% - stronger than the consensus estimate of 0.9% and our own 0.8% forecast, though there was a downward revision to the 2Q growth rate, which was trimmed from 0.8% to 0.5%, resulting in the year-on-year year-to-date growth rate dropping slightly to 5.2% from 5.5%. Taking into account the downward revisions, the implied GDP level was more or less in line with expectations, though the direction of travel is encouraging.

If we allow for some further modest acceleration of growth in 4Q23 on an incremental basis, then we still struggle to push the GDP total for the full year up to 5%, though given a little encouragement, we might consider a small upgrade from our current 4.5% forecast, which is towards the lower end of consensus.

Chinese GDP growth (QoQ% sa)

Source: CEIC, ING

Retail Sales is doing much of the heavy lifting

Industrial production came in slightly ahead of expectations with a 4.5% YoY growth rate - though this was unchanged from the August growth figure. Retail sales, in contrast, were more impressive. Retail sales growth rose from 4.6% YoY in August to 5.5% in September, considerably above the 4.9% growth expected. That may have been helped by a fall in the measured unemployment rate from 5.2% to 5.0%.

On a cumulative basis, the rate of retail sales growth was not quite so impressive, declining to 6.8% in September from 7.0% in August. But this is still a fairly healthy growth rate and makes up for some of the weakness elsewhere.

Retail sales growth

Source: CEIC, ING

It wasn't all good news

It wasn't all good news, however. Anything related to the real estate sector continues to look troubled.

Fixed asset investment growth slowed to 3.1% from 3.2% (YoY ytd). On the same basis, property investment slowed from -8.8% to -9.1%, and residential property sales also shrank at a faster rate, falling from -1.5% to -3.2%. The adjustment taking place in the real estate sector is likely to be a multi-year phenomenon, so we should probably get used to seeing negative figures posted for these parts of the economy. And so long as retail sales continue to post reasonable growth, this should be manageable.

Markets liked the report

Despite what are clearly still pockets of weakness in the Chinese economy, there was enough of a positive tilt to this latest activity report to provide some support for the CNY, which dropped to 7.3037 from its early trading level of about 7.3115.

Chinese stocks were a little less ebullient following the report, which may be seen to reduce the prospects of wider central government deficits which have been touted in recent weeks.

Nonetheless, today's report shows that incrementally, China's economy is making progress. The pockets of weakness are likely to remain drags on growth for some time, but other parts of the economy are taking up the slack, and cautious optimism is probably warranted.

Read the original analysis: China: Activity firms further

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.