Central banks are stuck with caring the most about core

Outlook: Today we get personal income and spending and PCE inflation, along with the March Chicago business survey, the University of Michigan final consumer sentiment and Canadian GDP, albeit for Jan so not so interesting. We also have a plateful of Fed speakers, including NY’s Williams. The day will be almost gone by the time Williams speaks but serious folks want to hear if he mentions CD’s and money market funds stripping banks of deposits and the Fed of money supply power.

We had a calm week and expect a calm day. Reuters reports Treasury volatility (.MOVE) fell to its lowest since March 13, which dampened whatever dollar buying was out there, even on a Friday ahead of religious holidays.

It’s saying something for risk-on when the dollar falls against the Brazilian real in the face of the defeated militarist ex-president departing refuge in Florida for Brazil again. To be fair, the Mexican central bank raised rates yesterday by 25 bp to 11.25%, exactly as expected, for the 15th consecutive rate hike–while noting that inflation is moderating better than expected. The attraction of such high yields is understandable if you are not expecting crisis conditions.

It's also helpful for risk-on that a whole week went by without any bank failures and only poor Charles Schwab under pressure. That brings inflation back to the forefront with the unhappy acknowledgement that while headline is falling, core is not falling and is rising, if by only a little. Central banks are stuck with caring the most about core. The ECB already has the issue and the US is about to get it at 8:30 am, today when we get the latest PCE version. Expectations are running at the same 4.7% as in Jan, which was up from 4.6% in Dec. While not a rise, not a decline, either, and thus the a real worry. Inflation hawks say it will mean one more hike of 25 bp.

As noted yesterday, Bloomberg is trying to make hay out of straw by warning we could be just beginning to see the labor market crack. This time the chart is about what companies are SAYING–not doing, saying. In hard data, jobless claims rose yesterday by more than expected, or 7,000, to 198,000 when 196,000 was forecast. Tiny bubbles. Trading Economics writes “While surpassing expectations, the result remained at a low level by historical standards and continued to point to a stubbornly tight labor market, in line with the hot payroll figures for February and the Federal Reserve's outlook of low unemployment. The tight job market forces employers to raise wages to attract and keep staff, magnifying inflationary pressure on the American economy and adding leeway for the central bank to continue tightening monetary policy. The four-week moving average, which removes week-to-week volatility, rose by 2,000 to 198,250. On a seasonally unadjusted basis, initial claims rose by 10,906 to 223,913.”

Okay, 7,000 or 11,000 in a workforce of 166+ million–sorry, but these numbers don’t cut the mustard. Even the WSJ reports the job market remains strong “despite warning signs.” The Bloomberg chart about company talk may well be right, but so far there is no cause for concern and the Trading Economics narrative is the sane one.

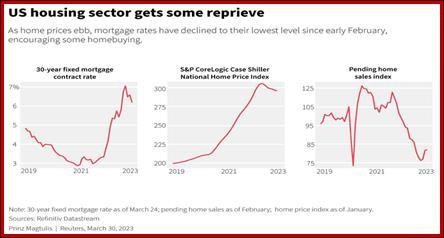

Bottom line, as just about every country is finding out, a drop in headline inflation is nice, but does not suffice when core inflation is the same or rising. That leaves central banks with at least one more hike to go–both the ECB and Fed are now seen at doing 25 bp in May. With Japan likely still sitting on its hands, the dollar/yen is the one place where the dollar can gain. Because housing costs are such a large component of US inflation, falling prices will start to have an effect–but not within a few months. See the charts from Reuters.

Forecast: Risk-on sentiment rules the day. That means the dollar doesn’t have a chance unless a new crisis pokes its head above the water. At some point, with the Fed having a higher terminal rate over the ECB and most others, and if inflation gets whipped more in the US than elsewhere, the real rate will begin to favor the dollar. No one can pinpoint when that might happen. “Later” is the best we can do.

Political Tidbit: As the whole world knows by now, ex-pres Trump was indicted by a New York grand jury and needs to surrender next week, probably Tuesday, to be formally arrested, booked (fingerprints and mug shot), and arraigned before a judge. Pundits imagine his status will prevent handcuffs and the famous New York perp walk into the courthouse. Cable TV has been agog starting from about 5:45 pm last evening when the news broke and remains obsessed with every little bit of it.

Some of the more interesting ideas are that Trump will deliberately set off riots and not just protests, which could result in a gag order or jail. Or he could refuse to surrender and since Florida Gov DeSantis has said he won’t act as a governor is supposed to act and help the arrest, it’s not clear how New York could capture him. A plan is not doubt being hatched.

After the arrest drama, it will be a slow slog. A trial date could be as far off as 16 months, the time between the Trump Org being charged and the trial. The trial itself could last an inordinate amount of time. It will be tedious, to say the least. And by the time the NY case goes to trial, we might have indictments in Georgia and by the Justice Dept in Washington for the Mar-a-Lago documents and Jan 6. And to make matters dirtier, all this will be going on while the 2024 presidential campaign gets into full swing.

The important thing: the US and other countries go after criminal behavior by elected officials all the time–hundreds of times per year. But other countries are less shy about indicting and convicting the top leader. The US alone has the rule that the president is immune while in office. Now that Trump has been charged, the US joins the democracy club of “no man is above the law.” This is a Good Thing. Trump is getting his chance to prove his innocence.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat