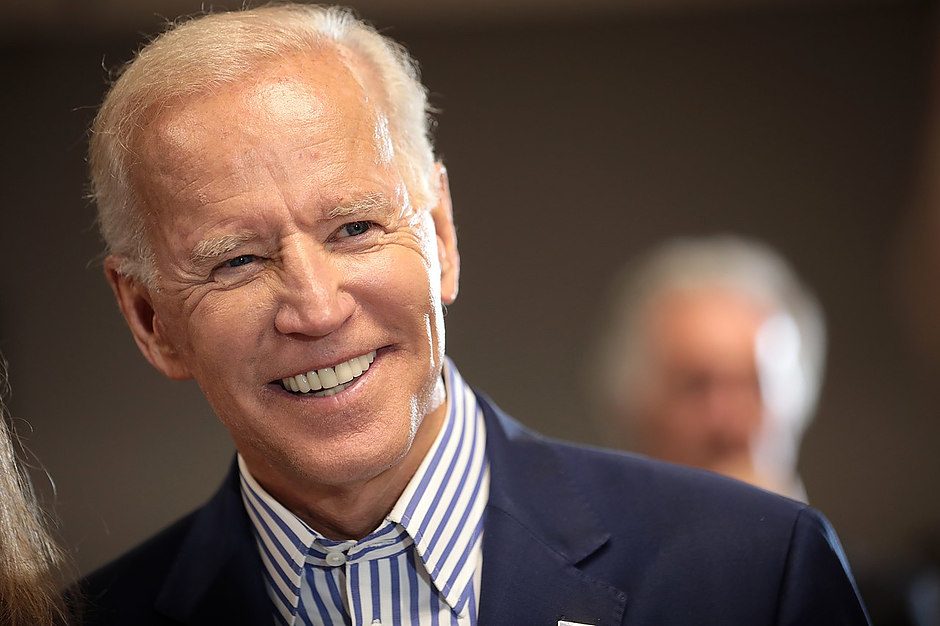

Biden prevents US govt shutdown over new year

EU mid-market update: Disjointed trading week with Christmas falling middle of week; Biden prevents US govt shutdown over New Year.

Notes/observations

- Overall Europe is mixed following a green Asia and US session on Friday. Catalysts are few and far between amid thin market volume due to a shortened trading week because of Christmas holiday changing trading hours.

- UK assets are little fazed after GDP was revised marginally lower in final Q3 reading. Current account was better than expected with less of a deficit compared to consensus.

- On M&A front, Honda and Nissan officially announced plans to merge in efforts to counter Chinese competitors and UK insurer Aviva finally pushed Direct Line bid over the line with £2.75/shr offer for £3.7B.

- Reminder of upcoming European trading hours: early closure tomorrow 24th, closed both 25th and 26th. Returns fully on Friday 27th. New Year sees early closure on Tues 31st and closed for 1st Jan.

- Asia closed mixed with ASX200 outperforming +1.7%. EU indices are +0.4% to -0.1%. US futures are +0.1-0.5. Gold +0.2%, DXY +0.3%; Commodity: Brent +0.1%, WTI +0.1%; Crypto: BTC -0.9%, ETH -1.3%.

Asia

- Singapore Nov CPI M/M: 0.0% v -0.3% prior: Y/Y: 1.6% v 1.8%e; Core CPI Y/Y: 1.9% v 2.1%e [multi-year low].

Mid-East

- Houthi Military spokesperson stated that it had bombed a occupied military target in Jaffa using a hypersonic ballistic missile in response to Israeli aggression.

- Reports circulated that Israel PM Netanyahu would likely to accept what appeared to be a recommendation from Mossad Director Barnea to attack Iran directly as a response to the latest Yemen Houthi ballistic missile attack.

Europe

- ECB Lagarde noted that was getting very close to that stage when could declare that had sustainably brought inflation to the medium-term 2.0% target. Still believe that should be 'vigilant' about services inflation.

- ECB’s Vujcic (Croatia) reiterated council stance that policy direction was clear and that rate cuts will continue into next year.

- ECB Makhlouf (Ireland) maintained stance of preference for gradual rate cuts as opposed to 'big leaps'. Would not want to complicate price stability objective by making 'some sort of insurance cuts'.

- UK Dec Lloyds Business Barometer: 39 v 41 prior.

Americas

- House passed 3 month govt funding bill that included disaster relief and agricultural aid (as expected). bill later passed the Senate late Friday night in an 85-11 vote and was signed by Pres Biden on Saturday to avoid a govt shutdown.

- Trump threatened to ‘return the Panama Canal to the US’ unless Panama cut its fees. Panama President Jose Raul Mulino said the canal and surrounding area belonged to Panama.

- Pres-Elect Trump stated that Russia Pres Putin wanted to meet with him as soon as possible about the Ukraine war.

- Canada Conservative party leader Poilievre stated that would ask Gov General to reconvene Parliament; Wanted urgent no-confidence vote to topple govt (**Insight: Trudeau had hung on to power in late Dec and now could not be removed before late January when Parliament reconvened on January 27th).

Speakers/fixed income/FX/commodities/erratum

Equities

Indices [Stoxx600 +0.4% at 504, FTSE +0.2% at 8097, DAX 0.0% at 19898, CAC-40 +0.1% at 7279, IBEX-35 -0.1% at 11458, FTSE MIB +0.1% at 3318, SMI +0.6% at 11463, S&P 500 Futures +0.3%].

Market focal points/key themes: European indices open lower across the board and remained under pressure through the early part of the session; among sectors managing to stay in the green are financials and health care; sectors leading the way lower include consumer discretionary and communication services; Direct Line to be acquired by Aviva; focus on US durable goods later in the day; no major earnings expected in the upcoming Americas session.

Equities

- Consumer discretionary: VusionGroup [VU.FR ] +15% (To expand digital solutions across all Walmart US stores generating an order intake of ~€1.0B).

- Financials: Aviva [AV.UK] +2.0% (acquires Direct Line for £2.75/shr).

- Healthcare: Carmat [ALCAR.FR] +3.0% (Bought back 2M shares from Airbus for €1), Novo Nordisk [NOVOB.DK] +8.0% (Handelsbanken raised to buy), Fagron [FAGR.BE] -9.0% (Receives warning letter from FDA following routine inspection at it's Wichita facility conducted in June).

- Technology: SoftwareONE [SWON.CH] -8.0% (ExaneBNP cuts to neutral).

Speakers

- Ukraine Central Bank (NBU) Dec Minutes noted that the vote to hike by 50bps was not unanimous (7-4); Rate setters see more rate rises in coming months.

- Russia govt spokesperson noted that the situation with European countries that receive Russian gas was complicated and needed further attention.

- Biden Admin announced Section 301 trade investigation into Chinese-made 'legacy' semiconductors, possibly leading to more tariffs.

Currencies/fixed income

- FX price action was listless as holiday-thinned trade dominated sentiment.

- GBP/USD was little changed even after Q3 final GDP reading was revised lower amid concerns the country might be heading towards a recession.

- EUR/USD holding above the 1.04 level as more ECB speak noted that the direction of rates was moving lower.

- USD/JPY staying below the 157 level in quiet trade.

Economic data

- (NL) Netherlands Nov House Price Index M/M: 0.9% v 0.8% prior; Y/Y: 11.9% v 11.5% prior.

- (FI) Finland Nov Unemployment Rate: 8.1% v 8.1% prior.

- (UK) Q3 Final GDP Q/Q: 0.0e v 0.1% prelim; Y/Y: 0.9 v 1.0% prelim.

- (UK) Q3 Final Private Consumption Q/Q: 0.5% v 0.5% prelim; Government Spending Q/Q: 0.1% v 0.6% prelim; Gross Fixed Capital Formation Q/Q: 1.3% v 1.1% prelim; Exports Q/Q: -0.5% v -0.2% prelim; Imports Q/Q: -2.5% v -1.5% prior.

- (UK) Q3 Final Total Business Investment Q/Q: 1.9% v 1.2% prelim; Y/Y: 5.8% v 4.5% prelim.

- (UK) Q3 Current Account Balance: -£18.1B v -£23.0Be.

- (DE) Germany Nov Import Price Index M/M: 0.9% v 0.6%; Y/Y: 0.6% v 0.3%e.

- (NO) Norway Nov Trend Unemployment Rate: 4.0% v 4.0% prior.

- (HU) Hungary Q3 Current Account: €0.7B v €0.7Be.

- (HU) Hungary Oct Final Trade Balance: €1.0B v €1.0B prelim.

- (ES) Spain Q3 Final GDP Q/Q: 0.8% v 0.8% prelim; Y/Y: 3.3% v 3.4% prelim.

- (CZ) Czech Dec Consumer Confidence: 100.6 v 102.0e; Business Confidence: 96.9 v 97.0e; Composite Confidence: 97.5 v 97.9e.

- (TW) Taiwan Nov Unemployment Rate: 3.4% v 3.4%e.

- (TW) Taiwan Nov Industrial Production Y/Y: 10.3% v 8.9%e.

- (CH) Swiss Dec UBS Expectations Survey: -20.0 v -12.4 prior.

- (CH) Swiss weekly Total Sight Deposits (CHF): 456.5B v 456.4B prior; Domestic Sight Deposits: 448.0B v 448.2B prior.

- (PL) Poland Nov Unemployment Rate: 4.9% v 5.0%e.

Fixed income issuance

- None seen.

Looking ahead

- (CO) Colombia Nov Industrial Confidence -0.4: No est v -0.4 prior; Retail Confidence: No est v 17.8 prior.

- (BE) Belgium Dec CPI M/M: No est v 0.2% prior; Y/Y: No est v 3.2% prior.

- (GR) Greece Debt Agency (PDMA) to sell €500M in 6-Month Bills.

- 05:25 (EU) Daily ECB Liquidity Stats.

- 05:15 (CH) Switzerland to sell 3-month Bills.

- 05:30 (HU) Hungary Debt Agency (AKK) to sell 3-Month Bills.

- 06:00 (IL) Israel Oct Manufacturing Production M/M: No est v 0.4% prior.

- 06:00 (IE) Ireland Nov PPI M/M: No est v 1.6% prior; Y/Y: No est v -1.7% prior.

- 06:00 (BR) Brazil Dec FGV Construction Costs M/M: 0.4%e v 0.4% prior.

- 06:00 (RO) Romania to sell RON600M in 7.9% Feb 2038 Bonds.

- 06:25 (BR) Brazil Central Bank Weekly Economists Survey.

- 06:30 (BR) Brazil Nov Current Account Balance: -$3.4Be v -$5.9B prior; Foreign Direct Investment: $6.0Be v $5.7B prior.

- 07:00 (MX) Mexico Nov Trade Balance: $0.5Be v $0.4B prior.

- 07:00 (MX) Mexico Oct IGAE Economic Activity Index (Monthly GDP) M/M: -0.5%e v +0.2% prior; Y/Y: 0.4%e v 0.3% prior.

- 08:00 (US) Nov Final Building Permits: No est v 1.505M prelim; M/M: No est v 6.1% prelim.

- 08:00 (PL) Poland Nov M3 Money Supply M/M: 0.7%e v 1.5% prior; Y/Y: 8.6%e v 7.8% prior.

- 08:00 (UK) Daily Baltic Dry Bulk Index.

- 08:30 (US) Nov Chicago Fed National Activity Index: -0.15e v -0.40 prior.

- 08:30 (US) Nov Preliminary Durable Goods Orders: -0.3%e v +0.3% prior; Durables (ex-transportation): 0.3%e v 0.2% prior; Capital Goods Orders (non-defense/ex-aircraft): +0.1%e v -0.2% prior; Capital Goods Shipments (non-defense/ex-aircraft): 0.2%e v 0.3% prior.

- 08:30 (CA) Canada Oct GDP M/M: 0.2%e v 0.1% prior; Y/Y: 1.6%e v 1.6% prior.

- 08:30 (CA) Canada Nov Industrial Product Price M/M: 0.3%e v 1.2% prior; Raw Materials Price Index M/M: 0.5%e v 3.8% prior.

- 09:00 (FR) France Debt Agency (AFT) cancelled planed weekly issuance of 3-month, 6-month and 12-month bills.

- 10:00 (US) Dec Consumer Confidence: 113.0e v 111.7 prior.

- 10:00 (US) Nov New Home Sales: 670Ke v 610K prior.

- 11:30 (US) Treasury to sell 13-Week and 26-Week Bills.

- 11:30 (US) Treasury to sell 52-Week Bills.

- 13:00 (US) Treasury to sell 2-Year Notes.

- 13:30 (CA) Bank of Canada (BOC) Summary of Deliberations.

- 16:00 (KR) South Korea Dec Consumer Confidence: No est v 100.7 prior.

- 17:30 (AU) Australia ANZ Roy Morgan Weekly Consumer Confidence Index: No est v 85.5 prior.

- 19:30 (AU) Reserve Bank of Australia (RBA) Dec Minutes.

- 21:00 (CN) China PBOC Setting: Expected to leave 1-year Medium-Term Lending Facility (MLF) unchanged at 2.00%; Prior injection of CNY900B.

- 21:30 (KR) South Korea to sell KRW100B in 20-year Bonds.

- 21:35 (CN) China MOF to sell 1-year and 7-year bonds.

- 22:00 (TH) Thailand Central Bank to sell THB55B in 3-month bills.

Author

TradeTheNews.com Staff

TradeTheNews.com

Trade The News is the active trader’s most trusted source for live, real-time breaking financial news and analysis.