Monthly industrial production results have been mixed but generally indicate a modest recovery in third-quarter GDP. Clear guidance from the Bank of Japan remains elusive, with each upcoming meeting being pivotal. If global USD strength continues alongside rising inflation and wages, a December rate hike is possible, though it remains a close call.

Unanimous decision from the Bank of Japan

The BoJ unanimously decided to leave its target rate unchanged at 0.25%.

In our view, Governor Kazuo Ueda's comments were leaning towards hawkish. He didn't hint at the next rate hike or completely rule out a hike in December. As expected, he reiterated that the BoJ will continue to raise the policy rate if the inflation outlook is realised. Moreover, his overall tone on growth and inflation remained positive compared to the previous meeting.

On the US economy, he welcomes the fact that the latest US data has been robust and that the risks surrounding the US economy are lower than before, but he remains cautious. His comments on inflation also support the case for further rate hikes, noting that Tokyo’s inflation data indicates a spread of cost pass-through to services.

From now until the BoJ's December meeting, US data, Tokyo inflation and labour income data should be closely watched. Another wild card is likely to be the US presidential election and the FX market's reaction to it. However, the Bank of Japan is keen to avoid commenting on domestic political uncertainty and maintain its independence from politics.

Having listened to Governor Ueda's comments, we maintain our long-standing call for a December hike. Financial market bets on a stronger USD are likely to push JPYUSD higher, while upcoming inflation and wage data are expected to be in line with the BoJ's outlook. We expect inflation to rise in November as the energy subsidy programme ends and service price rises broaden. For wages, we expect real labour cash earnings to rebound in September as the labour market remains tight. Several conditions need to be met for a December hike to be realised, but we still see a slightly higher probability of such a case.

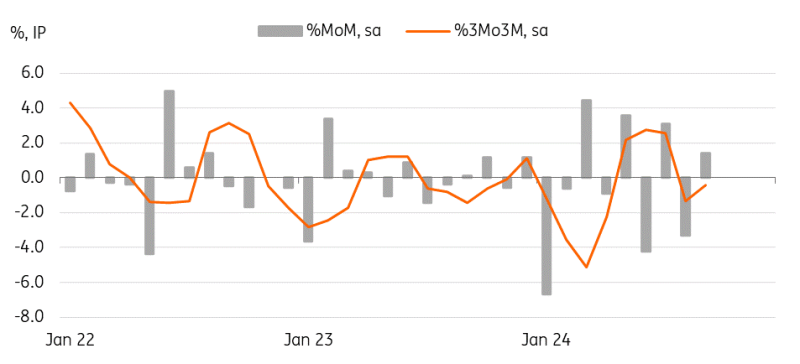

Monthly activity outcomes were mixed, but still suggesting a modest recovery in 3Q24

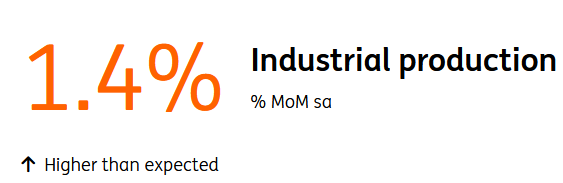

Industrial production in September seems to have recovered from the temporary disruptions caused by natural disasters. The rebound (1.4%) was stronger than the market consensus of 0.8%, but still did not fully make up for the previous month's decline of -3.3%. However, the output forecast for October rose sharply by 8.3%, suggesting that a technical rebound will continue.

Among industries, vehicles (9.7%), petrochemicals (11.9%) and electrical machinery were the biggest gainers. The rebound in vehicles was mainly due to the normalisation of production after the safety scandal-related production stoppage and will continue to recover in the coming months. Chip manufacturing equipment fell for the second month in a row, signalling a momentum slowdown for the global semiconductor sector. In a quarterly comparison, IP contracted -0.4% quarter-on-quarter seasonally adjusted in the third quarter, from a 2.7% gain in the second quarter. Sluggish manufacturing activity is likely to weigh on overall growth in the third quarter.

Meanwhile, retail sales fell by -2.3% more than the market expected (-0.3%), but it was the first decline in six months and we believe it was a temporary pause. As car production also returns to normal and mega earthquake warnings are lifted, we expect retail sales to rebound in the coming months. In a quarterly comparison, retail sales growth moderated to 1.0% QoQ sa in the third quarter from 1.8% in the second quarter, thus we expect private consumption in GDP to soften modestly.

We expect GDP to rise by 0.3% QoQ in 3Q24, slowing from a 0.7% gain in 2Q24. Goods consumption has softened a bit, but service consumption should have risen solidly instead.

IP continues to fluctuate, but points to a recovery in the coming months

Source: CEIC

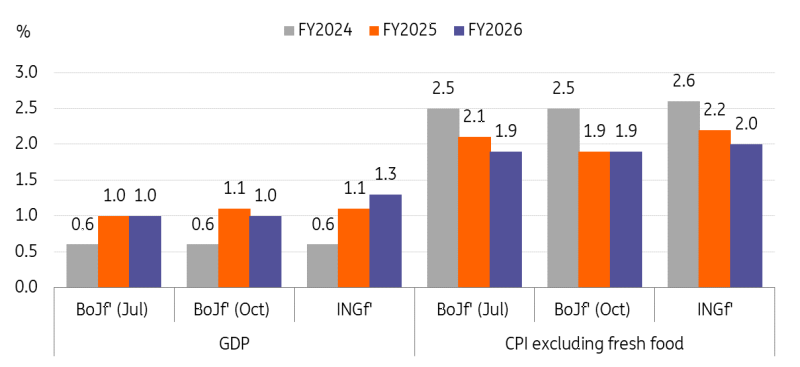

The quarterly outlook report didn't provide a clear direction for future policy

Surprisingly, the BoJ hasn't made much of a change to its growth outlook for the coming years, despite the unexpected activity disruptions in the third quarter. The BoJ still expects the economy to grow above potential for the next two years and it edged up the GDP outlook for FY25 from 1.0% YoY to 1.1%.

Meanwhile, on inflation, the latest outlook gives some confusing messages. The outlook for core CPI excluding fresh food broadly remained unchanged, except that the outlook for FY25 was revised down from 2.1% to 1.9%, which is lower than the BoJ's target of 2.0%. Despite the downward revision, the BoJ mentioned in its statement that price risks remain on the upside and the BoJ will continue policy normalisation if inflation is in line with its outlook.

Our interpretation of this is that government-administered prices – energy and utilities – are dampening overall inflationary pressures, so excluding this impact, inflation should remain above 2.0% in the medium term. Governor Ueda mentioned in his press conference that the lower global oil price outlook was the main reason for lowering the FY25 inflation outlook. Therefore, we believe the fact that core inflation is expected to rebound to 2.1% in FY26 should be more important.

GDP to stay above potential while inflation stays below the BoJ's target

Source: CEIC

Read the original analysis: Bank of Japan holds rates steady amid signs of modest GDP growth

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

EUR/USD keeps its daily gains below 1.0900 post-US PCE

The bearish sentiment in the US Dollar remains unabated and supports EUR/USD's constructive outlook, keeping it in the upper-1.10800s after the release of U.S. inflation data, as measured by the PCE, on Thursday.

USD/JPY trims losses and approaches 153.00

Following an earlier decline below 152.00, USD/JPY now manages to regain some composure and advance to the vicinity of the 153.00 barrier. The initial strong bullish move in the Japanese Yen came after BoJ's Ueda left the door open to a potential rate hike in December at the bank's meeting early onThursday.

Gold corrects lower to $2,770 following US inflation prints

Gold remains on the back foot near $2,770 per troy ounce, as US inflation data ticked lower in September, while US yields display a negative performance across the curve.

Eurozone inflation up to 2% in October as unemployment hits new record low

The Eurozone’s inflation rate increased more than expected, with core inflation stable at 2.7%. The direction of incoming data in the region is not quite clear, which provides the ECB with confusing signals for the path of rate cuts.

Bank of Japan holds rates steady amid signs of modest GDP growth

Monthly industrial production results have been mixed but generally indicate a modest recovery in third-quarter GDP. Clear guidance from the Bank of Japan remains elusive, with each upcoming meeting being pivotal.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.