- AUD/USD has been extending its uptrend as Australia is winning against coronavirus.

- The RBA decision, US Non-Farm Payrolls, and the next steps regarding lockdowns are eyed.

- Early May's daily chart is showing an uptrend channel.

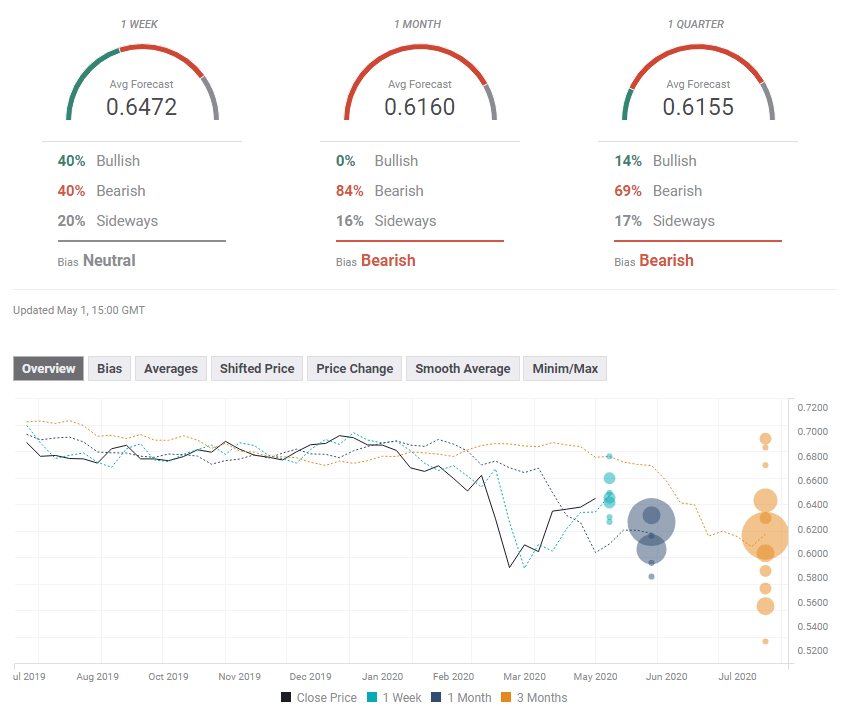

- The FX Poll points to falls in the medium and long-terms.

The Aussie has continued flying like a rugby ball – as the league is preparing to return. Apart from Australia's gains against the virus, it enjoyed the most upbeat market mood. The Reserve Bank of Australia's decision and quarterly report, the Non-Farm Payrolls buildup, and defeating the disease is in the spotlight.

This week in AUD/USD: Mixed signals

Beating coronavirus? The land down under confirmed fewer than 100 COVID-19 deaths at the time of writing, and cases are capped under 7,000. Several states have reported zero new infections in recent days. Australia's success has led by Prime Minister Scott Morrison to announce that restrictions will be eased next week. Similar to New Zealand, both countries acted fast and also enjoyed the fact they have no land neighbors.

Inflation: The Aussie also benefited from relatively robust inflation figures. The Consumer Price Index rose by 0.3% in the first quarter, while Trimmed Mean CPI advanced by 0.5%, both beating expectations. Official Chinese PMIs hovered around 50 – reflecting growth. However, these surveys from Australia's No. 1 trade partner were shrugged off by markets.

SIno-America relations: US President Donald Trump weighed on sentiment and contributed to sending AUD/USD lower after he suggested that coronavirus originated in a Wuhan lab. The worsening relations between the economic giants may have an adverse impact on global trade, which Australia depends on.

Full Fed support: Earlier in the week, the A$ enjoyed the upbeat market mood, partially stemming from the US Federal Reserve's unequivocal commitment to support the economy. The bank enlarged both its municipal and Main Street lending schemes. Jerome Powell, Chairman of the Federal Reserve, said more could be done and called on the government to enhance its spending as well.

Downbeat America data may have contributed to the Fed's sense of urgency. The economy shrank by 4.8% annualized in the first quarter, while accumulated job losses have reached 30 million.

AUD/USD advanced and pared some of its gains amid the general market mood and also Australian-specific developments.

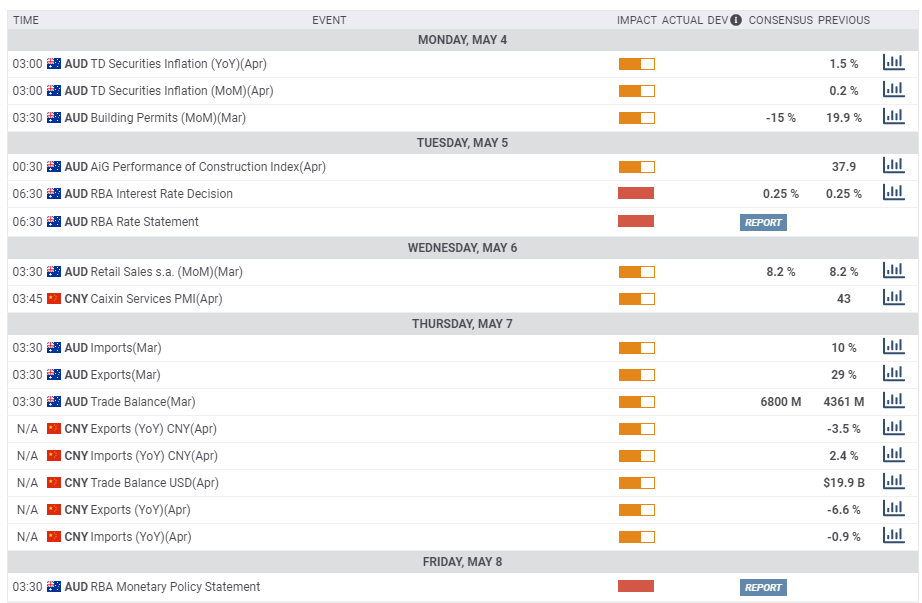

Australian and Chinese events: Lockdown, RBA in focus

At the time of writing, it is still unclear when the PM will announce the relaxing of restrictions, and some depend on states and localities. Nevertheless, the accelerated pace of reopening will likely keep supporting the Aussie. Additional sports events – which Aussies admire – will probably grab attention.

The Reserve Bank of Australia has two opportunities to move the Aussie. The Canberra-based institution is set to leave its interest rate unchanged and not offer additional accommodation at this junction. A positive message may boost the Aussie while fears about the global economy may bring it down.

The second appearance of the RBA is no less significant. The bank's Monetary Policy Statement – or quarterly report – will shed light on how Phillip Lowe, the Governor, and his colleagues see the state of affairs. It could also provide hints about future moves, including Quantitative Easing. Getting into more detail may result in a stronger reaction from markets.

Other events of interest are Retail Sales and Building Permits, which have likely come under significant pressure. China's trade balance figures surprised in MArch with smaller than expected falls in both imports and exports. An increase in imports would be encouraging for Australia's mining industry.

Here the most prominent Australian and Chinese releases on the economic calendar:

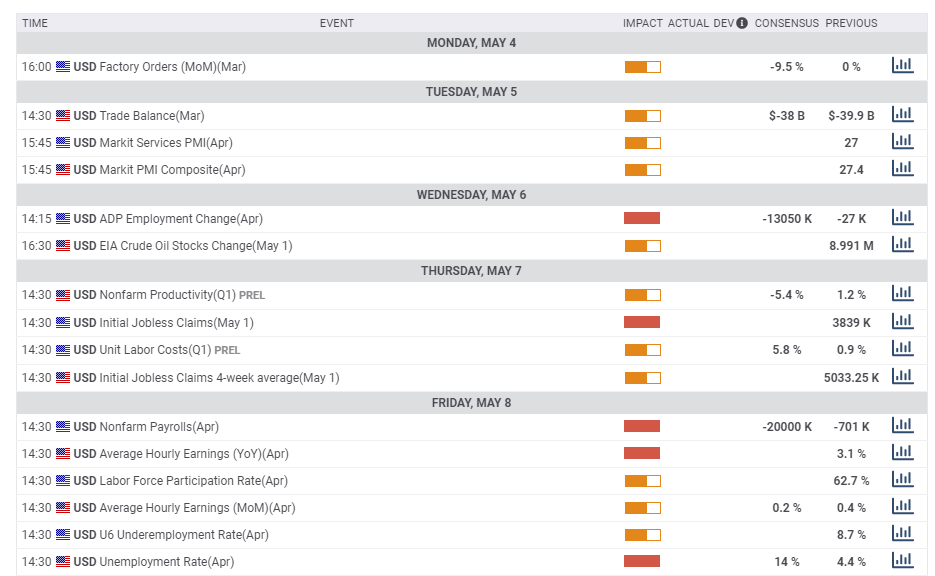

US events: 20 million jobs lost?

No fewer than 20 million jobs lost – that is what economists are expecting in April due to the shelter-in-place orders meant to curb coronavirus. The Non-Farm Payrolls report is also projected to show a leap in the jobless rate from 4.4% to 14% and potentially a drop in the participation rate – reflecting longer-term damage.

Devasting figures may boost the safe-haven dollar while a minor beat – devastating as they maybe – will likely weigh on the world's reserve currency.

Ahead of the NFP comes the buildup. The ISM Non-Manufacturing Purchasing Managers' Index for April will likely remain at the low ground, and the employment component will be eyed as a hint toward the jobs report. ADP, America's largest payroll provider, will provide a more direct clue with its private-sector labor market figures. A substantial fall is projected there.

Weekly jobless claims and other figures could have a more limited effect this week as they do correlate directly to the jobs report. Unemployment claims are for the week ending May 1, outside the NFP survey period.

Coronavirus statistics are also watched after several states let their stay-at-home lapse and other relaxed restrictions. Other places, like New York, are watching their local figures and how others are doing will be factored in. Testing and tracking capabilities are somewhat lacking.

Relations between the world's largest economies could continue impacting market sentiment and AUD/USD. Any conciliatory remarks by President Trump toward China – he initially praised his counterpart Xi Jinping for handling the crisis – may support the currency. Ongoing friction could have the opposite effect.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

Aussie/USD is trading within an uptrend channel since mid-March, and that is a bullish sign. At the time of writing, the currency pair is hovering around the bottom of that channel. Break or bounce? That is an open question.

The currency pair holds above the 50-day Simple Moving Average, enjoys upside momentum, and avoided entering the overbought territory, as the Relative Strength Index remained shy of the 70 marks.

Critical resistance awaits at 0.6570, which was April's peak and also where the 100-day SMA hits the price. The next significant cap is only at 0.6690, which was a swing high in early March, and then by 0.6660, that capped AUD/USD back in February.

Support is at 0.64, which held the currency pair down in mid-April. It is followed by 0.63, where the 50-day SMA hits the price, and then by 0.6250, a double-bottom that was seen last month. The next lines to watch are 0.6210, 0.61, and 0.5990.

AUD/USD Sentiment Poll

The Aussie has been defying gravity and the global downturn during April. Will this change in May? Australia's success with shaking the disease may already be priced in, and a mix of RBA warnings and weak US data could send it down.

The FXStreet Forecast Poll is showing the Aussie holding up in the upcoming week but collapsing afterward. The average targets for the short and long terms have been upgraded but it has been moderately downgraded in the medium term.

Related Reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637239369470197201.png)