AUD/NZD buy bias on an Australian CPI data beat

On Wednesday, we have the Australian monthly CPI indicator. This is expected to come in at 5.1% down from the prior reading of 5.4%. The way that inflation readings are understood by the markets is that high inflation readings will mean interest rate expectations increase, which will lift the country’s currency.

In this case, the Reserve Bank of Australia seems to have a terminal rate of just over 4.20%. Its current interest rate is at 4.10%, which means a high inflation reading on Wednesday is likely to lift the Australian dollar against the New Zealand dollar as investors expect a higher terminal rate from the Reserve Bank of Australia.

Short-term interest rate markets

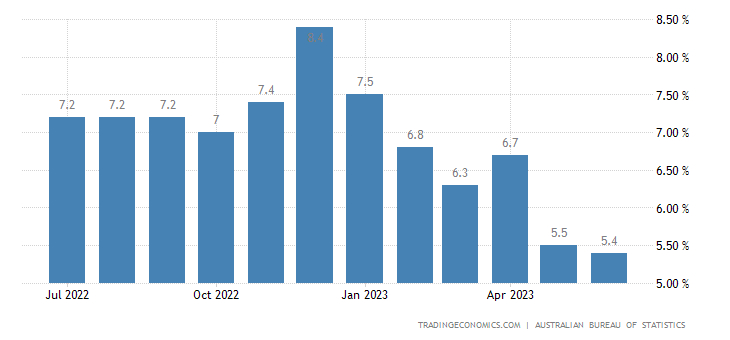

Short-term interest rate markets are currently pricing a 95% chance that the Reserve Bank of Australia will need to keep interest rates on hold for the 5th of September meeting that is coming up. They only see a 5% chance of a 15 basis point increase in rates for the same interest rate decision so investors will be looking at this monthly CPI print on Wednesday to get a sense of how inflation is doing in Australia. The latest series of CPI prints have shown a downward trend in inflation since the end of December last year. The last print in June had the lowest inflation rate since February 2022 and this was largely attributed to a slowdown in housing and food prices, however, we still need to remember that even this low inflation print is still more than double the Reserve Bank of Australia’s median range target. Therefore, the best opportunity that we are likely to see will come from a surprise inflation reading.

AUD/NZD levels to watch

The AUDNZD pair has been stuck in a recent range around some key levels at 1.0900 and 1.0750. The best opportunity will likely come from a surprise beat in the inflation data as that will most likely allow the Australian dollar to strengthen against the New Zealand dollar. Some investors will use the daily pivot pivots as key areas to define and limit risk. Also, note that a break out of August highs will likely trigger stops. See the chart below.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.