AUD, CAD: Inflation rising – Can central banks stay on pause?

Key points

-

Australia’s May inflation report showed a significant increase, with headline CPI reaching 4.0% YoY, up from 3.6% in April. A similar trend was seen in Canada where May inflation jumped higher to 2.9% YoY from 2.7% in April.

-

While market has added to the rate hike bets for the Reserve Bank of Australia, a pushback to further easing expectations for the Bank of Canada may not be warranted given the escalating recession risks.

-

Central bank divergence plays remains a key theme in the FX markets, with AUD outperformance likely to build further especially on crosses such as AUDNZD, AUDJPY, AUDCAD and AUDCHF.

Inflation is no longer falling in most countries and appears to be stabilizing. In the latest reports, May inflation prints for both Australia and Canada have shown a surprising rebound.

However, with slowing growth and increasing employment pressures, some central banks are in a challenging situation.

AUD: Bullish prospects remain for now

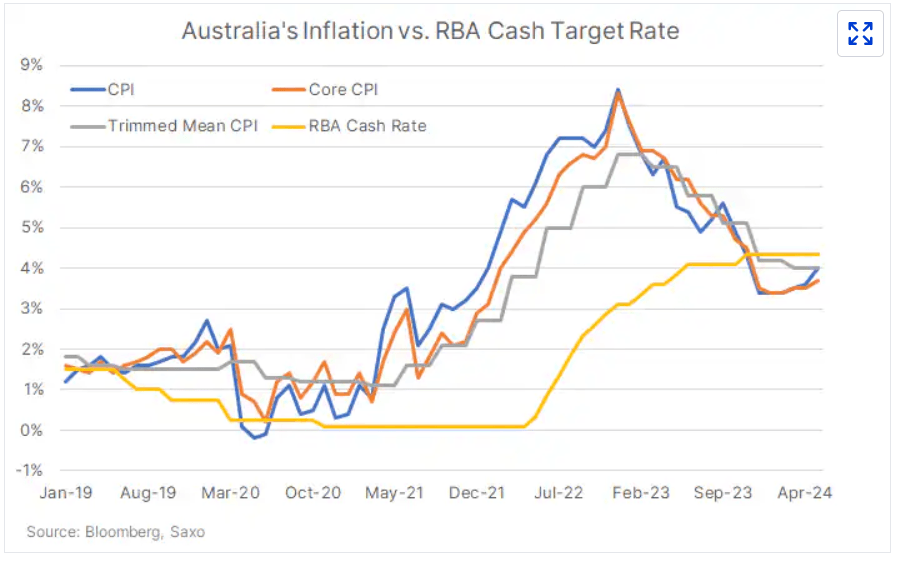

Australia’s May inflation report showed a further increase in price pressures, marking the third consecutive month that the figure exceeded expectations. Headline May CPI reached the 4.0%-mark on the headline from 3.6% in April and 3.8% expected.

The last good news on inflation that we got from Australia was at the start of the year, when December inflation was reported to ease to 3.4% YoY, the lowest since November 2021. In the following five months, there has been either no progress on disinflation, or inflation has actually kicked higher.

The trimmed mean core measure, which smooths out volatile items, advanced to 4.4% YoY versus 4.1% a month earlier.

This has boosted the case for a rate hike from the Reserve Bank of Australia. Markets are now pricing in a 50% chance of a September rate hike, up from 15% just a day ago.

The real test for the RBA comes in July with the quarterly inflation print is released. The RBA focuses more on quarterly inflation to guide their policy as the monthly inflation prints lack details. The Q2 CPI print will be released on July 31, ahead of the RBA’s August 6 meeting.

This suggests there may be room for AUD outperformance to last, for now, as the RBA bets can remain tilting hawkish relative to other central banks for longer.

AUD/USD: The currency is holding gains but needs a weaker USD to rally past 0.67 sustainably. Gains are also at risk from growing trade conflicts between the US or Europe and China. The upcoming US Presidential election debate could potentially signal the start of a divergence away from the gridlock between President Biden and former President Trump, and this could have significant repercussions for AUD given its dependence on China.

AUD/NZD: While RBA’s hawkish stance is getting some legs from the May inflation print, it also comes at a time when recession risks in New Zealand are growing and increasing calls for the Reserve Bank of New Zealand to cut rates. Markets have, however, only priced in a rate cut from the RBNZ in August with less than 20% odds, and risk of dovish repricing remains. Key to watch will be the RBNZ announcement on July 10 and NZ’s Q2 CPI due on July 17. AUDNZD has rallied past the 50-day moving average and above 1.09 for the first time in over a month. First key resistance at 76.4% fibo retracement at 1.0960 for pair to make its way back to the 1.10 handle.

AUD crosses: Other AUD crosses where central bank divergence play has room to play out is AUDCAD (discussed in the next section) or AUDCHF (with SNB cutting rates twice).

GBP/AUD: While GBP is holding up well for now and likely to remain so in the run upto the July 4 UK election, but economic concerns could take focus after that and the Bank of England might be forced into action as well. Immediate support for GBPAUD at May lows of 1.8909.

AUD/JPY: Yen-carry trade remains in vogue as FX volatility remains low. AUDJPY has reached fresh record highs of 106+.

CAD: Recession concerns could escalate

Canada’s May inflation also reaccelerated with headline CPI up 0.6% MoM vs. 0.3% expected. Annual price growth also rose to 2.9% YoY from 2.7% in April.

This report is likely a disappointment for the Bank of Canada that delivered its first rate cut in June, and raises concerns on the potential timeline of the next rate cut.

However, one data point is never a trend. However, caution is likely to set in given that disinflation progress has stalled broadly across the G10 economies. That could move the BOC to the sidelines at the July 24 meeting, especially if another upside surprise is seen in June CPI which is released on July 16.

But even a pause from BOC is not all good news for CAD, given that it comes with rising risks of a recession. Several measures of demand are slowing, and the housing market's sizeable imbalances make it particularly vulnerable to the lagged impact of higher rates. Canada’s labor market has also loosened dramatically, with the unemployment rate at 6.2% currently from the low of 4.8% in July 2022.

This means the risk/reward on the Loonie, or the CAD, remains tilted bearish. Among central bank divergence plays, USDCAD, AUDCAD and CADNOK remain well positioned.

Source: Bloomberg. Note: Past performance does not indicate future performance.

Read the original analysis: AUD, CAD: Inflation Rising, Can Central Banks Stay on Pause?

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.