- US markets have not traded on the election but on the pandemic.

- Lockdowns had the greatest economic impact in March and April.

- Current regime of closures is mild compared to the spring but it is escalating.

- Political differences in prevention efforts are less than meets the eye.

- Markets and the dollar have already given their Biden response, it is a vaccine.

In this fraught American political season, every policy difference, every analysis, and every choice, no matter how rational is portrayed as a product of party differences.

Democrats long to lock down the economy pursuing pandemic suppression at all costs while Republicans seek to balance the dangers of the virus against the equally real damage to individuals and families from a shuttered economy.

In reality, the responses of most state governments, Democratic and Republican, have been tailored to local needs and show less ideology than practicality, recognizing the dangers of the pandemic and the needs of people to work in a functioning economy.

In most states, regardless of political affiliation, the emphasis is on restricting the spread of of the virus indoors in public venues like bars and restaurants and large private groups. Several states have added curfews to their list of restrictions or asked people to avoid non-essential travel. No governor has threatened a general economic shutdown.

Governors like Pennsylvania's Tom Wolf whose edict that individuals must wear masks in their own dwellings if members of different household are present or New York's Andrew Cuomo who has banned private home gatherings over ten people, foolish rules because if nothing else they are unenforceable, are Democrats.

At the other extreme are the Republican governors of Texas, Gregg Abbott, and Florida, Ron DeSantis, who have vowed they will not close their states come what may, unequivocal statements they might regret in the unknowable future.

So far there have been no shutdowns comparable to those of the spring when all business considered non-essential were ordered closed by many state governments.

After growth collapsed at a record 31.4% annualized pace in the second quarter and rebounded at an equally historic 33.1% rate in the third, the Atlanta Fed estimates the economy is now expanding at 5.6% in the final three months of the year.

Markets and the pandemic

Markets have treated the much greater case load of the second wave as a prelude to recovery.

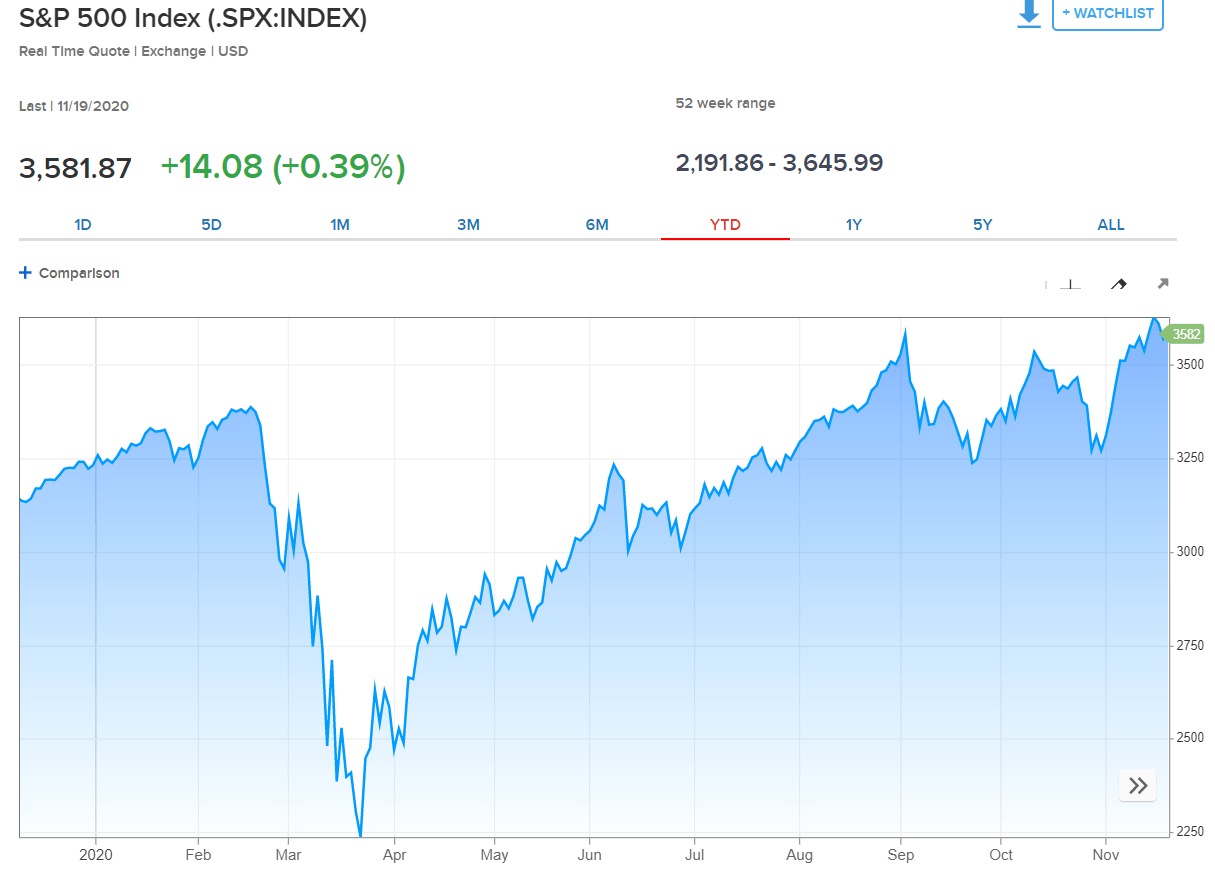

On November 6th the Friday before Pfizer and BioNTech announced their successful vaccine trial, the Dow had closed at 28,323, 89% of the February 12th to March 23rd pandemic plunge (29,551-18,591). The S&P 500 finished that Friday at 3,509, already 123 points above its previous all-time high of 3,386 from February 19th.

Pfizer's news conference and a subsequent and equally successful trial from Moderna of Cambridge, Massachusetts, brought the two averages to new records on November 16th, the S&P 500 at 3,626 and the Dow at 29,950.

CNBC

CNBC

Credit markets have taken a similar tack. The 10-year Treasury yield closed at 0.972% on November 10th, the best since its August 4th low of 0.515%. Higher rates are indicative of an expected stronger economy.

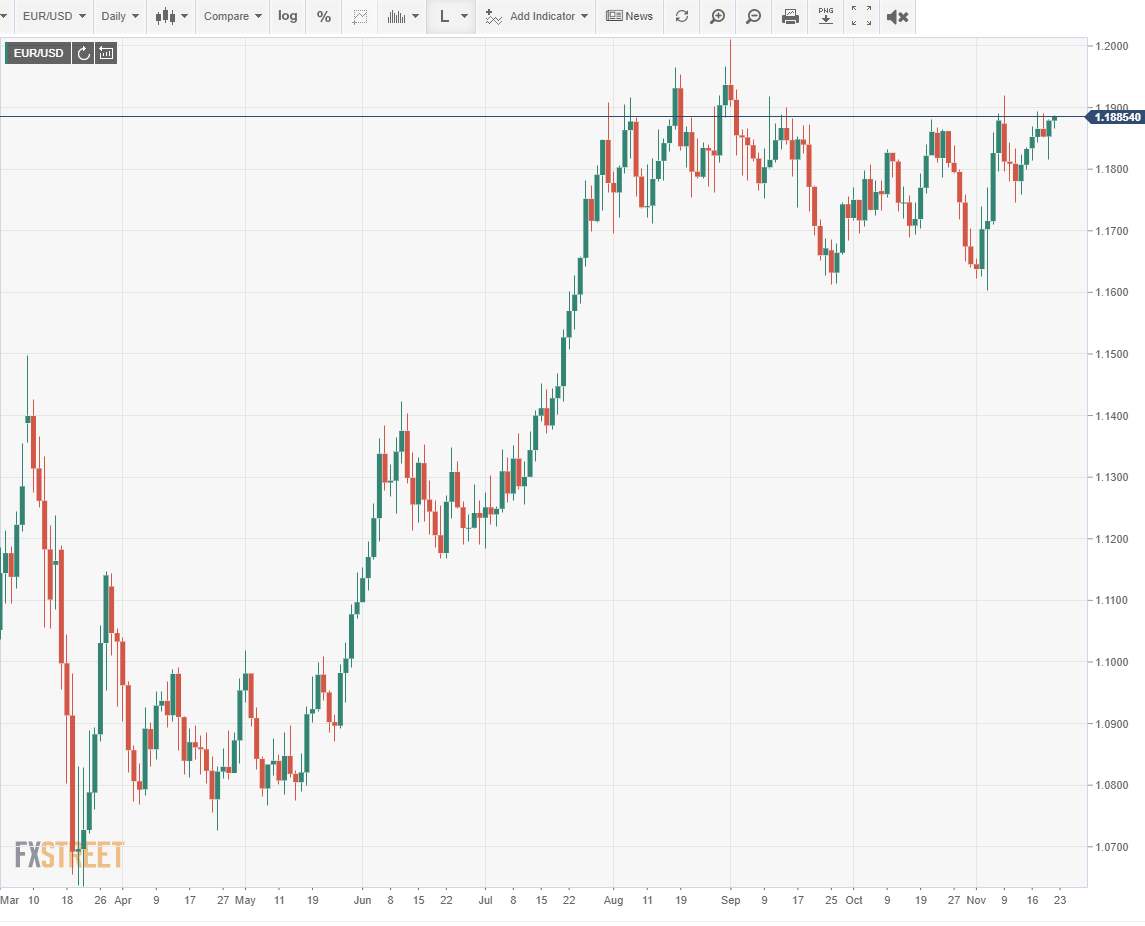

Currency markets have been the least motivated by the evolution of the pandemic. The major pairs have traded a denatured version of the US dollar safety-trade scenario where positive developments in the pandemic, lower cases, fatalities and hospitalizations, are risk-on and dollar negative and rising cases and attendants are risk-off and dollar higher.

Within that general scheme the movements of the majors have been limited to the ranges of the past four months. The EUR/USD has traded 1.1650-1.1900 since July with two breakdowns and the USD/CAD has moved between 1.3050-1.3400.

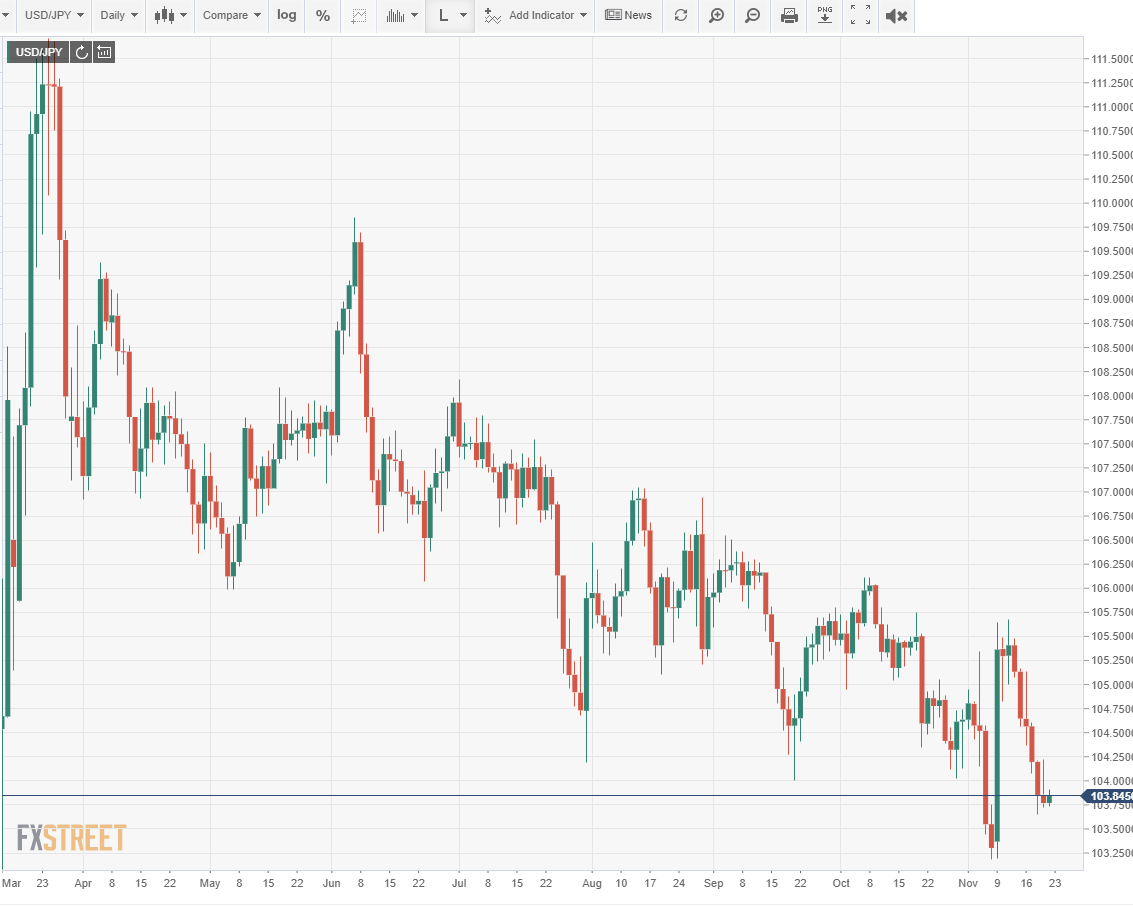

The USD/JPY has maintained its descending channel that dates to the end of June.

The USD/JPY has maintained its descending channel that dates to the end of June.

One of the reasons for the strengthening yen is not pandemic related but due to the Japanese edge in real interests rates. Because of the extremely low inflation rates in Japan the real yield (coupon minus inflation rate) is higher in Japan despite the negative base rate, -0.1% at the Bank of Japan and the 0.125% mid-rate at the Fed.

The waning influence of the risk-based scenario in the currencies is evident in the very minor movement of the past month despite the accelerating global caseload. The panic buying of the dollar safety-trade of the spring has been wholly absent.

The waning influence of the risk-based scenario in the currencies is evident in the very minor movement of the past month despite the accelerating global caseload. The panic buying of the dollar safety-trade of the spring has been wholly absent.

US politics and the markets

Markets have played the election odds of a Biden Presidency and a Republican Senate.

The prospect of a divided government with the Democrats controlling the White House with a much weakened majority in the House and a Republican Senate would normally be considered beneficial to markets and trading. There will no initiatives from either side, a stimulus bill will pass, either in the lame-duck session ahead or sometime after the inauguration on January 20.

This unthreatening legislative picture could change on January 5th when the runoffs for the two Georgia Senate seats take place. If the Democrats win both it would give them government control and at least two years to enact their agenda until the Congressional election in 2022.

Initially, that would mean a much larger stimulus package and equity markets would enjoy the support. But Democratic policies may also include repeal of the Trump tax cuts, new rules and taxes on the financial sector, increasing environmental regulations on businesses, restrictions on fracking and oil production and other initiatives favored by their progressive base.

Economic, regulatory and fiscal policies from a Biden White House and unfettered Democratic control have the potential to be decidedly more anti-market and more anti-business than a Trump administration.

However, it is also possible and perhaps more likely, that the large and unexpected losses in the House that several Democratic Representatives have openly blamed on the party's socialist members, will temper any serious consideration of the more radical aspects of progressive agenda.

US pandemic policies

Thus far markets see little or no difference between the responses of the Trump White House to the pandemic and those of a potential Biden administration.

President Trump has left the determination of local restrictions on business and the public to the governors of the individual states. He has focused the Federal Government on providing aid when requested and on the successful development of several vaccines in record time.

During the first wave in the spring, Washington's help was praised by the Democratic governors of California and New York, in contrast to the later rhetoric of the presidential campaign.

Biden has promised to make masks in public mandatory nationwide and said on Thursday that he will not order a national shutdown though during the campaign he spoke of the necessity of a four to six week economic pause .

A mask mandate is not very controversial, though several governors have said they will not enforce it and there is little evidence that it would be effective in preventing the spread of the virus.

A national economic shutdown would be of dubious legality, and would, without a doubt, end in the Supreme Court.

President Trump has said he will not impose a nationwide shutdown.

More importantly, a Washington ordered closure is unnecessary as many governors are already imposing tighter controls on restaurants, bars and other public venues curfews and will continue to impose restrictions if the pandemic remains unchecked.

Whoever is in the White House in January the front line of pandemic response will remain with the states.

Pandemic closure policies: Republican or Democrat

The policies of the next administration will be determined by two factors, the progress of the pandemic and its impact on the health system, and the advent and success of vaccination.

If the case numbers, hospitalizations and fatalities are still growing exponentially in January, perhaps Biden or Trump, despite their disavowals, would attempt a nationwide closure.

The economic and social damage from a countrywide closure would be incalculable. It would be resisted at many points and it would be impossible to justify on case numbers alone.

Only extreme danger to the hospital system could necessitate such a drastic and dangerous intervention. The original logic for shutdowns was to prevent hospitals from being overwhelmed. That will be the criteria again.

Pfizer has said that they could have 20 million doses of their vaccine ready by the end of December. A massive immunization program, administered by the government would be the natural alternative to destructive closure of the entire economy.

If that option is available, it would not matter who was in the Oval Office, the decision would be the logical, indeed the only choice.

Numbers: Cases, hospitalizations and fatalities

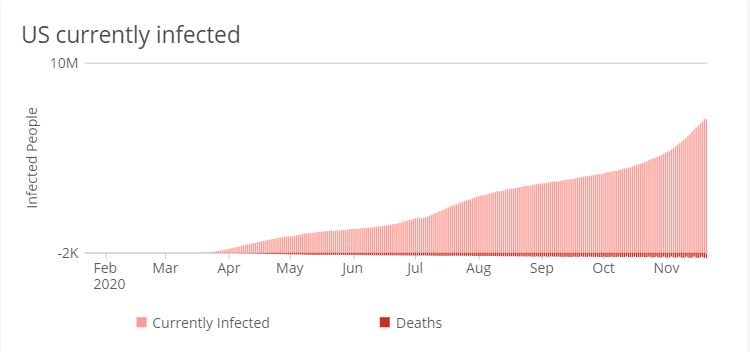

Thus far the strain that the pandemic is imposing on the US health system is very different than it was in the springtime. Hospitals are much better prepared this time, resources are stockpiled and most importantly, treatments are much more effective.

Cases are far higher, and while hospitalizations have surpassed the spring total, they are from a vastly larger known caseload.

In absolute terms hospitalizations have set new records. But in context of the number of diagnoses, the nation's health system and population, this wave appears less dangerous and taxing. The percentage of fatalities are much lower than in the spring.

domo.com

domo.com

In other words, although many more people have contracted the virus, the percentage getting sick is far lower.

Regardless of the number of people in hospitals from COVID-19 as a percentage of the overall caseload, the US hospital system has an absolute number of beds and intensive care units at any one time. The most important measure of the strain on the health care system and its personnel is the percentage of hospital beds in use.

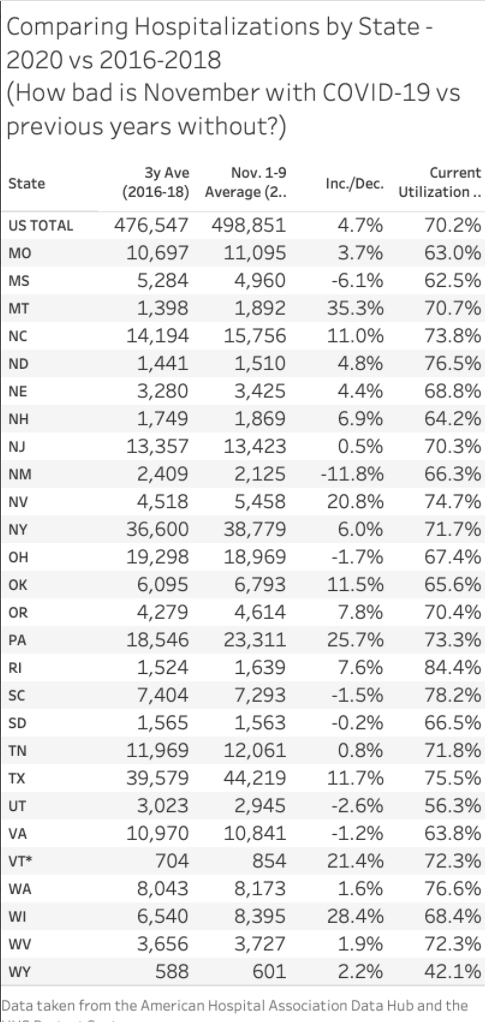

Here the most recent statistics show a 4.7% increase nationwide over the three year average from 2017-2019. The current utilization of 70.2% is about 3.1% higher than the national average from past years. It is lower than the hospitalization increase because the system has more beds.

The averages vary substantially from state to state. In Montana, which had few cases in the first wave, hospitalizations are up 35.3% but utilization is below average at 63.0%. Iowa is next highest at at 28.3% with a utilization rate of 64.2%.

A few states have lower hospitalizations. New Mexico is down 11.8% and Hawaii is off 10.5%.

Despite some local difficulties, at the moment the US hospital system is not under severe strain.

Pandemic: Markets and the dollar

To this point there has been very little economic impact from this second wave but everything depends on where it goes from here.

Job growth has slowed considerably with 638,000 added to Nonfarm Payrolls in October, though the unemployment rate dropped to 6.9% the lowest rate of the pandemic. Job creation has been declining for five months, the October drop was not caused by the new closures. November is the month to watch.

As they were the first time around, weekly Initial jobless claims are the most important metric for economic distress. The 31,000 jump in claims in the November 13 week could mean that a new round of layoffs has started. But claims also rose sharply in August without a change in the underlying labor picture.

The new business restrictions are centered on restaurants and bars, industries that have never fully opened and it is debatable how much employment is left to be furloughed. Some additional unemployment must be expected from the new restrictions, but how much?

For the currency markets the key question is will the pandemic become so become so frightening and a threat to the global economy that the dollar again becomes the safe-haven for the world's markets.

So far markets are not signaling such a case.

The measures that have been taken in France, the UK and other countries appear to be having the desired effect. With vaccines on the horizon there is little indication that the situation is running out of control.

We must remember that the March and April ranges in the dollar and the February and March plunge in the equity and credit markets, were the products of fear and of panic.

That situation is unlikely to repeat. The virus and its effects are no longer unknown. The therapeutic situation is far more accomplished and the actual metrics, hospitalizations and fatalities are well below what they were in the spring. Most importantly, there are vaccines on the way that will curb then eliminate the pandemic.

The equity, credit and currency markets have given no indication that they view the current state of the pandemic as a crisis of the magnitude of the spring.

In the United States, whether, as is likely, Biden becomes president on January 20, or the Democrats assume control of the Senate will matter far less to the markets than the actual state of the pandemic when inauguration happens.

The next two months will determine how the markets respond, not any potential policies from an incoming administration.

If the virus continues to spread and, most tellingly, if hospitals approach their overload point, governors will have instituted preventative measures long before Biden or Trump stand on the podium in Washington.

And markets will have long since responded.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD below 1.0400 as mood sours

EUR/USD loses its traction and retreats to the 1.0380 area in the second half of the day on Monday. The negative shift seen in risk mood, as reflected by Wall Street's bearish opening, supports the US Dollar and makes it difficult for the pair to hold its ground.

GBP/USD nears 1.2500 on renewed USD strength

GBP/USD turns south and drops toward 1.2500 after reaching a 10-day-high above 1.2600 earlier in the day. In the absence of high-tier macroeconomic data releases, the US Dollar benefits from the souring risk mood and weighs on the pair.

Gold falls below $2,600 amid mounting risk aversion

Gold fell below the $2,600 level in the American session on Monday, with US Dollar demand backed by the poor performance of global equities and exacerbated by thin trading conditions ahead of New Year's Eve.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.