All the central banks are going to cut rates regardless of inflation data

Outlook

This week we get inflation data from all over, the Fed minutes, and the rate decision from the Reserve Bank of New Zealand, expected to be a cut and likely a fat one.

The bond market response to the proposed new TreasSec Bessent is favorable. He gets the top story in the Financial Times—"Dollar falls after Donald Trump names Scott Bessent to Treasury role. US bond yields fall as hedge fund manager picked for top economic position.”

On Sunday Bessent said tax cuts are the priority, but the bond gang also likes the commitment to lower spending. Of course tax cuts and lower spending is contradictory, but markets also like Bessent’s gradualism in tariffs (when does Trump ever do anything gradually?). He says tariffs are mostly a negotiating stance—really? He favors lower inflation (who doesn’t? and it’s not the Treasury’s job).

Despite a tangled mess of conflicting goals, markets like him because he has some actual qualifications and has given more than ten minutes of thought to the issues, especially the debt and deficits issues, which he says are paramount in the public’s mind. We doubt that, but it’s certainly paramount in the minds of economists and financiers.

One clear benefit-—this is a guy who will know whom to call and what to do in the event of a crisis. .

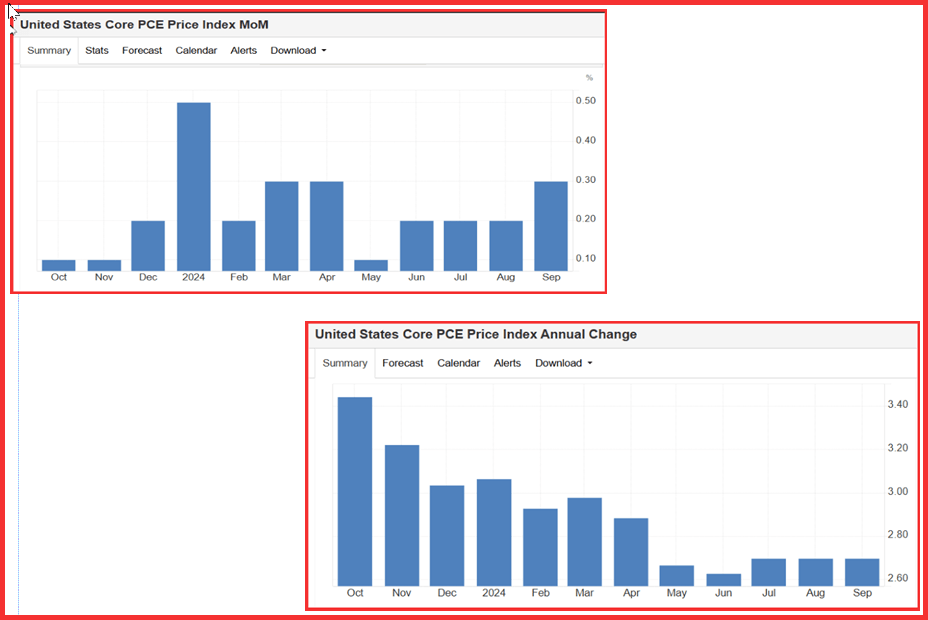

The big event this week is the US PCE on Wednesday. We had core at 2.7% y/y in Sept, the same as Aug, and this time the forecast is for a small rise to 2.8%, although Trading economics goes for 2.8%. Wearily we have to prepare for the usual variations in quotation method, including m/m and 3-month and 6-month average, plus supercore.

We also get a series of regional Fed indices, including the Chicago national today along with Dallas Fed manufacturing. Tomorrow it’s a slew of housing data, which gives cause for thought.

The favorable market response to the Bessent nomination for TreasSec is largely wishful thinking and in the very near term, may be seen to have been overdone. Traders imagine he will rein in Trump’s usual impulsive and reckless actions, but it’s simply not credible that he will tamp down tariffs to a “negotiating stance” or reduce spending at the same time taxes are cut. Still, his sane comments on the need to reduce spending are welcome and the market is willing (so far) to overlook an ugly face to focus on a nice figure.

The probability is gaining ground of an ECB rate cut. Chief economist Lane said today

"Monetary policy should not remain restrictive for too long. … the economy will not grow sufficiently and inflation will, I believe, fall below the target."

Reuters report a really weird comment from Swiss central bank chief Schlegel on Friday--"Nobody loves negative interest rates, the SNB does not love negative interest rates, but if it is necessary we are ready to take the next step.” For some reason this is not headlined everywhere.

Central Bank meetings

ECB December 12.

Fed December 18.

BoE December 19.

Bank of Japan Dec 19.

Forecast

All the central banks are going to cut rates regardless of inflation data. And they all know it’s could be the last cut for some time, depending on the policies of the incoming Trump administration. Normally we’d expect the dollar is soften on the prospect of a Fed cut, but if the BoE and ECB are cutting, too, it becomes less clear. The usual correction after a steep rally could be just as short-lived as the last one. However, reliance on a single sane and fairly reasonable TreasSec is exaggerated but is a hope the financial markets will want to cling to. And the bottom line is that the new TreasSec is already driving yields down, so the dollar with it.

One forecast that is becoming more widely held is BoJ Gov Ueda ringing the bell. Friday’s inflation data will or will not influence the decision, which is linked to inflation only as a sop to conventional thinking. Japan has been out of step with the rest of G7 for too long and it hasn’t done the economy any favors. Therefore, the yen appreciation story is the one that has some muscle.

Tidbit: Some analysts are starting to wonder if the incoming Trump administration will acknowledge that tariffs alone will not fix things (and of course are likely to make some aspects seriously worse). That may make them turn to the only other international component, the capital account. What, exactly, could they do?

Bloomberg had a story Friday on this crazy idea, which was named by a Trump campaign advisor. One analyst says “Trump simply cannot have both tariffs and an escape from the strong dollar unless he considers the capital account and that would be a game changer.”

“The flip side of the trade surplus is a financial deficit — China recycles its earnings into dollar assets. And that’s something that Washington has enormous sway to change. Citigroup back in 2019 labeled blocking Chinese access to its financial markets as ‘the most extreme US potential retaliation’ against Beijing.

“As with tariffs, there’s legislation that grants the president executive authority. In particular, the International Emergency Economic Powers Act, can be invoked for a variety of measures, including financial sanctions as well as tariffs.

“’Telling the rest of the world, that the Treasury does not want their funds might seem like shooting oneself in the foot. But it has to be considered as a tail risk. Capital controls seem likely at least to gain popularity as an idea, and even mere ideas can cause some volatility down the line.’”

In other words, the US forbids Chinese dollar-holders from investing in US Treasuries or anything else. We say this is not only stupid, but wouldn’t work. Just as Russia avoided being seen to hold dollars, so London invented the Eurodollar, investors who want to remain anonymous can do it easily enough using tax and privacy havens. This is how Middle Easterners and Russian oligarchs do it—using accounts in Luxembourg, the Caribbean, and other places. New ones would probably spring up.

And who would take the place of foreign investors? Yields would have to sky-rocket to bring in substitute investors, and what foreign investor would accept that new sovereign risk? What if Trump came for them, too?

Ordinarily we would say this is so stupid and unworkable that the probability of such an event is zero. But this is Trump and he has shown himself to be ignorant of international economics and finance, and he is reckless. So the probability is not zero.

Tidbit 2: We qualify forecasts with the phrase “barring a Surprise” with an upper case S. The probability of some kind of Surprise is pretty high these days—and while it will likely originate with Trump, it can spread like Long-Term Capital in the 1990’s and become something else, or rather, several somethings else.

The origin of the crisis 26 years ago was over-investment/overlending to Asian emerging economies coupled with pegged exchange rates. Hasty efforts to depart from all EM’s led to default and devaluation by Russia, an unthinkable development at the time. Banks and other funds went under, stock markets crashed. The only reason for the S&P and Dow to fall on events in Russia was pure fear, plus a cosmic loss of liquidity.

The root cause of all these failures was two-fold—far too much leverage in every asset class, plus expectations of future prices based on the normal distribution curve, however fancied up. Risk management statisticians are unable to factor in ten-sigma Events, and the best government risk managers have come up with is stress tests that are themselves predicated on a range of normalcies that excludes worst-case events. They think they encompass the worst, but they don’t, for the simple reason that no one knows how to model Contagion. Yes, another upper-case letter.

Another financial market crisis was the great mortgage debacle in 2007-08. Again the root causes included unrealistic overlending to high credit risks and reliance on “normal” default rates. Remember that then-Fed Gov Mishkin warned of exactly the outcome at Jackson Hole in August that year—when the ball was already rolling downhill. Banks and funds failed. Stock markets crashed. Worse, as with Long-Term Capital, contagion was widespread, even to improbable places like Iceland.

No one is talking about this yet, but just wait. They will. The probability of another global financial crisis is rising by the minute. Nobody blamed the presidents in office during Long-Term Capital or the Financial Crisis of 2008, but they did blame the central banks for inadequate supervision and regulation.

So we have to ask whether we have bubbles today that will burst in succession when the far-right hobby of deregulation comes into play under Trump. In the end, all the markets are related, however distant the links may appear. The New York Fed writes math-ridden essays about liquidity risk, but without a bow to the multi-factor failures that precede a liquidity crisis. Bottom line, who will default and devalue? The US? Mexico? Brazil? Turkey? Russia again? Or somebody else not even on the radar today—that’s how tricky contagion gets.

This may seem a bit over-dramatic. But consider that Shocks do come along quite regularly, if not precisely on any of the cycle timetables.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat