Outlook: Today offers almost no economic data and even if it did, all eyes will be on the Silicon Valley Bank story. We expect a load of dark musings about the regulation of the banking system, the foolishness of the venture capital/tech start-up ecosystem, and the non-bailout bailout. Until we know whether there is any contagion, the Silicon Valley bailout will dominate over all other news, especially namby-pamby economic releases.

A minor reprieve will be tomorrow’s CPI releases, expected to dip to 5.5% from 5.5%--but with PPI down from 0.7% in Jan to only 0.3%. Both Empire State manufacturing survey and Philadelphia Fed business outlook will likely show improvement, but retail sales are expected to fall. Elsewhere in the world, the ECB meets Thursday and is firmly expected to raise rates by 50 bp, although some doubts about that are already appearing. Before then we get a slew of data from China for Jan + Feb that will be used to predict whether the Chinese recovery is feeble or robust.

Let’s note that most folks have switched back to the 25 bp hike story, but Mr. Powell never did say the Fed is thinking about beefing up the amount. He said the Fed is thinking of picking up the pace.

So, it should not have been a surprise when Friday’s information took 50 off the table in favor of 25 bp, which is back to being the most likely. Did the payrolls data really suggest that? No. It showed mixed signals and it’s only one month, after all.

The FT reported over the weekend, “Combined, the data could ease pressure on the Fed to use bigger interest rate rises to curb inflation. CME Group’s FedWatch tool implied investors were pricing in a 64 per cent likelihood of a quarter-point rise at the Fed’s March 21-22 meeting. On Thursday there had been a 68 per cent probability of a half-point move.”

We keep getting wildly different numbers from the FedWatch tool. On Saturday evening, the probability of 50 bp was cited as 68.3 from 62.2 the day before and 9.2 the month before. Undoubted we will see other gyrations. As noted above, the CME Fed funds tracker that was 80% in favor of 50 bp crashed to 34% in the first 45 minutes after the payrolls release, according to Bloomberg TV. If Bloomberg was right, apparently it reversed. Then on Sunday night, the CME Fed Watch tool showed a mere 15.9% expecting the Fed to do 50 bp at the March meeting and 84.1% back at 25 bp. By 7:20 am today, the probability of a 50 bp hike in nine days is zero. Since futures don’t trade on the weekend, we are a tad confused by all these different numbers. This is not the first time we have seen such disparities. But as many economists, market-watchers and academics have noted before, this is not exactly a stable and useful metric (and usually a very bad predictor for farther-out periods).

As the FT ends its story: “The mixed message from the February jobs report makes the upcoming Fed meeting a close call, but we are sticking with a [quarter-point] hike for now,” said Michael Feroli, analyst at JPMorgan.” That was a day or more ago. Today, Reuters reports “Goldman Sachs now says it no longer expects the Fed to raise rates on March 21-22.”

Remember the wage price chart—it does not show wage-push inflation. The Friday data affirms that, leaving the Fed is a terrible pickle. At a guess, we might sanely expect a series of 25 bp hikes for each of the next six policy meetings after March, or five of them, or some other number. The Fed can even hike between meetings if it really wants to.

Some speak of the Silicon Valley bailout as a reason for the Fed to defer making any rate changes at all. Bank failures should halt the Fed’s hiking plans dead in its tracks. If we do not get panic and contagion, no. For one thing, it’s two banks, one involved with risky high-tech start-ups and the other with crypto. Contagion to the Big Banks is not likely, or if other regional banks have these same issues, they can easily fix a big chunk of them by declaring their T-note and bonds as “not for sale” and thus valued at face value, not marked-to-market. Plus, they have the Fed’s discount window, usually shunned because it makes it look like the bank using the window is in trouble. Well, yes. Or they can use the new Bank Term Lending Program.

Besides, it’s not the Fed’s job to make policy according to or directed at the problems of the banking sector. Its mandates are keeping unemployment low and keeping inflation in check. Deferring rate hikes doesn’t do any of those things, especially since the fallout, if there is a lot, will fall on the stock market and specifically the banking sector names. That is already happening in the UK, Europe and even Japan as well as the US.

But note that the Fed also has a vague mandate to maintain financial market stability. If additional banks go under or need extreme help, i.e., authentic contagion as we saw in 2008-09, it’s conceivable the Fed could delay. This specific item using those exact words (“financial market stability”) went away when Dodd Frank came in, as discussed in detail by the Richmond Fed but it’s still something the public expects of the Fed.

Dodd Frank also created something named “the Financial Stability Oversight Council (FSOC), with representation from all of the regulatory agencies, including the Fed. The FSOC comes perhaps closest to an agency responsible for financial stability, but the law does not go that far: FSOC is formally charged with identifying risks to financial stability, promoting market discipline by reducing the expectation of government bailouts, and responding to emerging threats to the financial system (emphasis added). The FSOC also must identify "systemically important financial institutions" (SIFIs) whose failure or distress could threaten the financial system.”

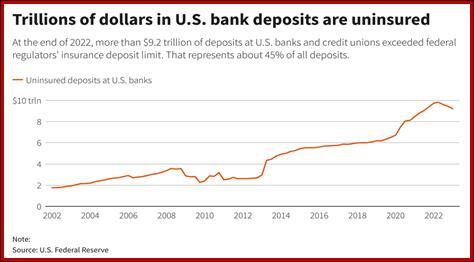

If we get more distressed regional banks and some degree of contagion, it would be catastrophic for public confidence in the Fed and other government institutions. And a banking crisis is not out the question. Reuters reports that as of year-end, $9.2 trillion in bank deposits are uninsured, or 45%. Do those depositors make a run on the banks? We don’t know yet.

As for the “confidence in government” aspect, we notice that those most cynically doubting the capabilities, competence and honesty of the government tend not to know very much about it, but it’s true that government regulators failed in these few cases. Of course, if regulators had brought down the stick on their heads beforehand, they would be accused of over-reaching and interfering with the free market. Regulators are always in this pickle. If confidence wavers, attention to turn again to the much-criticized stress tests of the Big Banks. Are they really good enough? The FT has a front-page story titled “Regulators face questions over missed warning signs at SVB.”

As of Monday morning at 8 am, the thing that is sticking out is Goldman Sachs now saying it no longer expects the Fed to raise rates on March 21-22. Goldman is not to be easily dismissed. This is, of course, fatal for the dollar. Too bad the Fed is going into its quiet period ahead of the policy meeting in nine days so we can’t count on comments.

Saga: The Silicon Valley Bank collapse was sudden and severe, raising doubts about contagion across the banking system. It was the second largest bank failure ever and he first since Washington Mutual in the 2008-09 financial crisis. A Reader sent us a Twitter chain from a CFA who seems to know her onions. She points out that this bank was managed in a very risky fashion. First, rich people need to learn that the FDIC insures deposits only to $250,00. But “only 2.7% of SVB deposits are less than $250,000. Meaning 97.3% aren't FDIC insured.” Note that other sources name a different percentage of uninsured accounts. We have heard everything from 80% to 91%. Whatever—it’s a big number.

Then, instead of loans, “55.4% of their assets are securities. The highest of their entire peer group. And 47.5% of those securities are maturing in +5 years. Again, the highest of their peer group.”

Separately, both S&P and Moody’s had deemed Silicon Valley “investment grade,” meaning people bought its stock and its preferred stock, too. When are regulators going to call ratings agencies to task?

Twitter goes on: This bank’s “deposit and asset mix differs significantly from that of the top 20 banks in the U.S. They funded long-dated fixed-rate assets (that are required to be marked-to-market) with variable-rate funding (customer deposits) in a rising interest rate environment. This is toxic. There will be follow-on effects.

“But I don't think we have grounds for contagion like 2008.” Aside from disapproving of the writer’s grammar, we think so, too, although time will tell. The normal way for these things to end, as in 2008-09, if for somebody to step forward and buy the bank. Chase bought the biggest loser that time, Washington Mutual, with maybe some arm twisting involved. Will somebody buy Silicon Valley? The FDIC met late into the night on Friday with members of Congress and bank experts as well as the Fed, Treasury, and White House all weekend.

In its usual show of muscle, the FDIC said Saturday the bank will go to auction on Sunday. TreasSec Yellen went on TV to say the Silicon Valley Bank problem will be swiftly repaired and will not spread to other banks, which will be provided with whatever liquidity they need in the event of massive deposit withdrawals, an assurance that serves to prevent them. Also included in this non-bailout is Signature Bank in New York, shut down on Sunday by New York Department of Financial Services, then appointed the FDIC as receiver.

Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Finally, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today’s actions demonstrate our commitment to take the necessary steps to ensure that depositors’ savings remain safe.

In a separate statement, the Fed said that this funding for other banks “will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions.” They have to pledge collateral in form of “Treasuries, agency debt, MBS, and other qualifying assets.” And the collateral “will be valued at par” (instead of market value).

“The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.” With approval of the Treasury Secretary, “the Department of the Treasury will make available up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP,” the Fed said, adding that it “does not anticipate that it will be necessary to draw on these backstop funds.”

This has a good side and a bad side. The good side is dealing with the problem swiftly. Failure Friday, problem fixed Monday. The bad side is (maybe) that nobody stepped forward to buy it, pushed or not. The only sale so far is the UK branch of Silicon Valley that was bought by HSBC in what Reuters names as “concern for tech sector clients in the UK.” The price was £1.

Auctions are strange. As anyone who has ever used eBay knows, something can sell for far less than its true value, in this case book value, or by vastly more. Maybe a place in the Silicon Valley money machine ecosystem is worth something, or even a lot. The failure of any other bank to step in to buy Silicon Valley at auction is worrying.

As of 9 pm on Sunday evening, nobody was named as a buyer. The best info we could find is a terse statement that ‘Its insured deposits were moved to a new bank created by the FDIC, called the Deposit Insurance National Bank of Santa Clara, operating from SVB's former offices.”

The other question is how much will the uninsured depositors get back? Ahead of the FDIC stating all depositors would get all their money back (and the money would come from the other FDIC members, not the taxpayer), talk was rife that if it were 50%, screaming and fainting would ensue, not to mention local high-tech start-up failures.. Now it turns out the Fed will advance the money to the depositors if they want to withdraw and the Fed will collect later from the FDIC. It won’t be as big as it seems, because the mitigating factor is that the bank has a ton of Treasury securities that “lost” value only when marked to market. They are still US Treasuries of one sort or another, not bad loans or bad investments, which is exactly what we had in 2008-09 with those investments in funds based on subprime mortgages.

And two other things: did regulators fail? Critics complain California over-regulates and the state stepped in only at the last minute in this case. Maybe overregulation is selective to green issues.

While contagion is not yet seen, we may get fallout of a different sort. First is that SVB paid bonuses on Friday, just before the state closed the bank. Does somebody go to jail for this? In addition, The Guardian courtesy of another Reader, reports that SVB’s CEO argued in Congress for less regulation for banks his size and got it after spending $500,000 on lobbying.

You can get lurid details from the Guardian report. Here is one sample: “… federal disclosure records show the bank was lobbying lawmakers on ‘financial regulatory reform’ and the Systemic Risk Designation Improvement Act of 2015 – a bill that was the precursor to legislation ultimately signed by President Donald Trump that increased the regulatory threshold for stronger stress tests to $250bn.

“Trump signed the bill despite a report from Democrats on Congress’s joint economic committee warning that under the new law, SVB and other banks of its size “would no longer be subject to nearly any enhanced regulations.”

Finally, “In 2019, [Silicon Valley Bank CEO] Becker was elected to serve on the board of directors at the Federal Reserve Bank of San Francisco. Becker left the board on Friday.”

The story is only beginning. Every couple of hours we get new information. By 8:36 am ET, the Fed Watch tool shows 38% now see no rate change at the next Fed meeting. By the time you read this, buyers for the two failed banks may have been announced. One thing is for sure—TreasSec Yellen said the equivalent of “we are not doing bailouts anymore” and yet here we are with the government providing the money to two failed banks to meet any and all depositor withdrawals. In what way is this not a bailout? Well, it’s a true bailout if the shareholders get something. This time they get zip. So, not technically a bailout but still a big rise in moral hazard. Also, will Congress go back to the original audit requirements that the Trump era dismissed?

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds losses below 1.0500 ahead of US data

EUR/USD remains on the back foot below 1.0500 in the European session on Tuesday. A negative shift in risk sentiment revives the haven demand for the US Dollar, while the mixed sentiment data from Germany hurts the Euro, weighing down on the pair. Focus shifts to top-tier US data.

GBP/USD recovers toward 1.2700 after UK jobs data

GBP/USD recovers toward 1.2700 in the European morning on Tuesday. The data from the UK showed that the ILO Unemployment Rate held steady at 4.3% in the three months to October, while the annual wage inflation climbed to 5.2%, helping Pound Sterling hold its ground.

Gold price remains confined in a range ahead of the crucial Fed decision on Wednesday

Gold price struggles to gain any meaningful traction and remains confined in a narrow range. Expectations for a less dovish Fed and elevated US bond yields cap the non-yielding XAU/USD. Geopolitical risks lend support to the safe-haven precious metal ahead of the FOMC meeting.

Ripple reveals official launch for RLUSD, XRP eyes new all-time high at $4.75

Ripple confirmed in a press release on Monday that its RLUSD stablecoin will officially launch on Tuesday across exchanges, including MoonPay, Uphold, CoinMENA, Bitso and ArchaxEx. Bullish sentiments surrounding the launch could help XRP overcome the $2.58 and $2.92 resistance levels.

Will the Fed cut interest rates again and why is the dot plot important Premium

The Fed is expected to cut interest rates on Wednesday for the third consecutive meeting. Every time the Fed decides on rates, it is a crucial event as it directly affects families and businesses in the United States. Moreover, the Fed’s last meeting of the year will also be important because it will provide the outlook for what it expects to do in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.