SPECIAL

SPECIAL

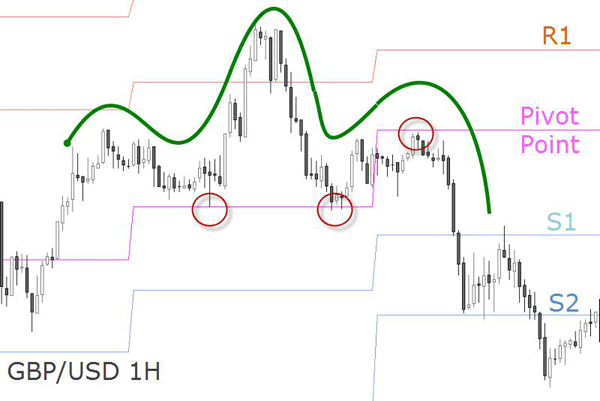

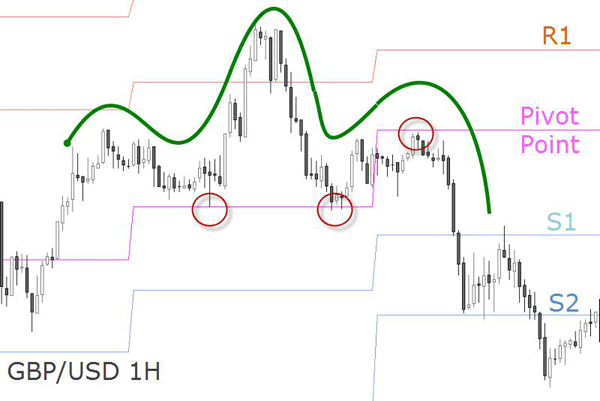

Identify support and resistance

Pivot Points, one of the basic and most important technical tools and the important one, is in the was used long before the era of computerized trading.

1. The London session is still the most liquid of all sessions traded, specially during its start and during the overlap period with the start of the New York session. You want to calculate your pivots points using the GMT session high, low and close. Why? Much like any Support or Resistance level created during a high liquid session, the highs and lows of the day are more significant during these hours.

2. Just like all traditional S&R price levels, the pivot levels can reverse roles also. An old resistance can turn into a new support once it is violated, and vice versa.

3. You can also use indicators (Bollinger Bands, Stochastics, RSI, Commodity Channel Index etc.) to time your entries around these levels. A very useful print is the 161,8% extension of the Fibonacci tool: when this level matches with one of the S&R pivot levels, price is likely to be attracted by this confluence. This is specially helpful for breakout trades making them much more effective. Pivot points act as veritable price magnets for the next day's trading.

4. Pivot points can also be used on weekly and monthly charts to get a perspective of where price is trading in reference to the previous week's or month's price range.

5. Any long term pivot point (weekly and monthly) which has not been touched by price for a large period of time gains attractiveness as a target level for counter trend moves. So if you don't feel comfortable with all the trend following techniques mentioned, this one is for you.

6. On high volatile market conditions, a break of the first support or resistance pivot level will mostly lead to a move to the next level (S2 and R2 respectively). This phenomenon is observed in pairs with higher volatility as well.