EUR/GBP Exchange rate

Editors’ Picks

EUR/USD climbs above 1.0350 ahead of German inflation data

EUR/USD gathers recovery momentum and trades above 1.0350 in the European session after the data from Germany and the Eurozone showed that Services PMI figures for December were revised higher. Investors await German inflation report.

GBP/USD extends rebound toward 1.2500 on broad USD weakness

GBP/USD extends its recovery from the multi-month low it set in the previous week and closes in on 1.2500. The improving risk mood makes it difficult for the US Dollar (USD) to find demand on Monday and helps the pair push higher ahead of mid-tier US data releases.

Gold price keeps the red near 100-day SMA despite modest USD weakness

Gold price (XAU/USD) turns lower for the second straight day following an intraday uptick to the $2,647-2,648 area on Monday and moves further away from a nearly three-week high touched on Friday.

Sandbox Price Forecast: SAND bulls eyes for $1 mark

Sandbox (SAND) price extends its gains by 7% and trades around $0.68 at the time of writing on Monday after rallying more than 16% the previous week. On-chain data paints a bullish picture, as SAND’s open interest and whale transactions are rising.

The week ahead: Three things to watch

Analysts believe that American exceptionalism will persist in 2025, and the first trading week of the year would suggest that investors are also betting on another strong year for the US.

Majors

Cryptocurrencies

Signatures

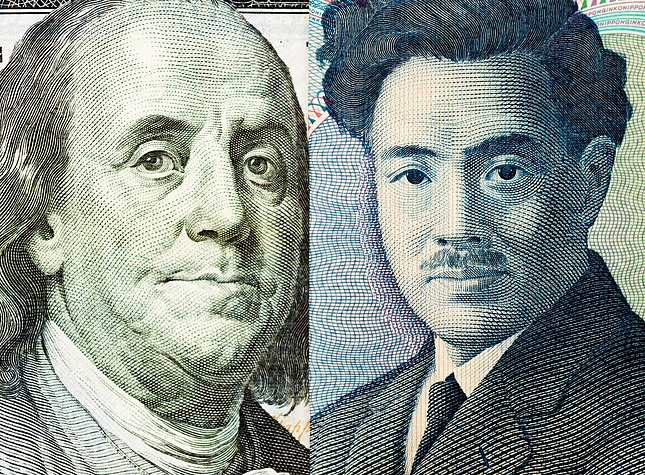

EUR/GBP

The EUR/GBP pair tells the trader how many British Pounds (the quote currency) are needed to purchase one Euro (the base currency). This is one of the most traded currency pairs. Since the European and British economies are massively intertwined (large amounts of capital are exchanged on a daily basis between the United Kingdom and all European countries), the pair tends to be relatively stable but events and news related to the exit of Great Britain of the European Union will probably affect the pair and create choppier movements than usual. A public vote (known as a referendum) was held in June 2016, when 17.4 million people opted for Brexit. This gave the Leave side 52%, compared with 48% for Remain. The UK officially left the EU on 31st of January 2020.

HISTORIC HIGHS AND LOWS FOR EUR/GBP

- All-time records: Max: 0.98049 on 29/12/2008 - Min: 0.56870 on 01/05/2000

- Last 5 years:: Max: 0.9324 on 12/08/2019 - Min: 0.69307 on 13/07/2015

* Data as of February 2020

ASSETS THAT INFLUENCE EUR/GBP THE MOST

- Currencies: USD and YEN.

- Commodities: Oil and Gold.

- Bonds: Gilt (debt securities issued by the Bank of England) and Bund (the German word for "bond", a debt security issued by Germany's federal government).

- Indices: FTSE 100 (share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization), ESTX50 (ESTX50 (Euro Stoxx 50, a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group) and DAX (Deutscher Aktienindex, German stock index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange).

ORGANIZATIONS, PEOPLE AND ECONOMIC DATA THAT INFLUENCE EUR/GBP

The organizations and people that affect the most the moves of the EUR/GBP pair are:

- Bank of England (BoE), known to be one of the most effective central banks in the world. It acts as the government's bank and the lender of last resort. It issues currency and oversees monetary policy (including interest rates). Andrew Bailey is the new Governor of the Bank of England since 16 March 2020. Her Majesty the Queen has approved the appointment. He is widely and deeply respected for his leadership managing the financial crisis, developing the new regulatory frameworks, and supporting financial innovation to better serve UK households and businesses.

- European Central Bank (ECB) whose main objective is to maintain price stability for the Euro. Headed by Christine Lagarde, the ECB sets and implements the monetary policy for the Eurozone (including interest rates), conducts foreign exchange operations and takes care of the foreign reserves of the European System of Central Banks.

- London’s City Financial District: This is still the largest and most developed financial market in the world and as a result banking and finance have become strong contributors to the national economic growth.

- The Prime Minister of Great Britain Rishi Sunak, serving as Prime Minister of the United Kingdom and Leader of the Conservative Party since October 2022.

- Olaf Scholz, at the head of Germany, the strongest economy of the European Union, is also an important figure for any Euro-related currency cross.

In terms of economic data, as for most currencies, the EUR/GBP traders have to keep an eye on:

- GDP (Gross Domestic Product), the total market value of all final goods and services produced in a country. It is a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing.

- Inflation measured by key indicators as the CPI (Consumer Price Index) and the PPI (Production Price Index), which reflect changes in purchasing trends.