- Shares in Zomedica (ZOM) fall 8% in early Wednesday trading.

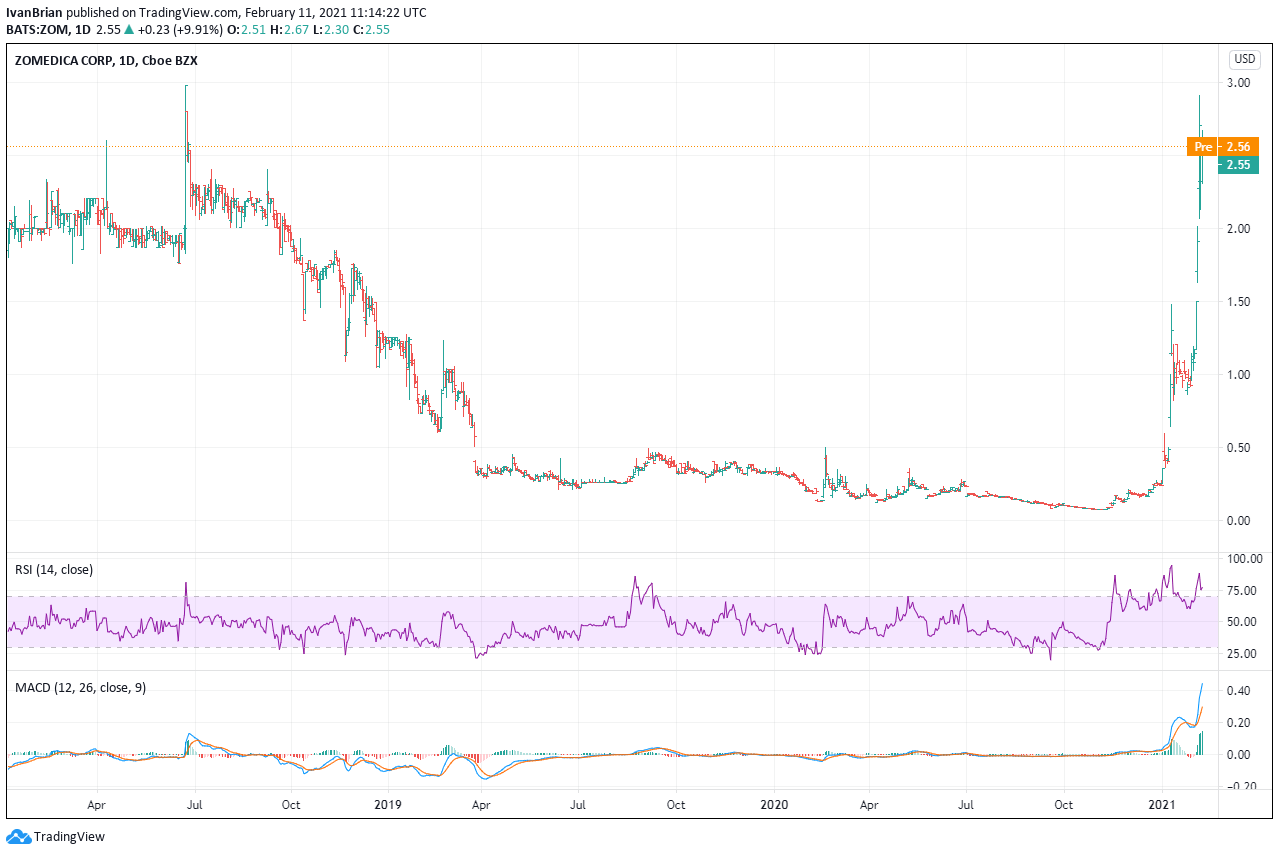

- ZOM shares have seen a peak near $3 in 2021 but have suffered since.

- ZOM shares newsflow has stalled, slowing the impetus in the stock.

Update February 18: Zomedica Corp (NYSEAMERICAN: ZOM) is set to bounce back on Thursday, gaining some 1.29% according to premarket data. Shares of the Ann Arbor-based firm have dropped by 2.11% on Wednesday as investors have assessed the company's discounted fund-raising move. Zomedica is offering 91.3 million shares – around sevenfold of its original plan – but a discounted price of $1.90, below the market price. Nevertheless, a successful issuance would boost its coffers by a whopping $173.5 million. The firm's bigger test comes in March when it launches Truforma – a product that diagnoses thyroid and adrenal issues in pets. See all Equities breaking news

Update: Shares in Zomedica (ZOM) continued to fall on Wednesday as profit-taking hit penny stocks across the board without fresh news impetus. Shares in ZOM are down 8% at $2.17 at the time of writing.

Update February 16: ZOM shares continue to fall from highs seen early in February, registering a drop of 7% on Tuesday. The shares closed 3% lower on Friday. No news developments were hindering the stock, most likely continued profit taking after ZOM shares spiked this year.

Update February 12: Shares in Zomedica fell 4% on Thursday, understandable given the run up in ZOM witnessed over the last few session. Shares in ZOM closed at $2.66, down 4%. ZOM announced on Thursday the closing of it's recently announced fundraising. The company raised $173 million at a price of $1.90 per share. ZOM will announce Q4 results on Wednesday, Feb 24.

Update February 11: Shares in ZOM continued to zoom on Thursday! At the time of writing, shares were up 8% at $2.76, having touched $3 in pre-market trading. Volatility remains high in the stock.

Zomedica (ZOM) was founded in 2015 in Ann Arbour, Michigan. The company is involved in developing diagnostic and therapeutic products for the veterinary industry. ZOM has a number of treatments in development for cat and dog digestive issues. Most investor focus has been on the company's Truforma diagnostic platform, due to launch in March 2021.

ZOM Stock Forecast

ZOM shares have been on a charge and are up a staggering 1000% for 2021 so far. So is this the next Gamestop!

Well, it has a lot of common characteristics. ZOM is heavily favoured by the Reddit community and has seen a sudden sharp appreciation in its share price.

Investors should tread carefully. When in a strong uptrend, that may stretch any valuation metrics, money can still be made but risk management is of paramount importance. Investors could well have bought Gamestop shares at $300 and made a 50% profit. But just to reiterate shares in Gamestop (GME) are now trading back at $50!

ZOM Stock News

Shares in ZOM have been boosted by retail investor sentiment. Most have cited the upcoming launch of the companies Truforma diagnostic product, launching in March 2021. However, ZOM does not own the technology underlying Truforma and according to reports will have to pay Nasdaq listed QRVO Biotech (QRVO) for purchasing the diagnostic tool. Truforma is based on technology developed and owned by QRVO. ZOM has guaranteed minimum purchase agreements it must meet from QRVO.

Shares in ZOM also have been touted as favoured by Netflix’s Tiger King actress Carol Baskin appearing to back the company. In a video, Baskin said “I don’t know if you guys have heard about Zomedica, but they help our veterinarians and our furry friends”, “definitely invested in finding out more,”. Retail traders, on the Robinhood platform and Reddit chat boards in particular, snapped up shares on the news and drove ZOM higher.

However, Baskin was paid $299 by a fan on the Cameo app for the piece. Cameo is an increasingly popular “shout out” app where members of the public can request celebrities to video message them for a fee.

Should I Buy shares in Zoomedica (ZOM) now?

Shares can stray far from underlying fundamental metrics, such as Gamestop! Share prices are determined by the law of supply and demand and also perceived supply and demand so can move away from underlying financial metrics for a period of time. But a short period of time. So extreme caution is needed and extremely sensitive risk management.

While the most recent funding was upsized due to demand, it was done at a 30% discount to the share price. A steep discount!

According to Zomedica (ZOM) the market for the “diagnostics segment of the global companion animal market” should reach $2.8 billion by 2024”.

ZOM is now worth nearly $2 billion so it would need to capture the entire market now, not in 2024!

We have been here before!

Shares in ZOM traded near $3 in Jun 2018 before sliding all the way back to $0.30 by March 2019. So tread cautiously!

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD soars past 1.1200 as China's tariffs confirmed at 145%

EUR/USD soared beyond 1.1200 amid headlines confirming the latest round of tariffs, levies on Chinese imports reached 145%. Wall Street collapses amid renewed concerns that Trump's policies will hit the American economy. Soft US inflation data released earlier in the day adds to the broad US Dollar's weakness.

GBP/USD retreats from daily highs, holds above 1.2900

GBP/USD retreats from the daily high it set near 1.2950 but manages to stay in positive territory above 1.2900. The US Dollar stays under strong selling pressure following the weaker-than-expected Consumer Price Index (CPI) data but the risk-averse market atmosphere limits the pair's upside.

Gold climbs to five-day highs around $3,150

Gold now accelerates its upside momentum and advances to multi-day peaks around the $3,150 mark per troy ounce, remaining within a touching distance of the record-high it set last week. The persistent selling pressure surrounding the US Dollar and the negative shift seen in risk mood help XAU/USD push higher.

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.