XPeng Stock News and Forecast: XPEV earnings beat on top and bottom lines

- XPEV stock is set for earnings before the opening.

- XPeng is a Chinese EV maker and a retail favorite.

- XPEV stock is due to report earnings before the open on Monday.

Update: XPEV unveiled a strong set of earnings on Monday with a beat on top and bottom lines. EArnings per share (EPS) reached $-0.24 ahead of the $-0.34 estimate. Revenue hit $1.34 billion ahead of estiamtes for $1.2 billion. Xpeng also said it sees q1 2022 sales units to be between 33,500 and 34,000 vehicles. Shareholders pushed XPEV stock higher on the news and XPEV is trading at $28.10 in Monday's premarket up 3.6%.

Xpeng (XPEV) reports earnings for its fourth quarter before the market opens on Monday in what will be a closely watched set of earnings to set up the Chinese electric vehicle stocks for some renewed interest. Chinese EV stocks were one of the favored sectors for retail traders in 2021 but fell foul of regulatory concerns that hit the broader Chinese tech space. This issue was partly cleared up last week with Chinese regulators announcing they would seek to support the companies. However, US accounting regulators said the issue is not yet clarified and more work needs to be done. The risk of delisting still hangs over the Chinese tech sector then but perhaps not to quite the same extent.

XPEV Stock News: Q4 earnings preview

XPEV is set to report fourth-quarter earnings before the bell on Monday with a conference call scheduled for 8:00 AM EST. For the fourth quarter, analysts expect revenue of $1.2 billion and earnings per share (EPS) of $-0.34. The last series of earnings results show XPeng steadily improving its revenue growth up from $411 million in Q4 of last year. Earnings per share have been less consistent, however, with only Q1 last year beating analyst estimates. The most recent earnings data from Chinese EV peer Nio were not so positive with a miss on earnings and guidance. NIO stock dropped nearly 10% after earnings. Given the heightened uncertainty surrounding input costs and the supply of raw materials needed for EV manufacturers, the guidance will be key for shareholders.

XPEV Stock Forecast

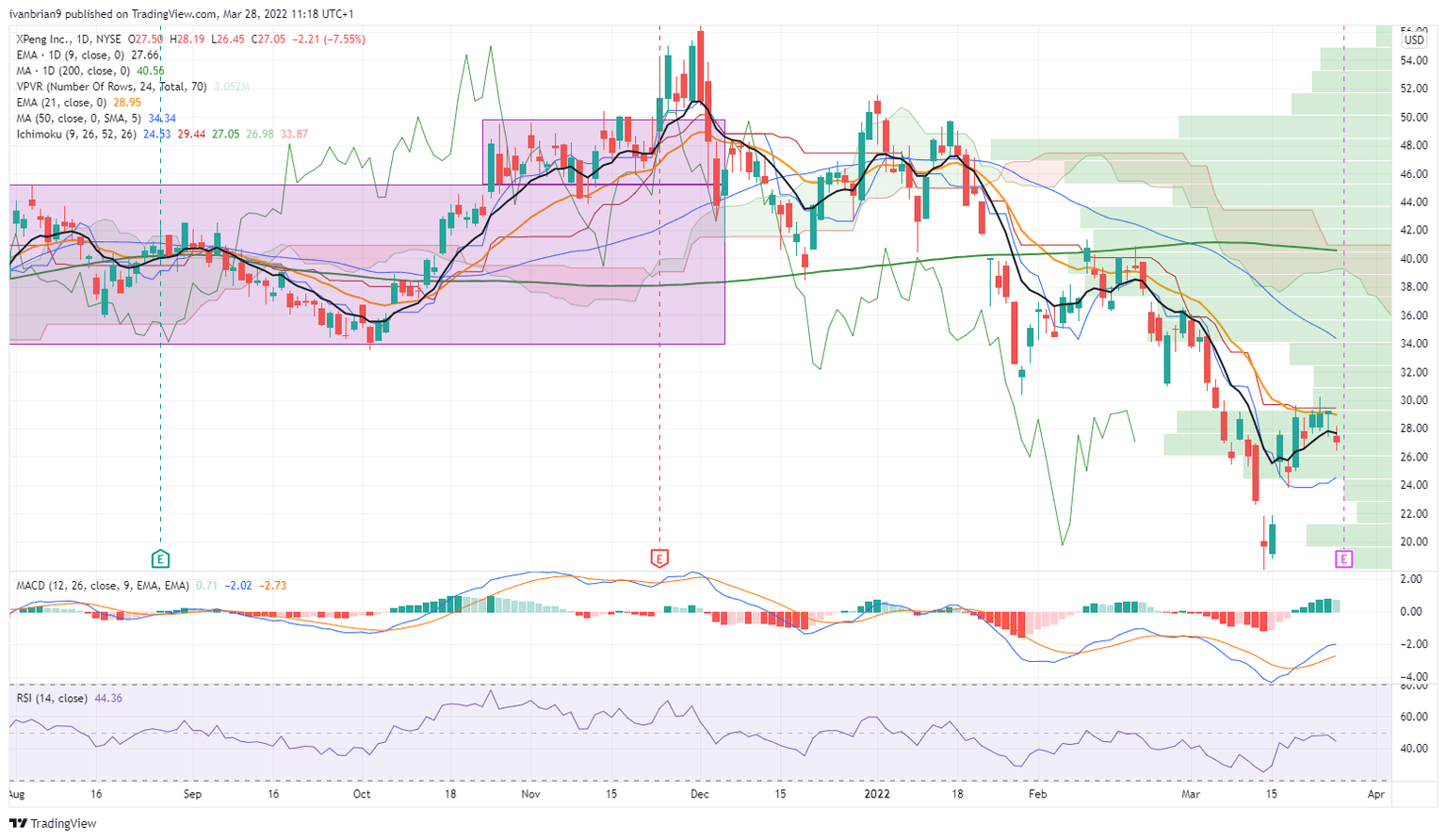

A strong downtrend is in place, so strong numbers will be required to turn this around. Notably, $30 is the first resistance level to get XPEV back into neutral territory. Ichimoku could show the trend is negative with the red crossover quite wide. XPEV would need to trade above $36 to change that. Ichimoku is a trend-following indicator that gives us clues as to the direction to take. In this case, it is identifying rallies that should be sold currently. Also of note for trend followers, XPEV is trading just below all major moving averages. These all currently converge at or near $30, marking the significance of the level.

XPEV chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.