XPeng Inc (XPEV) Stock Forecast and Quote: XPeng announces record Q1 deliveries, NIO also delivers

- XPeng announces record Q1 2021 deliveries on Thursday.

- XPeng shares jump sharply after release.

- NIO also releases record electric vehicle deliveries.

XPeng shares (XPEV) are rising sharply on Thursday in the pre-market session as the company released details of Q1 2021 deliveries. Shares are currently up 13% at $38.33. President Biden's $2 trillion infrastructure plan and NIO delivery data are also adding to the positive news.

Stay up to speed with hot stocks' news!

XPeng is a Chinese based smart electric vehicle manufacturer. XPeng also provides related services to customers such as supercharging, maintenance and vehicle leasing.

XPeng stock news

XPeng announced on Thursday delivery data for Q1 2021. 5,102 vehicles were delivered in March 2021 which was a 384% increase on a year-on-year basis.

This was a 130% increase month on month. XPeng delivered a record 13,340 vehicles in Q1 2021, this is a 487% increase in a year.

NIO also announced its delivery data for Q1 2021 on Thursday. NIO delivered 7,257 vehicles in March 2021, an increase of 373% year on year. NIO delivered 20,060 vehicles in the three month quarter to the end of March 2021. This is a 423% increase year on year. NIO also said cumulative deliveries of its ES8, ES6 and EC6 hit 95,701. See more on NIO deliveries and technical levels.

NIO shares are up strongly in pre-market on Thursday on the back of the deliveries. NIO is trading at $41.39 up 10%.

Electric vehicle stocks were all strong on Wednesday as President Biden unveiled his $2 trillion infrastructure plan. As part of the plan, $621 million is earmarked for infrastructure, roads, and electric vehicle development. Tesla, the EV sector leader jumped 5% on Wednesday.

XPeng technical analysis

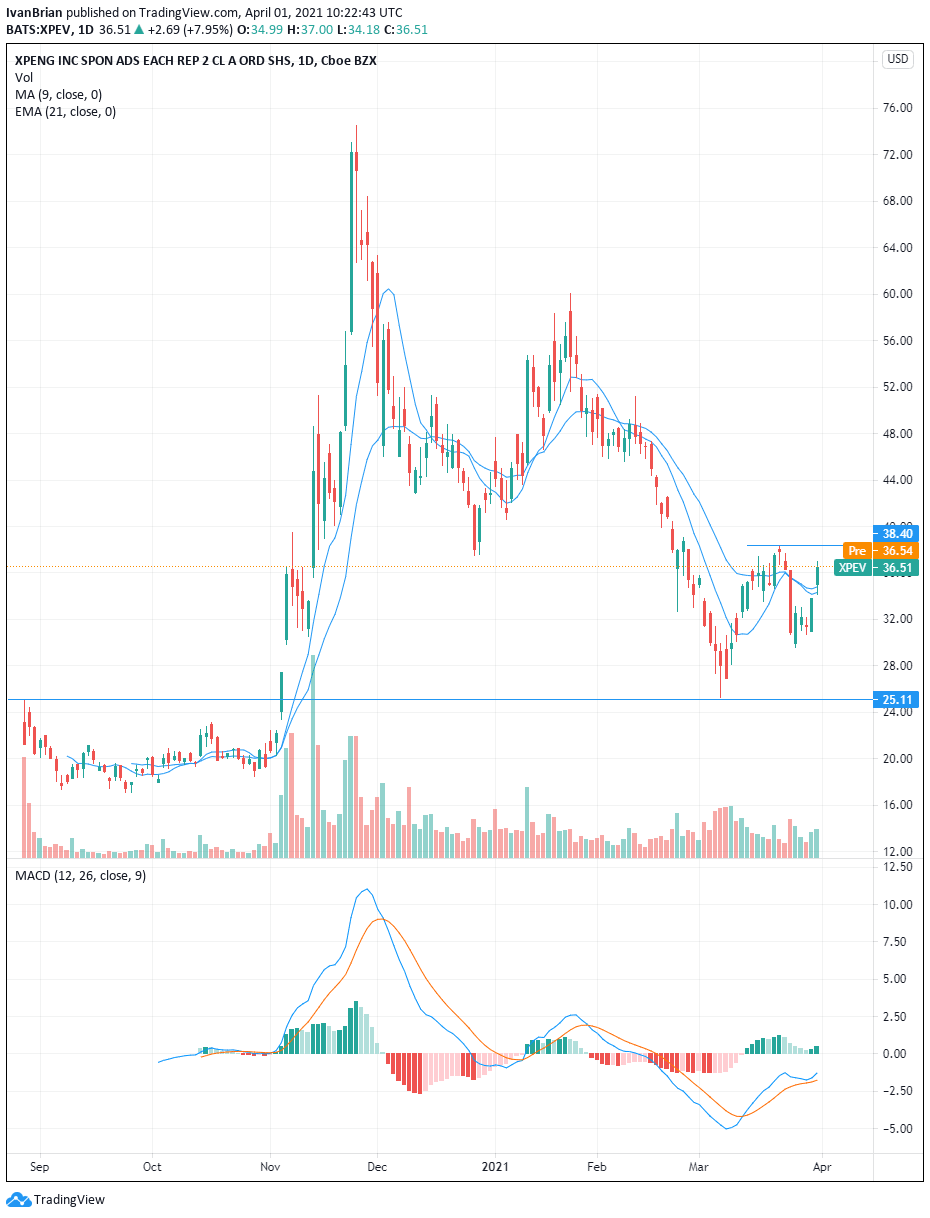

XPeng has suffered from a similar affliction to NIO, as its surge in 2020 is proving hard to sustain. XPeng (XPEV) surged from $21 to $74.49 between November and December 2020. From there the shares have steadily retraced back to $25. Currently, XPeng shares (XPEV) are at $36.51 and have a few key levels to take out to maintain the bullishness.

Support from both 9 and 21-day moving averages needs to hold. These levels are $34.33 and $34.80. The first resistance is at $38.39, the high from mid-March. A break of this level completes the formation of a new bullish trend with a lower low and higher high. This would open the door to a move up towards the $45-$52 range.

$29.57 would result in a lower low and so is key to the formation of this bullish trend. A break here would bring $25.11 support into focus.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.