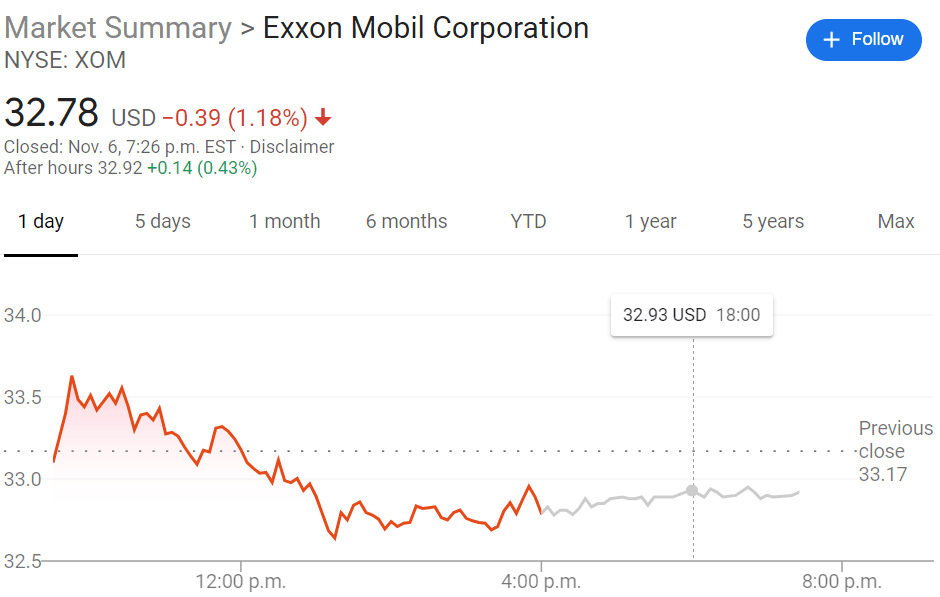

XOM Stock Price and News: Exxon Mobil dips again after mediocre earnings call and workforce cuts

- NYSE:XOM drops 1.18% after its earnings call on Friday morning.

- Exxon reported job-cuts and reduction of operating costs to save capital.

- Exxon announces that despite its struggles, the dividend will remain unchanged.

NYSE:XOM has had a forgettable year as the stock has dropped 53% over the past 52-weeks amidst the ongoing COVID-19 pandemic as well as a global shift away from fossil fuels. On Friday, the energy sector giant announced its earnings report for the most recent quarter and while the losses were only $680 million compared to $1.1 billion the quarter before, it is a far cry year-over-year from 2019 when Exxon reported $3.2 billion in profit during the same quarter.

Exxon has raised some eyebrows around Wall Street with its recent announcement of cutting its workforce as well as its capital expenditures in order to stop the bleeding. It's interesting that the company has maintained its dividend and has even forecasted that it will continue to do so heading into 2021, at a time when many large companies have either cut their dividends or stopped them altogether. Exxon has recently reported that it donated over $4 million to the Democratic Party campaign, despite its candidate Joe Biden running on a green wave initiative that would shift America’s focus to clean energy. What does this mean for the future? Exxon could be reading the writing on the wall and shifting its own focus to clean energy, but ultimately we will have to wait for the official outcome of the election after counting all the votes.

XOM Stock Price History

The entire energy industry continues to be beaten down as the coronavirus pandemic keeps people inside of their homes. The resulting drop in the demand for crude oil has sent the price per barrel down into the $30's although it was not too long ago that the price actually went negative during the heart of the pandemic. Exxon remains closely linked to the price of crude oil and with the next wave of COVID-19 continuing into 2021, we should not expect the demand to return to pre-pandemic levels anytime soon.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet