XLP resuming higher from another blue box area

In this technical blog, we are going to take a look at the past performance of one hour Elliott Wave charts of XLP a consumer staple ETF. In which, the rally from 16 April 2024 lows, showed the higher high sequence in higher time frame charts favored more strength. Also, the right side tag pointed higher against $74.71 low seen on 5/01/2024 low called for more upside. We will explain the structure and forecast below:

XLP one-hour Elliott Wave chart from 5.14.2024

XLP one hour Elliott Wave Chart from 5/14/2024 Midday update, in which the ETF ended the 5 waves rally within wave 3 at $78 high. Down from there, the pullback in wave 4 took place in 3 swings as zigzag structure, which managed to reach $77.06-$76.60 100%-161.8% Fibonacci extension area of ((a))-((b)). Thus provided buying opportunity to our members at the blue box area looking for the next extension higher or for 3 wave reaction higher at least.

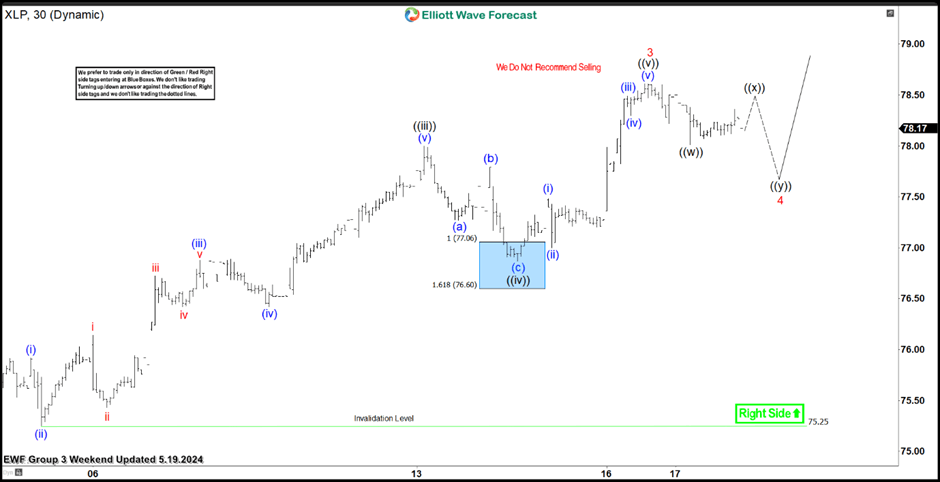

XLP one-hour Elliott Wave chart from 5.19.2024

Here’s one hour Elliott Wave chart from 5/19/2024 weekend update, in which the ETF is showing reaction higher taking place from the blue box area. And shortly after taking the trade the ETF bounced strongly & managed to make a new high above the previous high confirmed the next extension higher. Also, with this rally higher the ETF allowed our members to take profits from the bounce higher.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com