XAG/USD Price Analysis: Extends losses toward support at $21.50 psychological level

- Silver price persists as market caution prevails regarding the Fed's interest rate trajectory.

- Momentum indicators signal a potential bearish sentiment in the price movements.

- The psychological level at $21.50 emerges as the immediate support.

Silver price continues to follow its downward trajectory, trading lower around $21.80 during the Asian session on Monday. The prices of non-yielding assets like Silver face challenges, primarily due to the upbeat US Treasury Yields. The yield on the 10-year US Treasury bond stands at 4.61%, up by 0.96% by the press time.

Furthermore, China released its Manufacturing PMI data over the weekend, indicating improvement and entering positive territory. However, this positive development did not seem to have a favorable impact on Silver prices.

Chinese NBS Manufacturing PMI for August increased to 50.2 from the previous 49.7 figures, surpassing the anticipated 50.0. Additionally, the Non-Manufacturing PMI climbed to 51.7 from the previous reading of 51.0, exceeding the market consensus of 51.5.

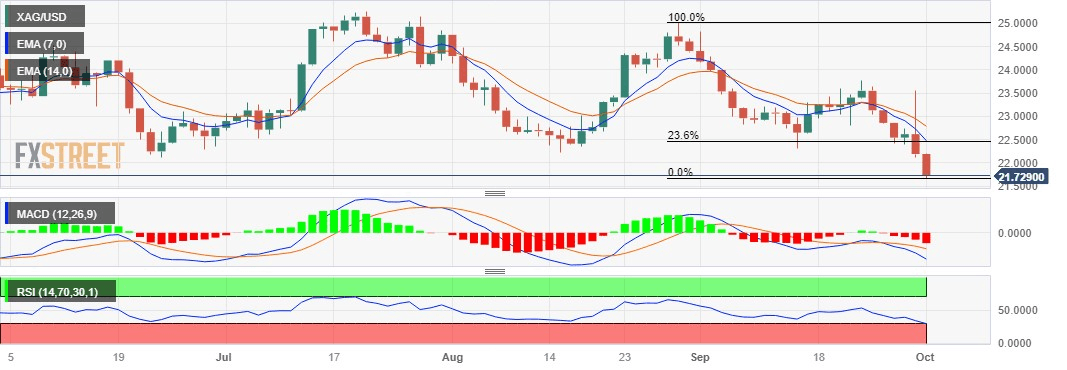

The current downward momentum in the pair appears to have a bearish bias, given that the 14-day Relative Strength Index (RSI) remains below the 50 level.

The XAG/USD pair could meet support at the $21.50 psychological level, following the $21.00 level.

On the upside, the 23.6% Fibonacci retracement at $22.46 lined up with the seven-day Exponential Moving Average (EMA) at $22.49.

A firm break above the latter could influence the XAG/USD pair to explore the area around the 14-day EMA at $22.79, followed by the $23.00 psychological level.

The Moving Average Convergence Divergence (MACD) indicator is providing a weak signal for the Silver bulls. The MACD line lies below the centerline and the signal line. This configuration suggests that there is potentially weak momentum in the XAG/USD's price movement.

XAG/USD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.