Wyckoff change of character bar shows up in S&P 500 [Video]

![Wyckoff change of character bar shows up in S&P 500 [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse2-637299021353183737_XtraLarge.jpg)

Watch the video extracted from the WLGC session before the market open on 26 Dec 2023 below to find out the following:

- How to identify a "change of character bar" in the market

- The 2 key elements to determine a "threatening condition"

- The key support zone for the S&P 500

- The immediate price target and the potential path for the S&P 500

- And a lot more...

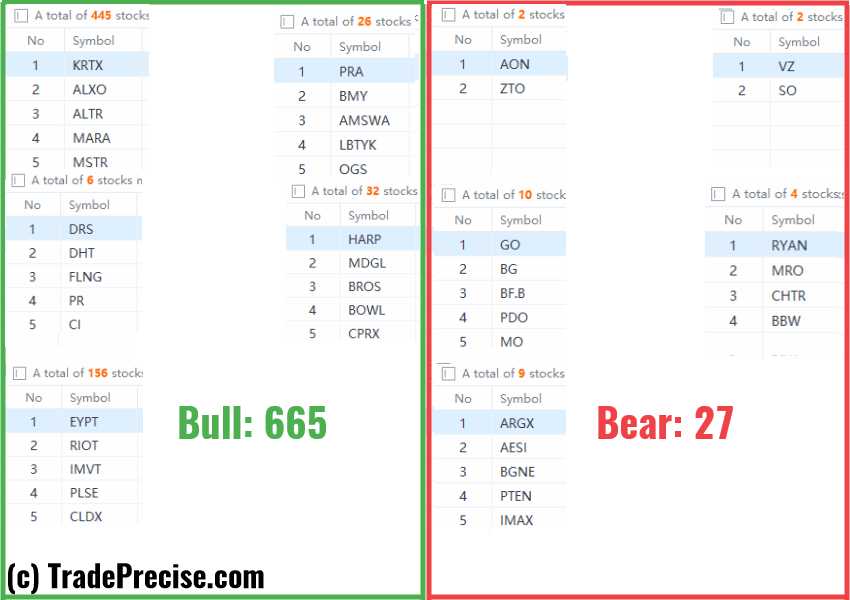

The bullish vs. bearish setup is 665 to 27 from the screenshot of my stock screener below pointing to a healthy and positive market environment.

The two short-term market breadth hit the overbought level together with the overbought and overextended condition reflected in the price action in the S&P 500.

This is a sign of complacency in the market, which we should be aware of and cautious of while riding the strong uptrend.

A trading blueprint has been discussed last week during the live session, as tweeted below:

Find out:

— Ming Jong Tey (@MingJong) December 27, 2023

- How to manage the trades in this extended market $SPX.

- Will the Dec 2021 market crash repeat itself #SP500?

- Price action analysis on the 4 indices $NQ $RTY $YM $ES, Gold, Silver, Bitcoin, Dollar Index, Crude Oilhttps://t.co/nvacbW7RVP

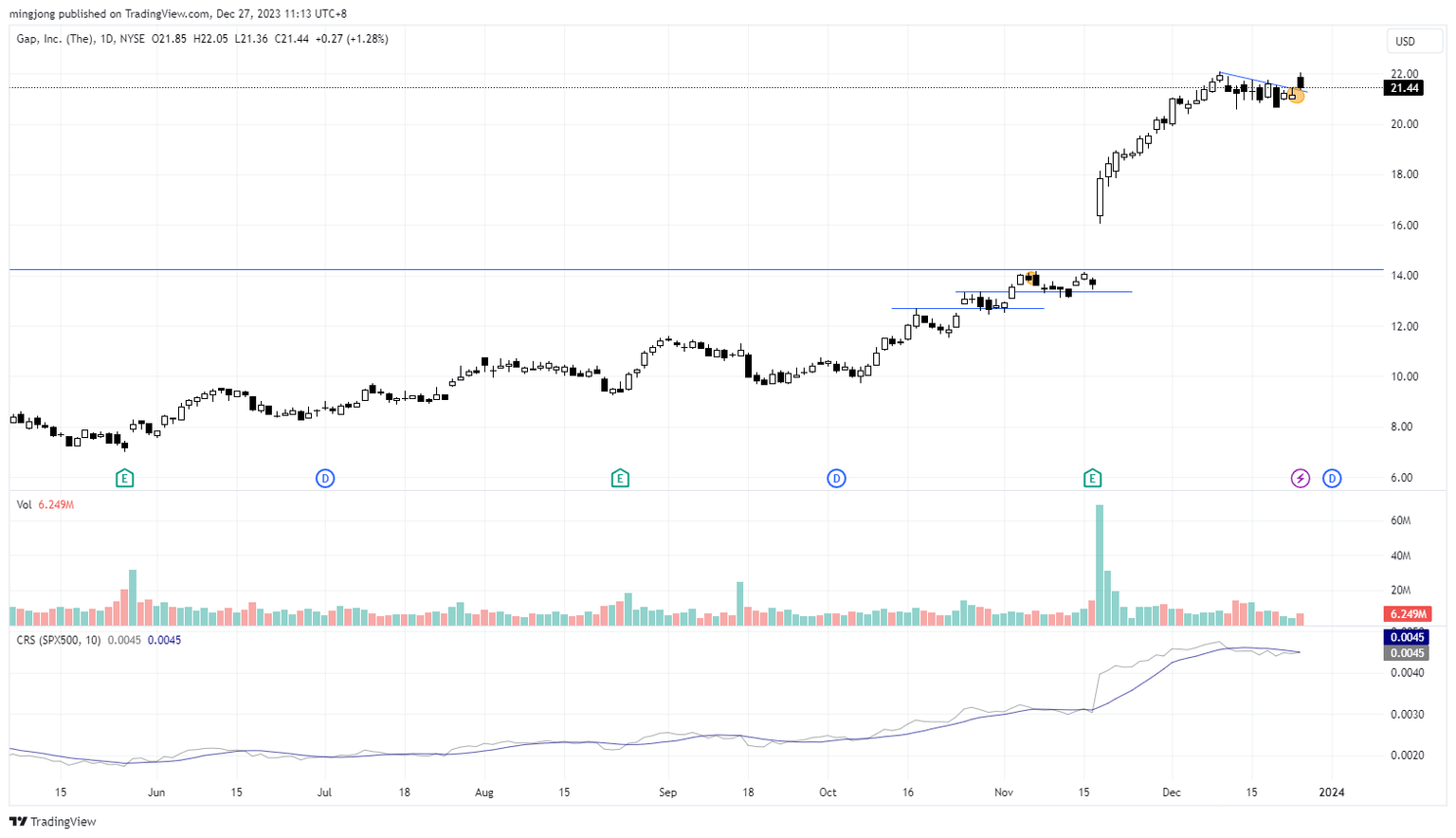

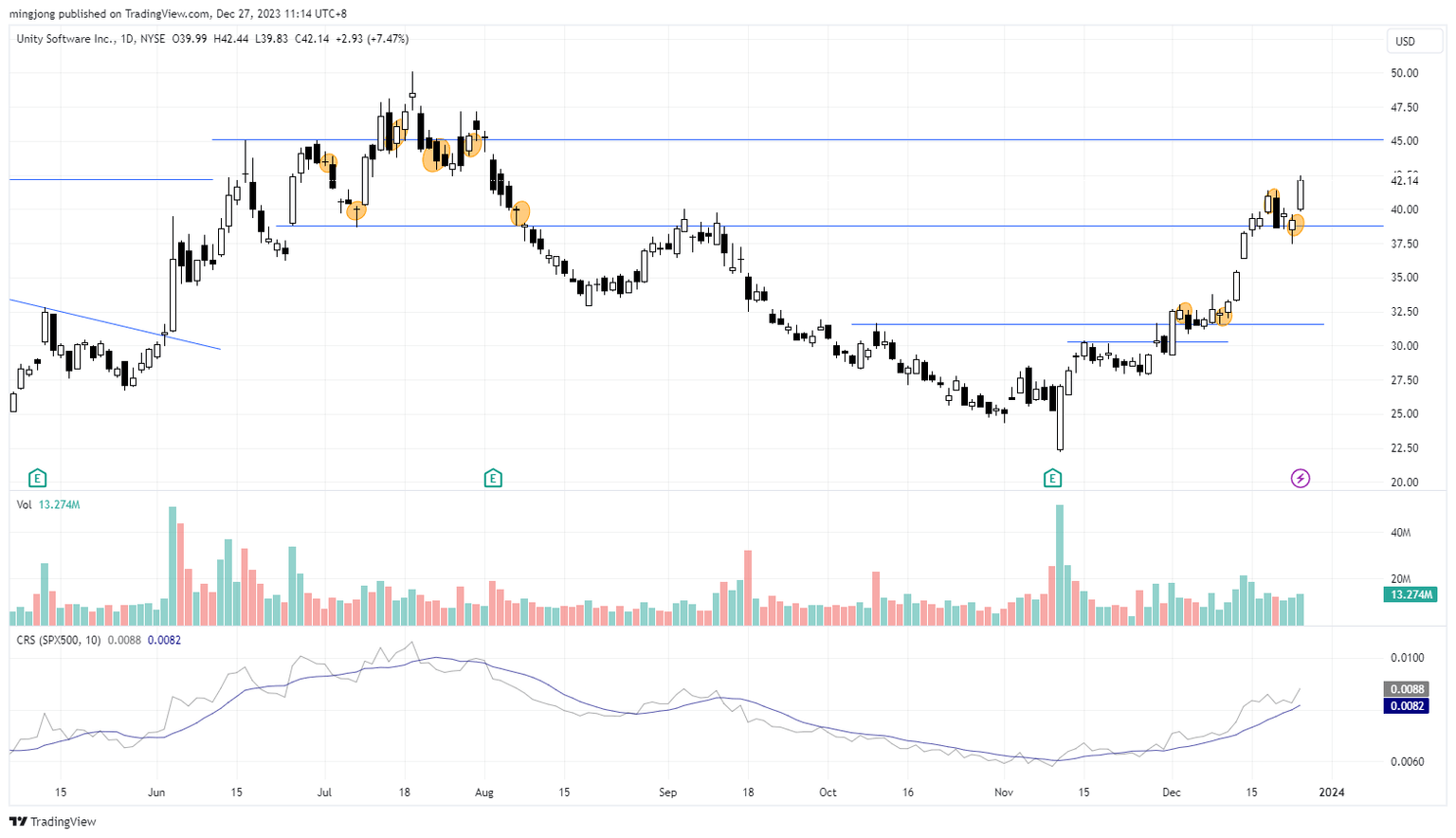

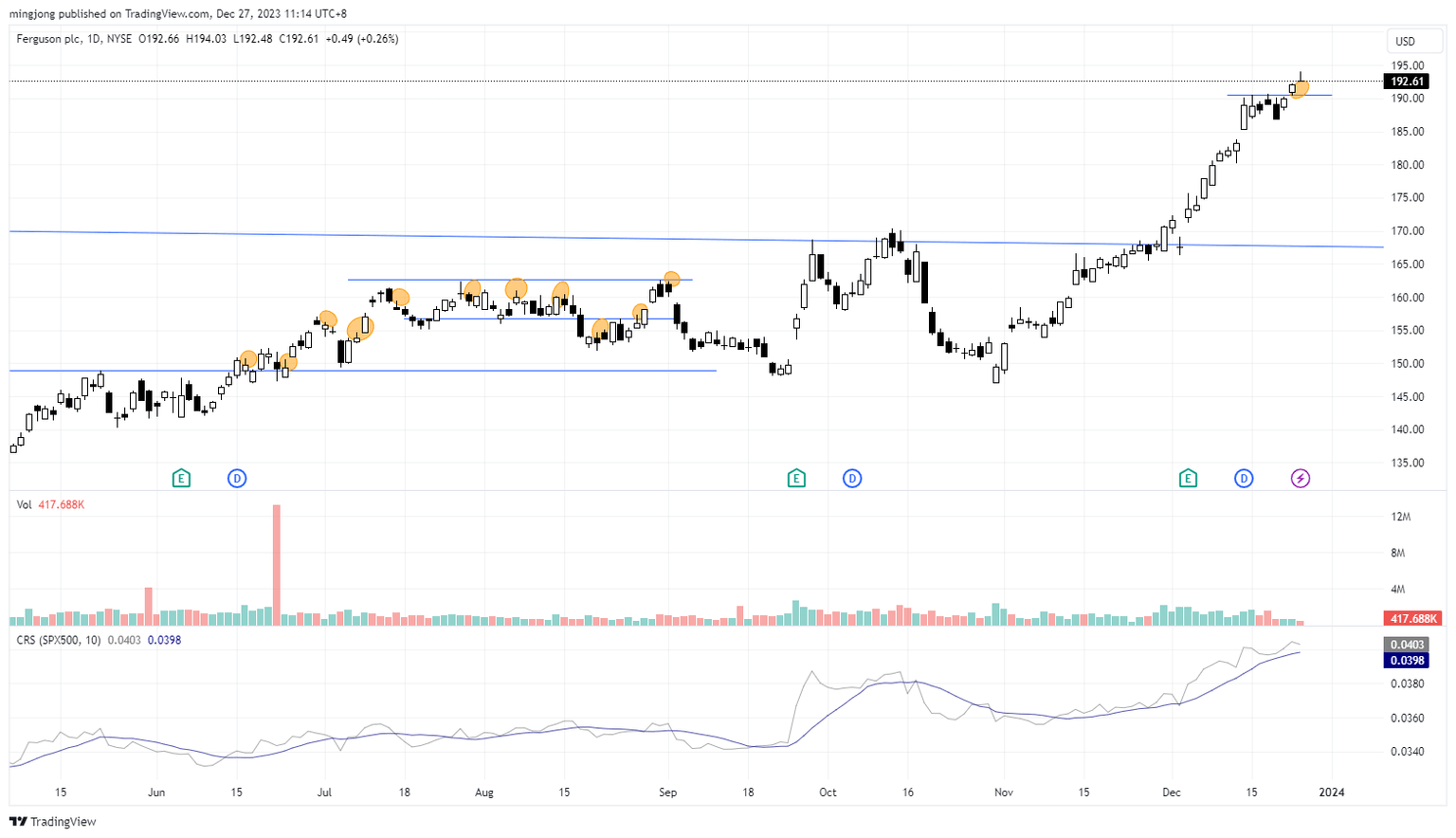

15 “low-hanging fruits” (GPS, FERG, etc…) trade entries setup + 21 others (U etc…) plus 10 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.