- Crude Oil whipsawed on Thursday as energies grappled with headlines pulling in multiple directions.

- Angola is the latest country to quit OPEC, further reducing OPEC’s market share.

- Red Sea attacks have diverted shipments between Asia and Europe, propping up Crude Oil bids.

West Texas Intermediate (WTI) Crude Oil tumbled nearly three percent to $72.50 per barrel on Thursday after Angola formally announced it would be leaving the Organization of the Petroleum Exporting Countries (OPEC), citing a lack of benefit to participating in the global oil cartel’s framework.

With Angola’s departure from OPEC, the oil consortium’s market share declines to 27% of all global oil production, which has declined from 34% in 2010.

Further reducing OPEC’s share of global oil trade is a new record for US Crude Oil production, which hit 13.3 million barrels per day. Angola, by comparison, produced 1.1 million bpd and was struggling to hit OPEC quotas for the country.

Crude Oil down, then back up as market factors spread in both directions

Despite the barrel crunch following Angola’s announcement, Crude Oil rebounded o nthe day as tensions over the Red Seas continue to mount on energies and trade. Houthi rebel forces have declared that they will continue to attack any ships that come within reach of their bases in Yemen, and have vowed to increase the ferocity of their attacks if the US interferes were to attack in retaliation.

A coalition battle group, led by US forces, is currently moving into position in the Red Sea in an effort to police trade waters, but nearly all trade through the region has been re-routed in the meantime, adding time and costs to shipping lanes.

Despite OPEC’s best efforts to curtail pumping within its consortium, global oil production continues to outpace demand and Crude Oil prices are likely to keep feeling the pressure.

WTI Technical Outlook

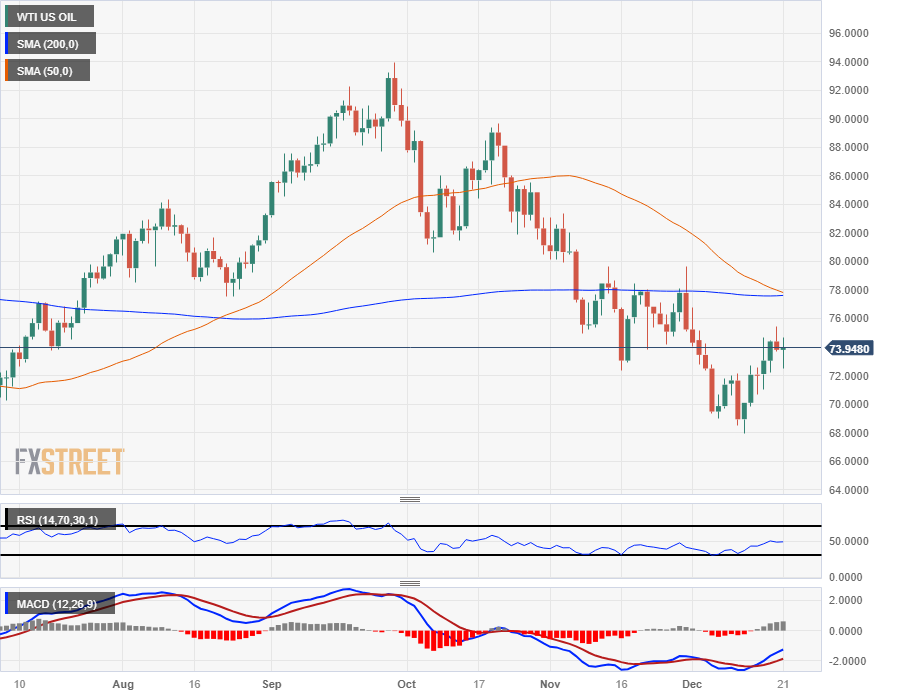

WTI’s dip-and-bounce on Thursday has Crude Oil prices near where the day started just below $74 per barrel, and US Crude Oil is bidding down from yesterday’s peak of $75.40.

Crude Oil’s near-term rally is quickly coming under threat after rising nearly eleven percent from last week’s low of $67.97 to this week’s high, but ongoing shortside pressure is capping off WTI below the 200-day Simple Moving Average (SMA) near $78.00 per barrel.

WTI Hourly Chart

WTI Daily Chart

WTI Technical Levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD under pressure near 1.0350 after mixed sentiment data

EUR/USD remains in the negative territory near 1.0350 in the European session on Tuesday, erasing a portion of Monday's gains. The pair is undermined by risk aversion and the US Dollar demand, fuelled by US President Trump's tariff threats, and mixed sentiment data.

GBP/USD drops to 1.2250 area on broad USD strength

GBP/USD stays under bearish pressure and trades deep in the red near 1.2250 on Tuesday as the USD gathers strength following US President Trump's tariff threats. The data from the UK showed that the ILO Unemployment Rate edged higher to 4.4% in the three months to November.

Gold price eases from over two-month top on stronger USD, positive risk tone

Gold price (XAU/USD) retreats slightly after touching its highest level since November 6 during the early European session on Tuesday and currently trades just below the $2,725 area, still up over 0.50% for the day.

Bitcoin fails to sustain the $109K mark after Trump’s inauguration

Bitcoin’s price steadies above the $102,000 mark on Tuesday after reaching a new all-time high of $109,588 the previous day. Santiment’s data shows that BTC prices quickly corrected, as social media showed major greed and FOMO among the traders in Bitcoin after President Donald Trump’s inauguration.

Five keys to trading Trump 2.0 with Gold, Stocks and the US Dollar Premium

"I have the best words" – one of Donald Trump's famous quotes represents one of the most significant shifts to trading during his time. Words from the president may have a more significant impact than economic data.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.