WTI tumbles amid global economic jitters, surging US gasoline inventories

- WTI experiences a sharp 1.50% drop, extending losses amidst global economic slowdown fears and hedge fund liquidations.

- OPEC+ maintains current production levels despite the WTI price slide, with no indication of extending cuts into 2024.

- US business activity decelerates, while the Eurozone economy faces potential contraction in the upcoming quarter, per HCOB PMIs.

West Texas Intermediate (WTI), the US crude oil benchmark, dropped almost 1.50% on Thursday, extending its losses to two straight days amid renewed fears of a global economic slowdown. Even though OPEC+ countries aim to keep a narrow supply, WTI price slides below $83.000 per barrel after hitting a daily high of $84.88.

Oil price slumps below $83, on traders booking profits, OPEC+ decision, economic concerns

On Wednesday, oil prices slid more than $5, according to sources cited by Reuters, due to “heavy hedge fund liquidation on fears that higher interest rates with inflation keep sapping fuel demand.” In the meantime, a sharp jump in gasoline inventories in the US warranting that demand was weak in the last week.

The Organization of Petroleum Exporting Countries and allies – also known as OPEC+, stick to its current oil production, which included recent output cuts of 1.3 million barrels by Saudi Arabia and Russia, extended into the end of 2023. The OPEC+ did not mention if those cuts would be prolonged until 2024.

Regarding the global economic outlook, business activity in the US slowed down, while the Eurozone (EU) economy would likely shrink in the last quarter, according to HCOB’s Services and Composite PMIs.

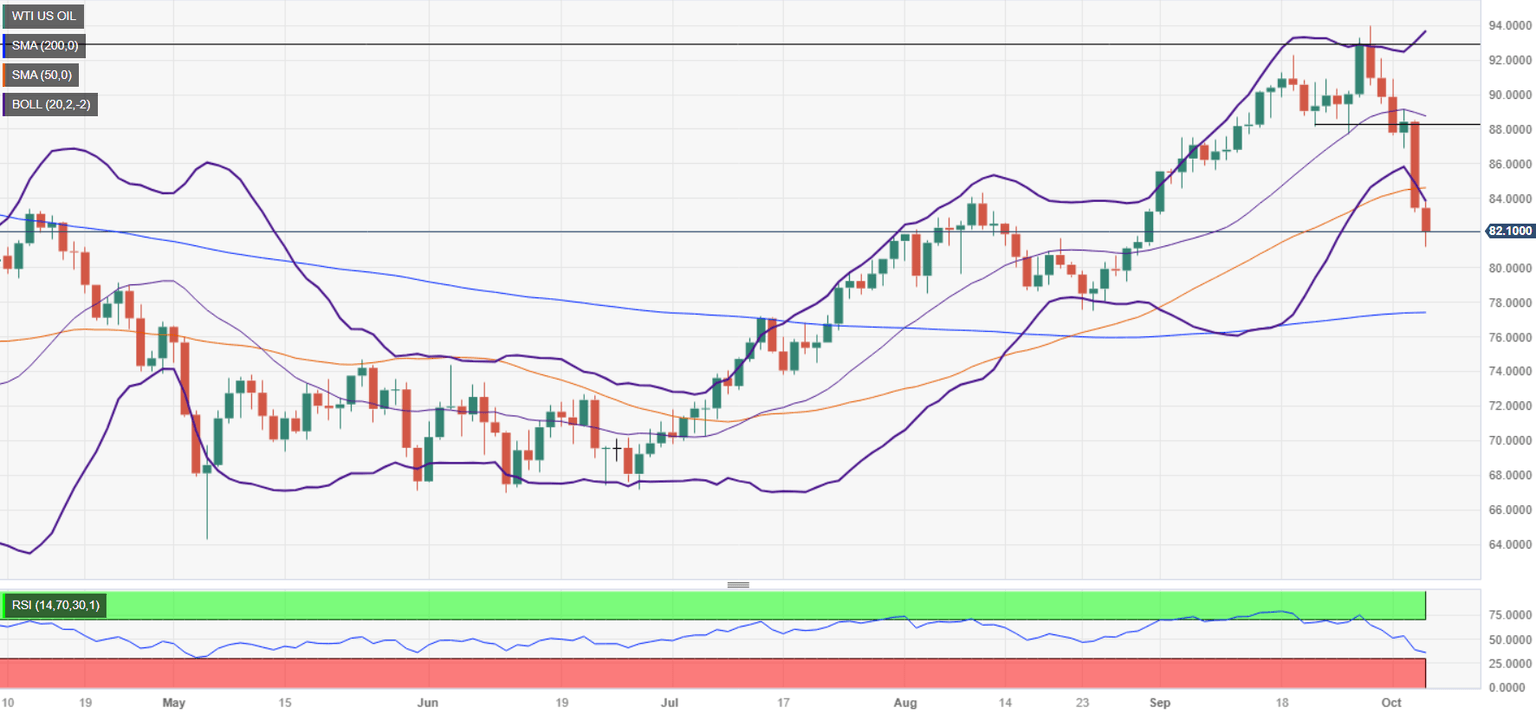

WTI Price Analysis: Technical outlook

Oil price is dropping below the latest cycle high before WTI reached a year-to-date (YTD) high of $94.99, at around $84.85. In doing so, the 50-day moving average (DMA) was surpassed, putting into play a test of the $80.00 figure. A breach of the latter would expose the 200-DMA at $77.47, which, once cleared, could open the door to test last year’s low of $70.10. Conversely, if oil prices jump above the 50-DMA at $85.03, the following resistance would be the $90.00 mark.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.