WTI testing bullish commitments around $79, downside remains favored

- WTI keeps falling as inflation woes dent appetite for riskier assets.

- WTI is weighed down by the prospects of the US SPR release.

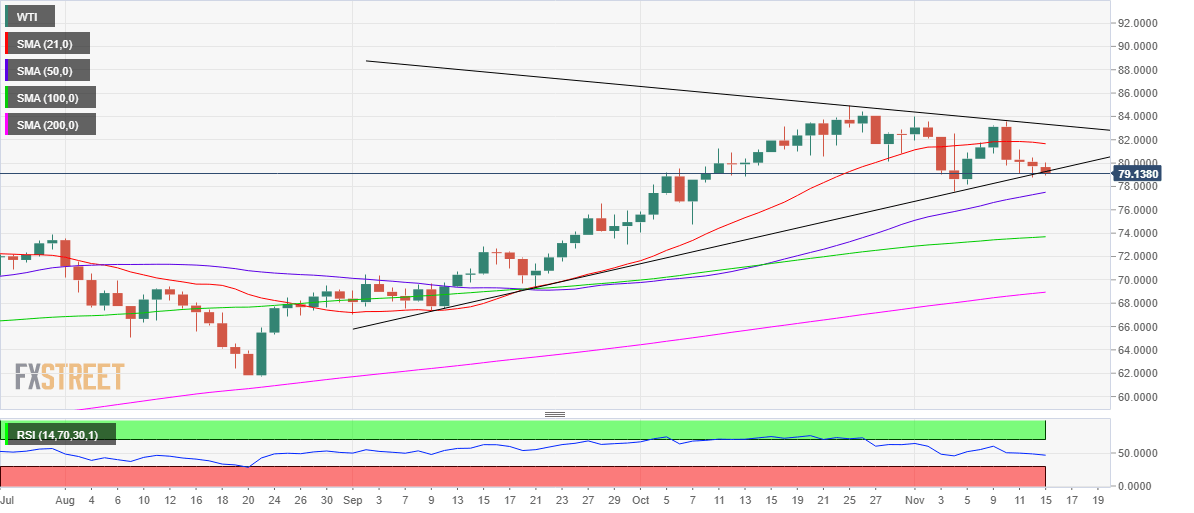

- The US oil is still eyeing symmetrical triangle breakdown on the 1D chart.

WTI (NYMEX futures) is pressurizing multi-day lows, flirting with the $79 mark, as persistent inflation concerns continue to sap investors’ confidence in higher-yielding assets such as oil.

The US oil also remains undermined by the increased calls for the US to release oil supplies from its Strategic Petroleum Reserves (SPR) to alieviate the pressure off the tightening oil market.

At the time of writing, WTI is posting small losses to trade at $79.30, little affected by the comments from the UAE and Oman Energy Ministers, as investors await the virtual meeting between the US and Chinese Presidents for a fresh take on the market sentiment.

From a short-term technical perspective, WTI continues to challenge the bullish commitments at the rising trendline support on the daily chart at $79.27.

The price briefly dipped below the latter on Friday but managed to recapture in on a weekly closing basis.

If WTI closes below the latter on Monday, then it will confirm a downside breakout from a two-month-long symmetrical triangle formation.

A fresh downswing will kick in, thereafter, opening floors towards ascending 200-Daily Moving Average (DMA) at $68.82.

Before reaching the 200-DMA, WTI bulls will look to find some support at the 50-DMA at $77.50.

The next support at the mildly bullish 100-DMA at $73.62 will appear on a firm break below the 50-DMA.

The 14-day Relative Strength Index (RSI) points south below the 50.00 level, allowing room for more declines.

WTI: Daily chart

On the flip side, any recovery attempts could meet the initial supply at the $80 round figure, above which the horizontal 21-DMA at $81.65 would be tested.

The falling trendline resistance at $83.39 will act as a tough nut to crack for WTI bulls if the recovery momentum picks up pace.

Acceptance above the latter could yield a triangle breakout, which could reinforce the bullish interests.

WTI: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.