WTI struggling to recapture $90 heading into the end of the week

- WTI is strung up near $89.00/bbl after slipping off of recent highs.

- US crude barrels briefly saw $92.00 in the midweek on continuing supply concerns.

- Price pressures have eased heading into the weekend, but prices are set to continue rising.

West Texas Intermediary (WT) US crude oil is struggling to hold onto the $90.00 price level as Friday trading leaves crude oil barrels trading mostly flat for the day, briefly piercing the major handle before falling back to near where the day's trading began.

Crude oil prices are seeing strong support looking forward, with global supply set to leave oil demand chronically undersupplied for the near future.

WTI US crude oil prices are up over 11% on the year, and have gained nearly 40% from the year's low at $64.31.

Market analysts broadly expect crude barrels to reach $100 in the future as global reserves of crude barrels dwindle away in what some experts calculate to be a 2 million bpd deficit in global production.

Ongoing production cuts to buoy crude prices towards the upside

Saudi Arabia and Russia have extended production cuts worth a combined 1.3 million bpd through the end of the year, bolstering prices across the globe and sending production facilities into a buying frenzy to eat up the expanded margins on oil accumulation, further constraining available supply.

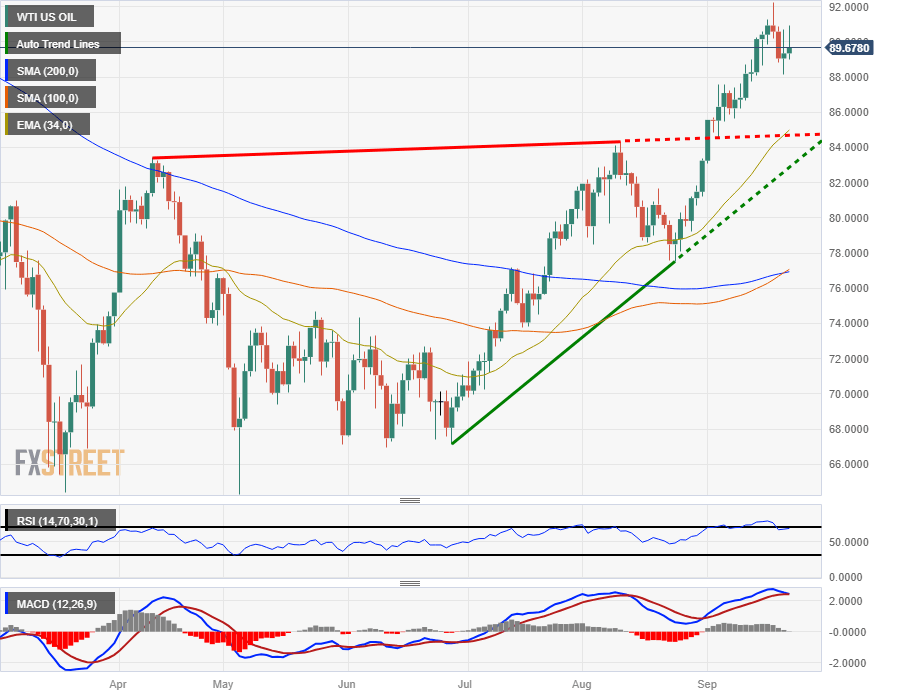

WTI technical outlook

US crude oil has closed in the green for ten of the last twelve months. Daily candles see crude prices well above technical support, with the 200-day Simple Moving Average (SMA) near $77.00, well below current price action.

A rising trendline from late June's lows near $67.00 remains in place, and bullish momentum is currently running far away from the technical pattern.

The Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) indicators are both firmly planted in overbought territory, and it will take a significant profit-taking reversal to recover the indicator patterns.

WTI daily chart

WTI technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.