WTI struggles to move beyond 80.00 amid inflation fears

- WTI circumvents around $81.00 as US inflation woes push investors to offload riskier assets.

- The fuel prices stay below 21-day SMA, Biden’s emergency oil inventory release in the pipeline.

- Black gold struggles to keep the rebound, US inflation not greasy enough to provide the push.

West Texas Intermediate (WTI) eases towards $81.00 per barrel, on Thursday, affected by the rise in US dollar prices after the US president Joe Biden said that he has asked National Economic Council to reduce energy costs amid increased inflation. At the time of writing, the WTI is trading 0.1% up at $80.35, after opening at $80.28.

The oil prices were struggling to rise because investors are offloading their riskier assets, including stocks and commodities, in fear that the banks may take steps to curb the rising inflation.

The consumer price index data has jumped 6.2% in October from a year earlier. The numbers may affect the White House and the US Federal Reserve, forcing them to take immediate action.

Earlier, the Energy Information Agency (EIA) said Wednesday that US crude stocks increased by 1 million barrels last week, partly due to a 3.1-million-barrel release from the US Strategic Petroleum Reserve to commercial markets.

President Joe Biden further asked the National Economic Council to help reduce energy costs and the Federal Trade Commission to push back on market manipulation in the energy sector in a bid to slow accelerating inflation. There is also speculation that the US might coordinate with other nations such as Japan in releasing emergency oil inventory.

The US dollar index is up toward 95.00 while the Treasury bond yields gain ground from earlier sessions, trading at 1.57%. A stronger US dollar makes black gold more expensive to foreign currency holders. Analysts believe US oil reserves will address high energy costs and have less impact on the oil market in the short term.

WTI Technical levels

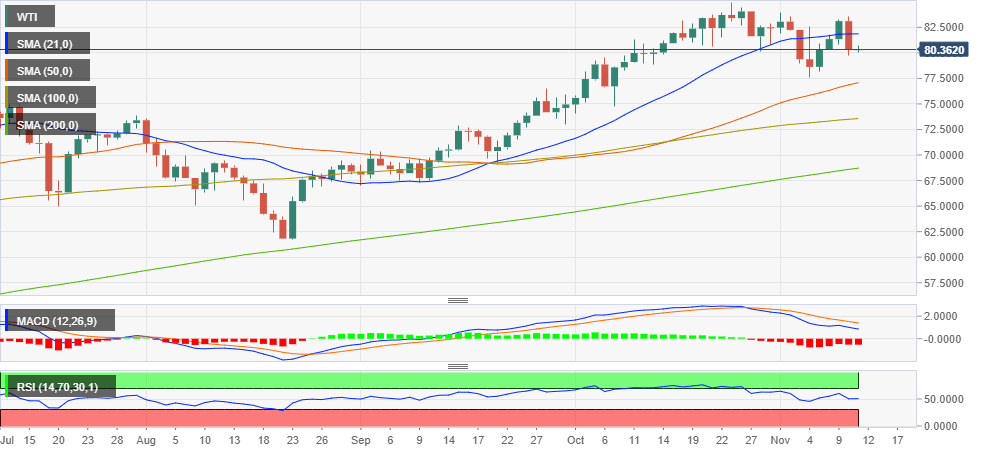

The daily chart indicates that $81.86, the 21-day Simple Moving Average (SMA), remains to be conquered before moving the next barrier to the upside, which is $83.97 and $84.98, the black gold's one week and one month high.

The support level for WTI is noted with 50, 100 and 200-day SMAs, $77.08, $73.56 and $68.71, respectively.

Daily Chart

WTI Additional Levels

Author

Sounava Ray Sarkar

Independent Analyst

Sounava has been working as a Journalist since 2012. He has worked with several reputed media organizations in various capacities before settling as a writer and news editor for business and technology segments.