WTI sinks beneath $78.00 on global recession fears, upbeat USD

- Western Texas Intermediate erases last Friday’s gains, tumbles more than 3%.

- Technical factors and China’s Covid-19 crisis increased traders’ worries about diminishing oil demand.

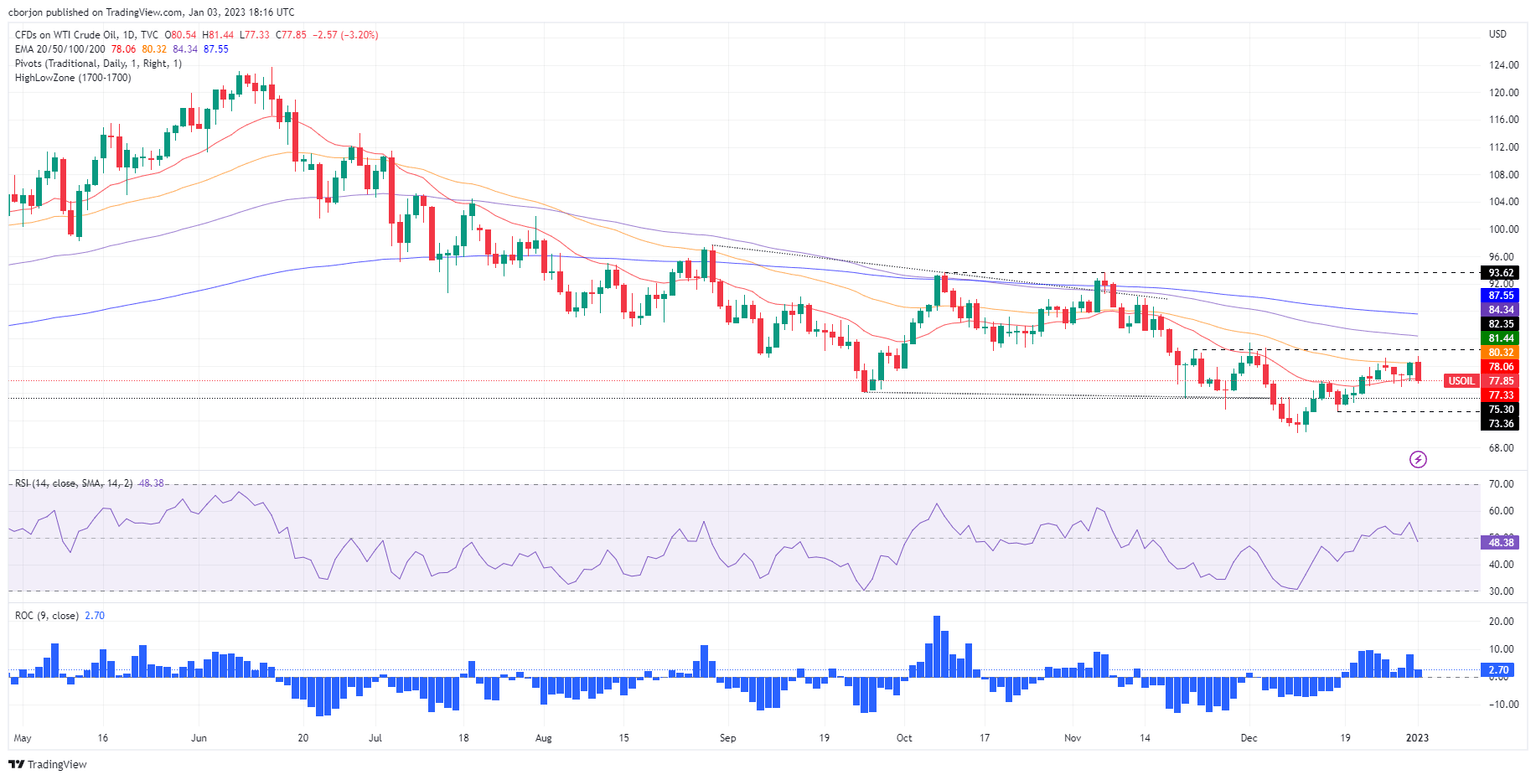

- WTI Price Analysis: A daily close below the 20-DMA to pave the way towards $75.00.

Western Texas Intermediate (WTI), the US crude oil benchmark tanks more than 3% on Tuesday, due to increased concerns of diminishing demand from China, as the country battles spurring Covid-19 cases amidst increasing worries for a worldwide recession. At the time of writing, WTI is trading at $77.78 per barrel, below its opening price, after reaching a high of $81.44.

WTI halted its upward trajectory at the 50-day Exponential Moving Average (EMA) at $80.32 a barrel. An increase of Covid-19 cases in China threatens to dampen demand in the second-largest economy and the world’s leading oil importer.

On Sunday, the International Monetary Fund (IMF) Director Kristalina Georgieva said that the global economy faces “a tough year, tougher than the year we leave behind.” Additional central bank tightening and weaker growth expected by the worldwide economy keep recessionary risk skewed to the upside.

Saxo Bank analysts wrote, “Another volatile year undoubtedly lies ahead with multiple uncertainties still impacting supply and demand. The two biggest that potentially will weigh against each other in the short term remain the prospect for a bumpy recovery in Chinese demand being offset by worries about a global economic slowdown.”

WTI Price Analysis: Technical outlook

From the daily chart perspective, WTI is neutral-to-downward biased. The 50-day EMA, around $80.31, capped the rally, while Tuesday’s price action is witnessing sellers stepping aggressively, dragging WTI’s price below $78.06, leaving the 20-day EMA above. If WTI achieves a daily close below the latter, it will exacerbate a fall toward the December 16 low at 73.36, ahead of the December 9 swing low of $70.10.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.